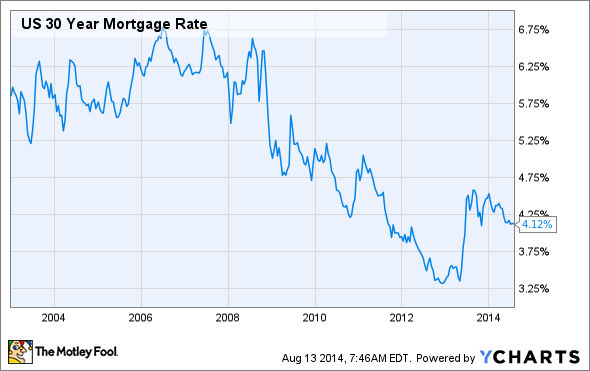

Today's home loan rates have risen from their all-time lows, but they're still appealing on a historical basis. As you can see in the chart below, it wasn't too long ago when 6.5% 30-year mortgage rates were the norm.

To put this in perspective, consider that for a $300,000 30-year mortgage, an interest rate of 6.5% would cost you $440 more per month than a 4.12% rate (today's average).

But even though rates are low, it's still worth shopping around for the absolute best rate you can find. You may be surprised to learn how much a small difference in rates can save you.

Why should you care?

A slightly lower rate can mean thousands in savings over the life of your loan.

Consider two 30-year mortgage options for a $300,000 loan amount, one with a 4.2% interest rate and one with a 4.1% rate. The respective monthly principal and interest payments on these loans would be $1,467 and $1,450. They sound pretty similar, right? Yet the difference adds up to more than $6,100 over the course of the loan.

That's money you could have added to your retirement savings and invested in your financial freedom. You could probably use an extra $6,000 or more in your retirement savings. That's why it's so important to make sure you get the best rate possible.

Shop around

The best thing you can do to get the lowest possible mortgage rate is to shop around. Usually when you agree to buy a home, your real estate agent will refer you to a mortgage lender they know.

While you should definitely hear what this lender has to say, under no circumstances should you blindly accept their loan terms. Do your homework and spend an afternoon looking into other options. Potentially saving thousands of dollars is certainly worth a few hours of your time.

Check some of the national banks, the local banks in your area, and your credit union, if you have one. Then look into direct lenders and perhaps even call a mortgage broker to see what your options are. You may be surprised how much rates can vary between lenders.

And don't worry about your credit taking a hit because of too many inquiries. So long as all of your mortgage activity takes place within a two-week time period (or 45 days, depending on whether your lender is using the new or old version of the FICO formula), it will show up on your credit as a single inquiry and will have little effect on your score, if any. So, to be safe, limit your rate-shopping to a two-week window and check out myFICO for a full description of how inquiries are counted and can affect your score.

Things you can do to get a lower rate

First, you should learn where you stand credit-wise by checking your credit report and score. Most lenders use the FICO model, and you can buy your FICO score and credit report from myFICO.com for about $20. Check the report for incorrect or negative information, and if anything isn't right, taking steps to correct it could help your score. myFICO can also tell you what the average home loan rates for your score are, so you'll know what to expect.

And anything that reduces the amount of upfront fees you'll have to pay lowers your annual percentage rate (APR), which is the effective rate you pay for the loan. For example, by choosing a shorter rate-lock period -- say, 15 days as opposed to 60 days -- you can cut your fees by up to 0.5% of the loan amount.

Another thing you can do is to put more money down than is required. Basically, a larger down payment demonstrates to the bank that you're serious about paying your bills on time, as you're putting more of your own money at risk. For example, a quick search on Zillow's mortgage marketplace in my local area shows that raising a down payment from 20% to 30% reduces the best APR by 0.03%.

In a nutshell

When it comes to home loan rates, a small difference can add up to big savings. Searching for the lowest rate and fees available to you is definitely worthwhile, and it shouldn't take more than a few hours of your time.