Source: Flickr user Mark Moz.

Different types of mortgage loans can have widely varying rates, and these differences in rates can have a huge impact on what you pay to own a home and your total interest costs over the lifetime of your mortgage. Knowing how mortgage rates tend to behave across common types of loans can make choosing the right mortgage a lot easier.

A recent history of mortgage rates

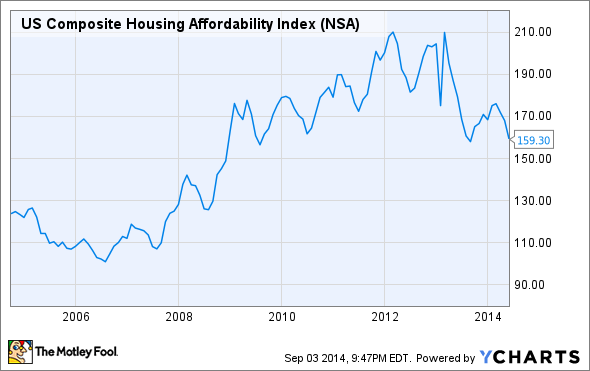

Back in the housing boom of the early and mid-2000s, home prices soared, making homes appear unaffordable in many popular locations. But because mortgage rates were relatively low, many homeowners could still afford more expensive homes because the monthly payments on their home loans were still fairly low. Most measures of home affordability stayed relatively constant during those boom years despite the steady rise in prices.

Once the housing bust came, prices reversed course and started to fall. But mortgage rates stayed low and even fell during the first few years following the financial crisis, and those rock-bottom rates helped drive demand back into the housing market by making homes more affordable than ever. Extraordinary efforts from the Federal Reserve to push mortgage rates lower sent the Housing Affordability Index to record levels.

US Composite Housing Affordability Index data by YCharts.

Last year, though, mortgage rates started rising. That in turn hurt housing affordability, but even now, the rate you'll pay on a typical mortgage is a lot lower than it has been historically. Moreover, for those with some flexibility, different types of mortgages can offer even better bargains on rates.

The typical trade-off with mortgage rates

Usually, you'll find a hierarchy across different types of mortgages. The 30-year mortgage rate tends to be highest, as it locks in financing for the longest amount of time. From an affordability standpoint, the 30-year mortgage offers the longest amortization period, making monthly payments relatively small compared to the loan amount. But because home equity builds up relatively slowly, lenders take on more risk for a longer period of time with a 30-year mortgage.

Source: TaxRebate.org.uk via Flickr.

A 15-year mortgage often has rates as much as 1 percentage point lower than a 30-year mortgage, reflecting the shorter financing period and quicker buildup of home equity that a 15-year mortgage's higher monthly payments require. With a 15-year mortgage, monthly payments will be much higher, but you pay much less in interest over the course of the loan because you pay off the mortgage more quickly.

Finally, a one-year adjustable-rate mortgage can offer some the lowest rates available. They typically come with repayment schedules based on the same amortization as a 30-year fixed mortgage. But in exchange for lower up-front rates, you run the risk that the short-term rates on which they're based will rise above what you could have secured with a fixed-rate mortgage.

As you can see below, this relationship has generally held true for decades:

US Mortgage Rate data by YCharts.

So what's the best mortgage rate now?

At first glance, the adjustable-rate mortgage, or ARM, seems like a no-brainer. Not only have rates started out lower than fixed mortgages, but they've tended to adjust lower during much of the past 30 years, giving further rewards to those daring enough to take on interest rate risk.

Source: Flickr user woodleywonderworks.

The problem, though, is that ARMs are near historical lows. Most experts expect short-term interest rates to rise in the near future, which would force ARMs to boost their rates, raising monthly payments and potentially making ARMs inferior to fixed-rate mortgages in the long run. With rates 1.75 percentage points below the 30-year rate, ARMs have a fairly large margin of safety, but the unprecedented level of accommodative Federal Reserve monetary policy has many worried that a reversal of those policies could send rates higher by even more than that amount. Even though ARMs may be the best deal for borrowers in the short run, they could turn into a long-term nightmare if rates move higher quickly.

For those who can afford higher monthly payments, a 15-year fixed mortgage offers a reasonable compromise and gives you a good deal. Saving almost a full percentage point will cut thousands off the total cost of your home loan, and locking in those low mortgage rates for a decade and a half avoids the anxiety involved in tracking the Fed's monetary policy changes.

Overall, mortgage rates across the board remain subdued, and even though they're higher than they were at their lows, they've still allowed housing to remain affordable. Even if you can't qualify for a loan with the lowest mortgage rates, most loan options available are still quite attractive from a longer-term perspective.