Clean Energy Fuels just did a lot of heavy lifting, reducing long-term debt by over 30%. Image source: Getty Images.

The weight hanging over Clean Energy Fuels Corp. (CLNE -2.18%) for some time now has been debt -- particularly, $150 million in convertible notes due next month. However, as the company announced on July 15, that debt is no more, with the final tranche having been paid off with a combination of cash and stock.

And while dilution isn't fun -- this deal alone watered down shareholders by 14% -- long-term investors will benefit from this move, as well as moves earlier this year that caused dilution. Here's a closer look at why this is a situation when investors should be happy their holding got watered down.

What Clean Energy's been dealing with

Clean Energy Fuels entered 2016 with $572 million in long-term debt, with $150 million of it due in August. Over the past several years, the debt load has weighed heavily on the company, costing it roughly $40 million per year to service. The cost has been especially troublesome, considering the assets that debt paid for have been slow to generate the returns management expected following the crash in oil prices in 2014, which has caused diesel prices to do this:

Brent Crude Oil Spot Price data by YCharts

In short, this has led to slower natural gas adoption in the trucking industry than Clean Energy was betting on, and instead of getting a quick payback on the expansion that debt funded, the company has instead been saddled with the cost of the debt while the market for natural gas trucking has been slow to build.

What's happened with debt in 2016

The company has aggressively retired debt in 2016, and not just the 2016 notes. So far this year, the company has retired $64 million of its 2018 debt, with $20.7 million in cash and 6.27 million shares of stock. Based on a recent stock price of around $3.25 per share, that's paying off $64 million in debt for $41 million in capital.

Combine that with the full retirement of the 2016 notes, and it looks like this: Clean Energy Fuels has retired $209.2 million in long-term debt in 2016, using $118.6 million in cash (and some short-term debt via a revolving credit instrument) and $20.3 million in shares. Long-term debt was over $570 million at the end of 2015. That's a 35% reduction in long-term debt, which should reduce debt payment expense by as much as $15 million per year. It also positions the company with no debt maturities until 2018, when it has $217.5 million in debt coming due.

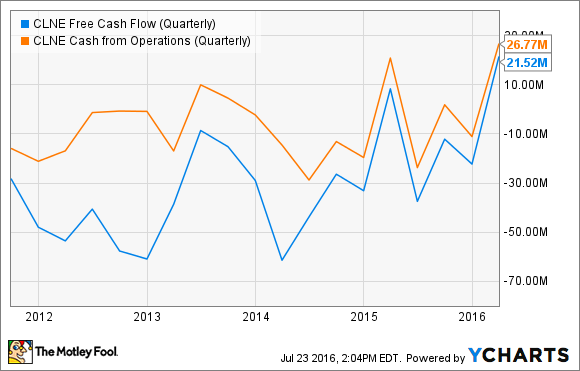

Reducing debt will improve cash flows even more. CLNE Free Cash Flow (Quarterly) data by YCharts

The company also announced that it had $182 million in cash and short-term investments as of June 30, an $18 million increase from the end of the first quarter in March. If we subtract the $37.9 million paid in July to retire the 2016 notes, that leaves the company with $144 million in cash, equivalents, and short-term investments.

That's only $2 million less than it started the year with, though its long-term debt has been significantly reduced. That's a stronger balance sheet than the company started the year with, and evidence that cash flows are indeed strengthening.

What it means for Investors going forward

First, the "bad": In less than one year, more than 20 million new shares have been issued, diluting shareholders by 22%. In other words, if you did nothing, you now own 22% less of the company than you did at the end of 2016. But this dilution wasn't unexpected. Management told us in late 2015 that it would be using shares to retire part of its debt, and the market has probably been pricing the impact of dilution into the stock.

But there's a lot of good from this when it comes to cash flows. By retiring $209 million in debt, the company will reduce its annual interest expense by at least $10 million. That might not seem like much, but consider this: Clean Energy Fuels reported a profit of $2.8 million last quarter. When factoring out some non-cash gains, the "cash profit" was more like $1.4 million. So getting a $2.5 million-per-quarter reduction in cash costs by paying down its debt is a major boost to net cash flows.

This is especially important right now, as the company makes the transition from heavy investments in its network to profitable growth and leveraging those assets.