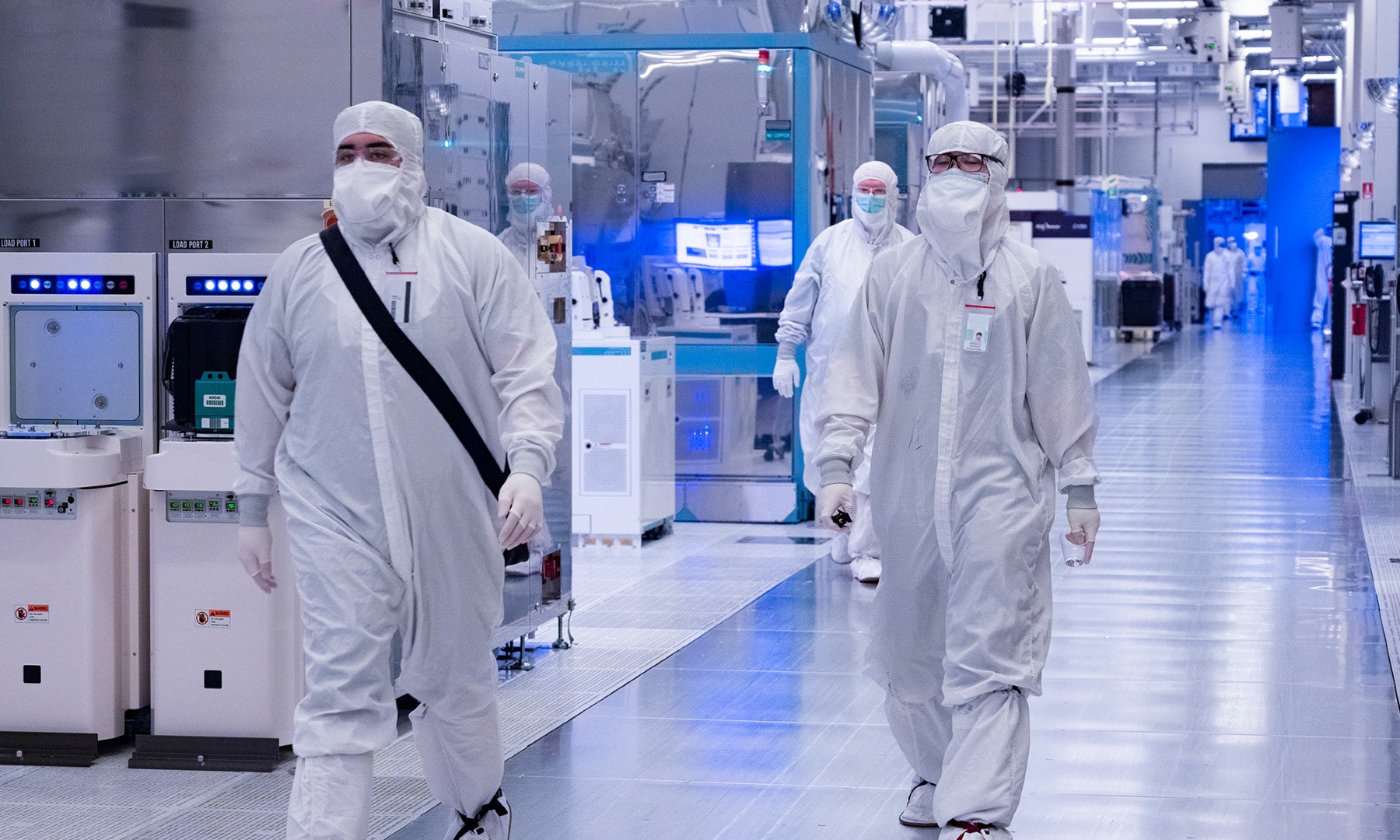

Image source: Intel.

Earlier this year, Intel (INTC +0.16%) revealed that it had canned its entire pipeline of publicly announced smartphone applications processors. This included Broxton, a high-end stand-alone applications processor targeted at tablets and phones, as well as the SoFIA family of integrated applications processors and cellular modems (SoFIA LTE, SoFIA LTE 2, and, presumably, SoFIA MID).

Although the company made it clear that it intended to continue trying to build stand-alone modems that would be paired with third-party applications processors, it seemed that the company was pretty much done in the market for integrated applications processors and modems.

That still seems to be true in the near term, but at a recent investor conference, Intel's Brice Hill indicated that long term the company will try its hand once more at smartphone processors.

What Hill said

"Baseband, at least in the current period, is our primary focus in mobile but it's not our only focus in mobile," Hill began.

He went on to tell listeners that Intel is investing substantially in LTE as well as in future 5G modem technology and that getting those core modem technologies right would eventually allow the company to reenter the mobile applications processor market.

"Our view is that building a mobile [system-on-a-chip] or [system-on-chips] for the [internet of things] business or [system-on-chips] for other potential segments is a relatively short step and that we'll have the [intellectual properties], the different features, that will allow us to build products in those spaces," Hill explained.

Intel is going to try again, but will it succeed?

Intel's previous attempts to go after the smartphone applications processor market clearly failed. There are a lot of explanations and hypotheses out there about why the company failed in this market, but the bottom line is that the company could not field competitive products in a timely fashion to meet customer requirements.

Intel's applications processors were typically underpowered compared to what key players such as Qualcomm (QCOM 0.19%) and MediaTek offered. The problem wasn't just limited to a single area; CPU performance, graphics performance, and imaging performance were all areas in which Intel's processors simply couldn't compete.

Beyond the performance problems, Intel's mobile processors suffered from integration issues. In particular, while the company's competitors had been integrating cellular baseband processors onto the same piece of silicon as the applications processor for quite some time, Intel seemed to have exceptional difficulty building such products.

A popular hypothesis was that Intel faced difficulties moving its cellular modems from third-party manufacturing technologies to its own chip manufacturing technologies, which hurt the company's efforts to build integrated processor and modem solutions. Given that Intel still hasn't told investors when it plans to move its stand-alone modem products to its own manufacturing technology, this hypothesis seems reasonable.

At any rate, if Intel is going to give this market another shot (my guess is that they forgo building processors with LTE modems and try to intercept as 5G networks come online), it needs to make sure to learn from its many prior failures in this market and come with competitive products.

Whether the company will be able to succeed, only time will tell.