Retirement planning is a journey, not a destination.

If even thinking about retirement planning makes you nervous or puts you to sleep, you are not alone. What does retirement planning even mean?

Retirement planning is a broad term that refers to learning about and choosing financial strategies that will enable you to be comfortable and secure in your retirement years. A good retirement plan, executed smartly, can provide you with enough money to cover all of your later-year living expenses.

Let's explore the importance of retirement planning and examine the steps you need to take to prepare for your golden years.

Why should you plan for retirement?

Good news! People on average are living longer and are able to remain healthy and active well into their sunset years.

But many Americans haven’t saved or invested enough money to retire in their 60s with the confidence that their funds will last. Both the Center for Retirement Research at Boston College and the Consumer Financial Protection Bureau have estimated that approximately 50% of today's retirees have cut back on their spending, or will be forced to do so, due to dwindling resources.

Far too many retirees end up relying on Social Security to cover the majority of their living expenses only to find out the hard way that it isn't nearly enough. Social Security retirement income is only designed to replace about 40% of the average worker's salary, but more than one in five married couples and 45% of single retirees depend on Social Security for more than 90% of their incomes in retirement.

The bottom line is that, while many get by without ever making and executing a retirement plan, those who most enjoy their retirement do so in part due to having a retirement plan. Retirement planning is what can help you to be financially comfortable after you leave your job.

Social Security is only designed to replace about 40% of the average worker's salary after they retire. Many retirees drastically downgrade their lifestyles due to inadequate savings.

What to consider when planning for retirement

Here are a few key questions to ask yourself as you think about a retirement plan:

- When do you want to retire? Are you planning to work until age 65 or until you are older than that? Do you have a goal of retiring early? How many more years you plan to spend in the workforce significantly affects how much money you are likely to need. If you choose to work until you are older, not only do your investments have more time to grow, but the number of retirement years you need to fund is slightly reduced.

- Where do you want to live? Are you going to stay in your current home or downsize? Do you want to stay in the same area or retire somewhere warm or closer to relatives? The cost of living in the area where you'd like to live as a senior citizen is another major factor impacting how much money you will need in retirement.

- How will you pay for your living expenses? Your Social Security retirement income isn't likely to be enough to cover all of your expenses, so will you also have a pension? A 401(k)? Will you need to save or invest money as well? Another factor to consider is the magnitude of your living expenses themselves. Whether you own or rent property in retirement can significantly change the amount of your living expenses.

How much money do you really need to retire?

You may be wondering what dollar amount will be enough money to comfortably retire. Unfortunately, there's not a one-size-fits-all number. To estimate how much money you personally need to retire, follow these basic steps:

- Estimate your total annual living expenses in retirement. You can use the rule of thumb that the typical retiree needs about 80% of his or her pre-retirement income to maintain the same standard of living after leaving the workforce for good.

- Subtract your expected Social Security benefits and any pension income you expect to receive from your estimated total annual living expenses in retirement to compute your estimated net annual living expenses. Your latest Social Security statement, which you can find on the Social Security website, has an estimate of the Social Security income you are likely to receive.

- Multiply your estimated net annual living expenses in retirement by 25 to determine a total amount of money you need to save for retirement. Multiplying your expenses in retirement by 25 to determine the total amount of retirement money you need is linked to another rule of thumb called the 4% rule. This rule advises you not to withdraw more than 4% of your retirement savings per year in order to fund your retirement for at least 30 years.

How to save and invest for retirement

Saving money is distinctly different from investing it. Most people save for retirement by investing money, often in the stock market. You are unlikely to meet your retirement planning goals if you simply allocate a portion of your salary to a savings account. You need to invest in assets that gain value.

To emphasize that the way to save for retirement is to learn how to invest, imagine that you contribute $5,000 per year to a savings account paying 1% interest annually. In 35 years, that account would be worth $208,000. But if you invested that same $5,000 annually, assuming just a 7% average annual return, the account would hold close to $700,000.

Of course, the returns your portfolio achieves depend on what you invest in. We advocate for stock investing as the best way over the long term to build and retain wealth, and we also advocate for saving some money in cash.

