Image source: Getty Images.

What happened

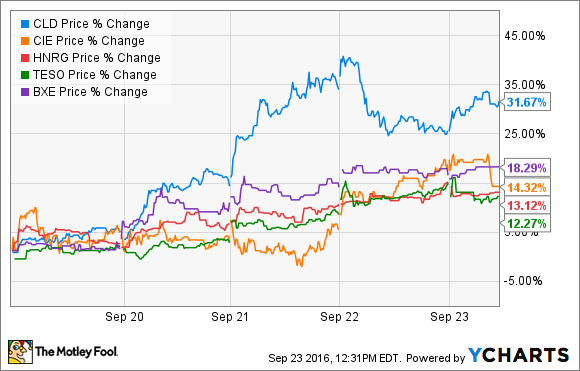

More often than not energy stocks move on the fundamentals driving commodity prices. However, last week fundamentals took a back seat to politics on the national and global stages. Nationally, Republican presidential candidate Donald Trump's energy stump speech sent coal stocks soaring while statements from several OPEC members fueled enthusiasm in the oil market that OPEC might do something to stabilize prices. These talking points, likewise, fueled big moves in energy stocks. According to data from S&P Global Market Intelligence, Cloud Peak Energy (CLD), Cobalt International Energy (NYSE: CIE), Hallador Energy (HNRG 2.00%), Tesco (TESO), and Bellatrix Exploration (NYSE: BXE) led the charge higher:

So what

As coal producers, last week's rallies of Cloud Peak Energy and Hallador Energy had nothing to do with OPEC's rhetoric. Instead, an energy speech by presidential candidate Donald Trump fueled the coal stock rally after he promised an "America first" energy policy, which would roll back regulations hurting the country, and coal producers like Cloud Peak Energy and Hallador Energy in particular. Further, he promised to restore America's coal sector to greatness, which would imply better days ahead for Cloud Peak Energy and Hallador Energy if Trump wins the election.

Cobalt International Energy, meanwhile, jumped not only due to rising oil prices, but it continued to ride last week's wave after reaching an agreement with drilling contractor Rowan Companies (RDC) to terminate a lease one year early. Doing so will save the company $80 million through 2018, which is critical for the cash-strapped company. That said, Cobalt International Energy did agree to use Rowan as its exclusive drilling contractor for the next five years, which could end up costing it more money in the long run.

Canadian oil and gas producer Bellatrix Energy, on the other hand, not only rallied thanks to the OPEC-inspired oil price rally, but due to an asset sale. The company announced on Monday that it sold its non-core Pembina assets for $47 million in cash. Bellatrix Energy plans to use the cash proceeds to repay debt.

Finally, the move higher by oil-field service company Tesco's stock was primarily driven by OPEC. That is because higher oil prices are a critical factor to drive a market recovery, which would improve demand for Tesco's tubular services and products. As such, investors are betting that OPEC will intervene this week, which would help restart Tesco's earnings growth.

Now what

The problem with these rhetoric-driven moves is that it is entirely possible neither comes to fruition. Trump might not get elected and even if he does he might not make coal great again. Likewise, OPEC might not move, and even if it does it still might not stabilize the oil market. That is why investors are better off steering clear of stocks that are moving based on hope instead of tangible improvements in market fundamentals.