Image source: Getty Images.

Last quarter, billionaire investors that The Motley Fool tracks loaded up on a net 27 million shares of Activision Blizzard (ATVI), the video game developer behind hit franchises like Call of Duty and Destiny. While it's never a good idea to blindly follow other investors -- billionaire or not -- into stocks, it can be interesting to watch where the biggest buyers direct their resources.

In Activision's case, six money management firms sold a total of 2.8 million shares in Q2, according to their 13-F filings with the SEC. By far the most bearish in that group was Paulson & Co., run by billionaire John Paulson. That company sold two thirds of its ATVI holdings, or roughly 2 million shares.

The bullish bets far outweighed the bearish ones, though. Ten investment firms bought a collective 30 million shares of Activision last quarter. Lone Pine capital, headed by Stephen Mandel, established the largest new position by adding 10 million shares in Q2.

|

Investment company |

Change in ATVI shares |

|---|---|

|

Bluecrest Capital Management |

(27,400) |

|

Bridgewater Associates |

(23,403) |

|

Caxton Associates |

203,300 |

|

Citadel Advisors |

4,852,712 |

|

GLG Partners |

(16,900) |

|

Highbridge Capital Management |

(442,520) |

|

Lone Pine Capital |

10,293,113 |

|

Millenium Management |

806,004 |

|

Moore Capital Management, |

289,997 |

|

Oz Management |

9,380,334 |

|

Paulson & Co |

(2,140,000) |

|

Renaissance Technologies |

923,298 |

|

Soros Fund Management |

378,981 |

|

Third Point |

3,000,000 |

|

Tudor Investment Corp |

(177,977) |

|

Two Sigma Investments |

88,911 |

|

Grand Total |

27,388,450 |

Data source: 13-F SEC filings.

Improving profit outlook

Activision's latest business results have been impressive. The company outpaced management's sales and profit guidance in each the past two quarters while raising its full-year outlook on the top and bottom lines. Most recently, quarterly sales rose 50% and earnings, after adjusting for costs related to its King Digital acquisition, jumped 45% higher.

Image source: Activision.

The video game developer is benefiting from a few positive trends that are making its business steadier, and more profitable. Gamers are embracing digital sales, whether through micro transactions or, increasingly, full game downloads. As a result, middleman retailers like GameStop (GME -0.68%) are often cut out of the equation, leaving more profit to trickle down to ATVI's bottom line. Meanwhile, the online connectivity of next-generation video game devices has helped extend the life cycle of any given game through rounds of expansion packs and subscription-type services like season passes. Now Activision can produce tons of revenue from a hit like Call of Duty: Black Ops III many months after its release.

These industry tailwinds aren't worth much unless you have a strong enough content portfolio to take advantage of them. Judging by its user engagement, that's not a problem for this developer. Activision logged 10 billion hours of play time across its titles last quarter, including 500 million hours for Blizzard's the new property, Overwatch.

Is Activision stock a buy?

On the other hand, Activision's business could stumble in the critical upcoming holiday season. Its Call of Duty franchise is showing signs of age and could post its third straight year of declining revenue. The ultra-profitable Skylanders brand, meanwhile, is struggling under intense competition after having dominated the category since 2012.

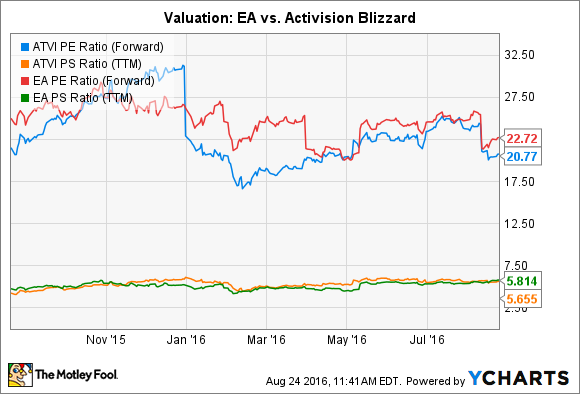

Meanwhile, the stock has grown more expensive, which raises the stakes on Activision's performance this year. Investors are paying nearly six times annual sales right now, a high-water mark for this company.

ATVI PE Ratio (Forward) data by YCharts.

Ultimately, I'd side with the buyers in this matchup. In terms of earnings, Activision seems valued right about where it should be at 21 times expected profit, or similar to rival Electronics Arts (EA -0.19%). The publisher has by far the deepest bench of hit titles in its history, demonstrating how far Activision has come since 2013 when just three brands, Call of Duty, World of Warcraft, and Skylanders accounted for nearly all of its profits. It has the strong track record of success at cranking out new high-value franchises -- from Overwatch to Hearthstone to Destiny -- that provides the best indication that Activision has a long growth runway ahead.