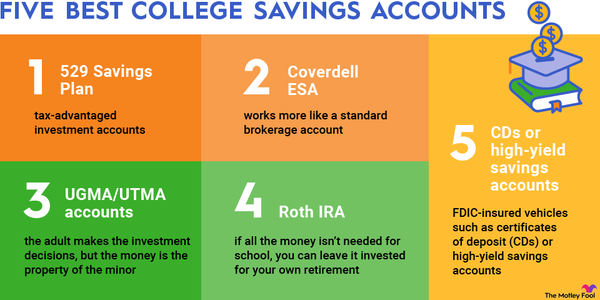

You may be eager to get started on executing a retirement plan, but before you begin investing, you should already have three to six months of living expenses saved in a high-yielding savings account. Keeping this amount in cash enables you to cushion against any unexpected financial blows without having to withdraw money from a retirement fund. Likewise, if you are already retired, we advise holding the amount of money you expect to need for the next three to five years in bonds or cash.

How much money should you save for retirement each month?

Again, the monthly amount of money that you should save differs for every person. Your current age, your target retirement age, and how much retirement money you’ve already accumulated are all relevant factors. But, as a starting point, most Americans would do well to save and invest 15% of their incomes for retirement.

If putting aside 15% of your paycheck seems daunting, know that you don't need to achieve that right away. At a minimum, if your employer sponsors and contributes matching funds to a retirement plan, then you contribute enough money to that retirement account to receive the full company match.

If you don’t have an employer-sponsored retirement plan, aim to save 6% of your income, which in the U.S. is the average retirement contribution rate. Then you can work on increasing the amount. Try to increase the percentage of your income you allocate to retirement investing by 1% annually until you reach your desired contribution rate. You can also boost your contribution rate whenever you get a pay raise.

Types of retirement plans

There are many different types of retirement plans, so you have plenty of great options to achieve your retirement goals. Retirement plans are grouped like this: Employer-sponsored retirement plans, pension plans, ndividual retirement accounts (IRAs), and self-employed retirement plans.

- Employer-sponsored retirement plans: These types of retirement plans are established by employers and often confer the benefit of employer-matched contributions. Each of these plan types are employer-sponsored:

- 401(k) plan: Retirement plan that allows tax-deductible contributions but treats withdrawals in retirement as ordinary income for tax purposes.

- 403(b) plan: Similar to a 401(k) plan but only offered by public education institutions, nonprofit organizations, and ministries.

- 457 plan: Also similar to a 401(k) but only available to state and local government employees and certain (usually highly compensated) nonprofit employees.

- Thrift Savings Plan: Similar to a 401(k) and only available to federal government employees and uniformed services personnel.

- Pension plans: Pensions are also known as defined benefit plans because, after you retire, they provide a predictable, defined amount of income every month for life. Companies that offer pension plans are becoming quite rare, although many public sector employers still offer them.

- Individual retirement accounts: IRAs, or individual retirement accounts, are available in two types. Both of these confer tax advantages, just at different times:

- Traditional IRA: Retirement plan that permits tax-deductible contributions and treats withdrawals in retirement as ordinary income for tax purposes.

- Roth IRA: Retirement plan for which contributions are not tax-deductible, but withdrawals in retirement are tax-free.

- Self-employed retirement plans: Although these types of plans require some administrative legwork, if you are self-employed, you have a few different strategies available to access many of the same tax advantages conferred by employer-sponsored retirement plans. These types of retirement accounts are available to self-employed individuals:

- SIMPLE IRA: Short for Savings Incentive Match PLan for Employees, SIMPLE IRAs are retirement savings plans for employers with 100 or fewer employees.

- SEP IRA: The Simplified Employee Pension IRA requires employers to contribute 100% of the accounts' funds and provide equal benefits to all eligible employees.

- Solo 401(k) plan: This type of retirement plan is similar to employer-sponsored 401(k) plans but has a higher annual contribution limit.

