Image source: Getty.

Costco (COST 0.84%) is the second-biggest retailer in the U.S., but its dividend badly lags comparable peers. The warehouse giant's stock yields just 1%, versus over 3% for Target (TGT -0.71%) and 2.8% for Wal-Mart (WMT 1.02%). Even high-flying Home Depot (HD 0.22%) delivers significantly more of a return to income investors with its 2% yield.

That payout gap has kept Costco off of many dividend hunters' stock screens. However, it doesn't capture the company's true dividend commitment, which suggests the retailer will significantly boost its payment next year.

Costco dividend history

Costco has raised its dividend by double digits in each of the last three fiscal years, culminating in this past April's 13% hike to $0.45 per share (or $1.80 a year). For the bigger picture, though, investors must include the large one-time dividends it has made over the past few years.

Image source: Getty Images.

In early 2015, Costco sent shareholders a special dividend of $5 per share just two years after delivering an even bigger $7 per share special payment. Factor in those payouts and the company's dividend priorities seem much more substantial than its 1% yield – and 29% payout ratio -- suggest.

In fact, Costco has delivered $7 billion to shareholders in dividends over the past three fiscal years, which equates to slightly more than 100% of net earnings over that time and 60% of operating cash flow. Seen in this light, the company clearly considers dividend payments a core channel to return cash to its investors.

A small commitment

The warehouse giant's stated dividend commitment is modest -- and that's putting it mildly. Costco is on the hook for $800 million in annual payouts, equating to about 30% of the profits it should generate this year. In contrast, many peers deliver a higher proportion of earnings and much larger dividend yields.

Dividend Comparison

|

Metric |

Costco |

Wal-Mart |

Target |

Home Depot |

|---|---|---|---|---|

|

Dividend yield |

1.1% |

2.8% |

3.4% |

2% |

|

Payout ratio |

31% |

32% |

42% |

43% |

Data source: Yahoo! Finance.

Costco could arguably declare an even greater chunk of its earnings than these retailers, too, given that it generates a big portion of profits from membership fees. In comparison to product sales markups, these subscriber fees are much steadier and more predictable -- even during economic downturns. That means Costco would be at a much lower risk of needing a dividend cut when a recession pulled revenue lower.

Aggressive growth plans

On the other hand, Costco has promising growth initiatives that are taking priority over dividend returns right now. While Wal-Mart is shrinking its store base and Home Depot and Target keep theirs steady, the warehouse titan is in the middle of its biggest annual expansion in years.

The company plans to open up 30 new warehouses in fiscal 2016, nearly matching its record year of 2007 when it launched 31 locations. Those 144,000-square foot buildings are expensive, which is why the company raised its capital expenditures to $3 billion this year -- up 20% over the prior year.

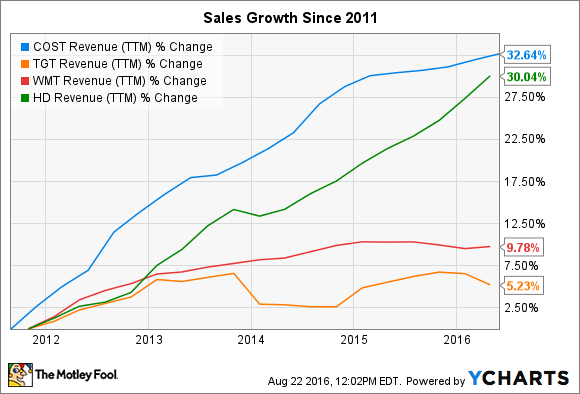

Market-beating customer traffic gains have powered industry-leading growth for Costco lately. Sales are up 33% over the last five years, putting it in a retailing class of its own. Meanwhile, the membership base and renewal rate metrics are both sitting at record highs. If any of these trends were sinking, it might raise a red flag for income investors, but that's just not the case here.

COST Revenue (TTM) data by YCharts.

With the business growing at a healthy pace, and with plenty of cash flow to fund expansion efforts, I'd be surprised if Costco didn't boost its dividend by double digits again in 2017. It may even employ another special dividend in the coming years. Over the longer term, though, hopefully management will boost its dividend commitment rather than relying on sporadic, unpredictable payouts.