Peter Schiff is an investment manager, author, media personality, and outspoken advocate for investing in gold. He has an estimated net worth of $70 million, coming from his brokerage firm, EuroPacific Capital, several books, his blog, and various other media shows he controls. Schiff is a regular guest on financial news programming, a platform he uses to regularly recommend gold as a safe investment.

Schiff's prowess as a media personality is exceptional. His investment record, however, is far less impressive. His most consistent recommendations are for gold, a position motivated by deeply held beliefs and his own self-interest.

Image source: Getty Images.

Peter Schiff's blog, various radio and podcast shows, and media savvy give him a powerful platform

The core of Peter Schiff's notoriety in the investment world is his ability to regularly appear in respected, prominent financial news media. He's frequently quoted in The Wall Street Journal, The New York Times, Barron's, and Fortune, to name just a few.

He's a regular guest on various financial and business television channels, from CNBC to Fox Business to MSNBC. His radio show, The Schiff Report, went off the air in 2014, but survives today as a popular weekly podcast. He's published several books, all of which deal with the threat of an imminent crash in the U.S. economy and how investors should prepare.

His platform is a powerful tool to promote his economic and market forecasts. More often than not, Schiff uses this platform to tell investors that they should be buying gold.

Peter Schiff's predictions completely hinge on the price of gold

It's no secret that Peter Schiff is bullish on gold. He has consistently criticized U.S. monetary and fiscal policy, repeating ad nauseam that an economic disaster is looming in the U.S. and abroad. In that scenario, gold is his asset of choice to provide a safe haven for capital amid a collapsing world economy.

To the casual observer, Schiff's omnipresent media persona can give credibility to his worldviews and stock picks. He is a talented self-promotor. The reality, though, is that Schiff's worldview and forecasts, while consistent, have proven to be incorrect far more often than not. Investors should approach his advice with a large grain of salt.

To the surprise of no one, Schiff's current list of stock recommendations are heavily concentrated in gold. Gold prices have jumped over 20% so far this year, driving strong stock gains throughout the industry. However, looking at a slightly longer time horizon, the fund's picks have largely trailed the S&P 500 and its industry benchmarks.

The largest holding in Schiff's gold fund is Franco-Nevada Corp. (FNV 0.67%), a Canadian based owner of gold royalties and natural resource investments. Gold miner Agnico Eagle Mines (AEM 1.06%) is the fund's second largest holding. Both stocks have handily outperformed both the S&P 500 and the gains in commodity prices so far this year.

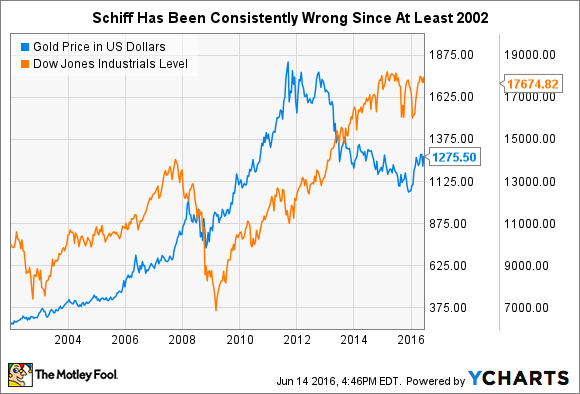

Gold Price in US Dollars data by YCharts

However, over the past five and 10-year periods, the S&P 500 outperforms each, with only Franco-Nevada Corp. being an exception. Schiff's gold fund is down nearly 27% since its inception and trails its benchmark index by over 2%.

Gold Price in US Dollars data by YCharts

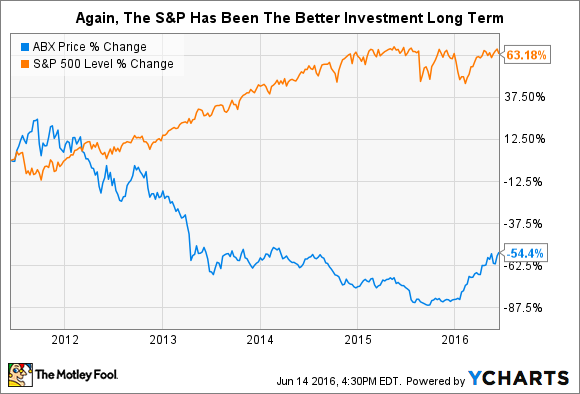

Even Schiff's other funds, presumably those without an explicit focus on gold, are heavily dominated by companies with direct ties to the metal. Four of the top five holdings in EuroPac's International Value Fund, for example, are gold miners. Again, these stocks have done well this year -- gold miner Barrick Gold (GOLD 1.64%) is up over 167% this year alone! – but again with a longer time horizon they've trailed alternative investments. Schiff's value fund trails its benchmark by over 20% since its inception.

Proceed with caution: Schiff's gold recommendations are wrong, a lot

Schiff's public predictions, separate from his actual investing, have an equally bad track record. In 2009, he predicted an economic collapse driven by hyperinflation in the U.S. It turns out that deflationary pressures were the bigger concern following the crisis, a reality that persists today.

Or, consider his October 2012 statement on CNBC that investors "are going to be shocked at how inexpensive gold" was at the time. Gold traded around $1,700 that day, a level that the metal hasn't seen since. Today it's 32% off that high, trading around $1,275. He's been predicting a gold rally to over $5,000 since that time, despite the clear bear market over the past four years.

Schiff is also quick to boast that he predicted the financial crisis, which he did, sort of, six years before the crisis actually started. If you predict a recession every single year, eventually you're bound to get one right. He also predicted at that time that the Dow Jones Industrial Average would soon collapse from 10,000 to 2,000. Instead, the Dow has climbed to nearly 18,000 this year.

Gold Price in US Dollars data by YCharts

Blind consistency should be a red flag

There are countless other examples of Schiff recommending gold to protect investors from one false crisis after another. His consistency is remarkable, and seems to have no regard for contrary evidence or changes in economic and market conditions.

I think the reason is two-fold. First, Schiff seems to genuinely believe in his hypothesis. His father, Irwin Schiff, was a noted libertarian with an anti-establishment streak similar to his son's. His disdain for the federal government and Federal Reserve resulted in several stints in jail for a variety of run ins with the IRS, all driven by his staunch libertarian beliefs. Today, Peter Schiff carries the torch forward with as much enthusiasm as his father, albeit staying on the other side of the law. I think Schiff genuinely believes what he says, however incorrect those predictions turn out to be time and again.

Second, it's is critical to understand how Peter Schiff actually makes his money. There are the mutual funds managed by his brokerage firm, Euro Pacific Capital. Those funds charge fees on the capital invested, generally around 1.5% annually. The funds are highly concentrated in the business of gold, making them a perfect place for fearful investors to park their capital after seeing Schiff on TV, online, or on the radio. In other words, he's in the business of selling gold, so it makes sense that he'd consistently advocate for the metal over time.

Further, he profits from the sale of his books and other media products. It is again in his best interest to make as many headlines as possible to draw in readers, viewers, and listeners. In a world awash in competition for every eyeball and click, Schiff is a master at standing out from the crowd.

At the end of the day, Peter Schiff's market predictions will be correct if gold rises and incorrect if gold falls. He'll continue padding his net worth as long as investors put their capital into his funds, regardless of the price of gold. As far as everything else he predicts, I'd proceed with extreme caution.