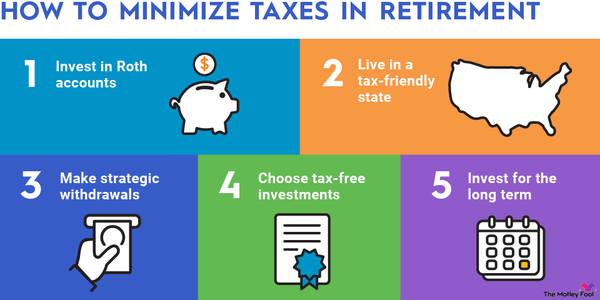

Tax advantages in retirement

When saving for retirement, investors generally have a choice between paying taxes on contributions to a retirement plan and receiving the money tax-free in retirement, or contributing to a retirement plan with pre-tax dollars and being taxed on withdrawals in retirement. Choosing a retirement plan that confers tax advantages in retirement is generally the best option if you believe that your income requirements in retirement are likely to put you in a higher tax bracket than your income today.

The Roth versions of retirement plans are those that confer tax advantages in retirement. Roth IRAs and Roth 401(k)s are generally the most popular, but you can also consider a Roth 403(b) plan, Roth 457 plan, or a Roth solo 401(k). Investing in an HSA also enables you to withdraw money, in retirement or at any age, for qualifying medical expenses without paying income tax on the withdrawal.

Even if you have a 401(k) or a traditional IRA, you may be able to avoid paying state taxes on withdrawals. Some states exempt from taxation your income from these types of retirement accounts.

Using your home to boost your retirement income

If you own your home, are nearing retirement, and are worried about your retirement account balance, you may be able to leverage the value of your home to generate extra retirement income.

By assuming a reverse mortgage, a lender would make mortgage payments to you in exchange for the equity in your home. Reverse mortgages aren't for everyone, but they’re certainly worth exploring for homeowners who are evaluating their retirement plans.

Start your retirement planning today

Planning your retirement strategy is important but not something to stress over, especially if you start early. The same adage that applies to planting a tree, with the best time being 20 years ago and the second-best time being now, is relevant to investing.

If you need assistance with determining your ideal asset allocation, estimating when you can retire, or planning your retirement income strategy, you can seek the advice of a Certified Financial Planner or other qualified professional. The important thing is that you take retirement planning seriously and get started in earnest today.

Expert Q&A on Retirement

The Motley Fool had a chance to connect with Jialu Streeter, Ph.D., a Research Scholar at the Stanford Center on Longevity. Jialu’s research primarily focuses on the economics of aging, retirement security, and financial security and mental wellbeing of older adults.

Expert Advice

Jialu Streeter, PhD,

The Motley Fool: Because of the COVID-19 pandemic, many Americans now fear they won’t be able to retire. What is your advice for someone who may be worried about retiring because of recent financial setbacks?

Streeter:

- First, I would suggest the person and their family have a thorough review of all their assets and debt, including home equity, mortgages, student loans (including their children’s if they have co-signed), retirement plan balances, and other checking and savings accounts.

- Second, it’s important to understand the implications of retirement age on the Social Security benefits. For some people who are in good health and can afford to delay Social Security, it might be better for them to delay in order to receive higher benefits for the rest of their lives. Third, the person or family need to have an honest conversation about their envisioned retirement style. E.g., will they travel much? Will they dine out or cook at home?

- Lastly, the longevity risk. Whether they will outlive their wealth. People need to put all these points together in order to see whether they are on track of a retirement life that they had planned for.

The Motley Fool: In 2019, the average retirement account savings for American households was $65,000 with the average American under 35 having $13,000 saved for retirement. Why do you think this average is so much lower than what experts typically expect Americans to have?

Streeter: Only about half of American adults have access to workplace retirement plans such as a 401(k). Second, people are going to school for longer and start saving for retirement later. Third, many people just follow the “default” rate of retirement savings which is lower.

The Motley Fool: There are no hard and fast rules about when to retire or how much we should have saved, but what three pieces of advice would you give someone who is just starting their first retirement savings account?

Streeter:

- Start saving early.

- Save more than the default rate.

- Max out on the retirement contribution if you expect that your retirement income will be lower than your current income, and of course, if it doesn’t interfere with your other financial goals.

Retirement FAQs

What is a retirement plan?

A retirement plan is the financial strategy that will enable you to be comfortable and secure in your retirement years.

Why is retirement planning important?

While some people manage to live out their golden years without a retirement plan, you will set yourself up for truly enjoying your retirement by being financially comfortable during those years.