It may have hurt taking a 30% one-day loss on Skechers U.S.A. (SKX -0.79%) stock when it reported third-quarter results a year ago, but selling then would've saved investors the pain of losing an additional 40% in the year since.

Skechers stock is giving investors a workout after tumbling more than 60% over the past year, but there were trip-hazard warning signs that could have saved them from skinning their knees. Image source: Skechers U.S.A.

Those who did hold on to their shares should have seen the subsequent decimation in value coming a mile away, and used numerous exit points along the way to avoid the value destruction. It may be hard to hear, but if you're licking your wounds from Skechers' 60% loss, you have no one to blame but yourself.

What we can learn from this debacle

Okay, enough with the tough love. Let's look at how we can all use Skechers as a "teachable moment" so we can perhaps avoid the next stock implosion.

It's true the footwear maker didn't give off any warning signs up till the third quarter of 2015. Before then it was a high flyer that had surpassed Adidas to become the second largest footwear maker behind Nike. And though its 5% market share was a mere speck in the rearview mirror for the industry leader -- which commanded a massive 62% of the market -- it indicated Skechers was on the rise and its stock reflected that potential.

Between August 2014 and August 2015, Skechers stock tripled in value, rising from $50 per share to over $160. Pull back the lens a little further to the beginning of 2013, and Skechers stock had surged 700%!

The footwear maker subsequently split its stock 3-for-1, a maneuver the market often views as bullish even though there is nothing fundamentally different about the business -- it's slicing the pizza into 18 small slices instead of six larger ones, which is why smart investors should largely view stock splits as background noise.

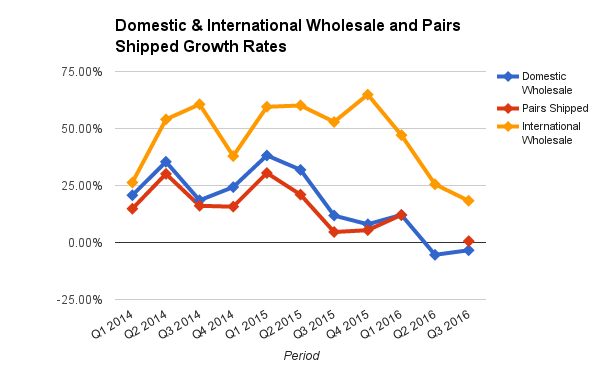

Data source: Skechers quarterly SEC filings. Chart by author.

The first warning sign

But then a year ago, the company reported third-quarter earnings that caught the stock market by surprise as sales suddenly slowed, missing Wall Street expectations despite a 27% increase in quarterly revenues. Moreover, where the domestic wholesale business was up 12% from the year-ago period and the international wholesale business was 53% higher, they were both showing signs of deterioration.

It was key that the domestic market's growth rate had plunged 36% from 2014, a yellow flag that something was amiss. Because the domestic business accounted for the lion's share of the footwear maker's operations, some 60% of the total, the dramatic deceleration was a warning signal.

Those problems became even more apparent in the fourth quarter, but remarkably, Skechers stock jumped 5% the day after, and eventually rose some 25% over the next month. Investors should have instead used the opportunity to get out.

Red flags start waving

The domestic wholesale business was in free fall. Where sales growth in the prior year had been near 25%, this time out it was up just 8%, for a whopping 67% decline in the rate of growth. Anytime there's a 50% or more drop in the growth rate, it's a red flag, and here it was waving furiously for Skechers.

No doubt it was somewhat masked by the 62% gain in the international wholesale business, a market Skechers said it was targeting and eventually hoped would account for 50% of the total, but its prime business was still reeling.

The falloff in growth in domestic wholesale repeated its gut-wrenching drop in the first quarter: Growth rose just 12% this time, for a 68% drop in the growth rate, until finally turning negative in the second quarter when sales actually fell 5.4% from 2015. That it's negative once again in the third quarter shows just how much this footwear company's business has shriveled.

All along the way, however, investors could have used any of these moments as opportunities to get out of the stock, and save themselves from suffering the latest decline.

Image source: Skechers U.S.A.

Should you still run away?

But if you're still holding on at this point, it's fair to ask: If the damage has already been done, should you just hang on? After all, a stock does at some point become very cheap -- but I think Skechers may not have hit bottom yet.

Where once it was looking for the back half of the year to see a turnaround, it now says its midpoint guidance for fourth-quarter net sales will actually be below last year's results. That means a negative result for its domestic business will probably be a three-peat, and even its international wholesale business has seen growth vanish by some two-thirds, rising just 18% in the third quarter compared to 53% a year ago.

It's true Skechers has been hurt by a strong U.S. dollar and a warehouse fire in Malaysia, but there's nothing indicating its business is turning around, either. With an enterprise value trading at almost 16 times its free cash flow, the footwear maker isn't being discounted nearly enough to make it a buy right now. With the prospects for future sales declining on the horizon, I'm not sure I'd want to be holding it either.