Image source: Getty Images.

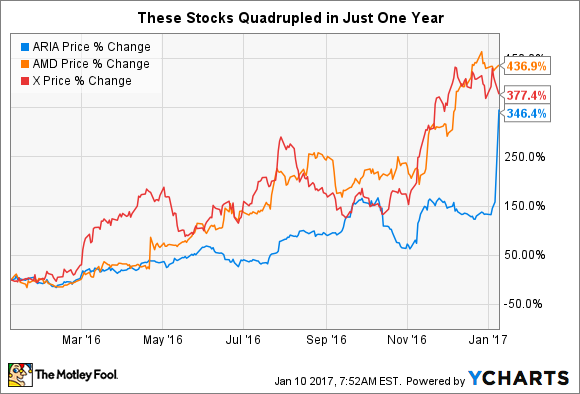

Investors love stocks that give them massive returns. The most common way to get huge gains is to invest for the long run, counting on fundamental business success to produce ample dividends and lucrative share-price appreciation. Yet sometimes, gains come in a very quick period of time, and a very small number of stocks have managed to quadruple in value in just the past year. Below, we'll look at Ariad Pharmaceuticals (NASDAQ: ARIA), U.S. Steel (X -0.94%), and Advanced Micro Devices (AMD -3.37%) to see whether investors who are seeing the companies for the very first time will be able to squeeze out any more gains from their stocks.

Ariad gets a great deal

Ariad Pharmaceuticals has seen the bulk of its share gains come very recently. Throughout 2016, excitement built up for Ariad's Iclusig treatment for two rare forms of leukemia. Yet although the treatment had good results for the blood and bone marrow diseases, the high price tag that Ariad charged for the drug made some investors nervous that more stringent federal regulation of drug prices could result in lower long-term profits for the company. Those fears largely abated after the presidential election, as investors see President-elect Donald Trump as being less likely to encourage regulation and allowing Ariad to earn its profits longer.

Then, just earlier this week, Ariad announced that Japanese pharmaceutical company Takeda Pharmaceutical would buy out Ariad in an all-cash deal worth $5.2 billion. The $24-per-share price for the takeover sent Ariad up 73% in a single day, bringing its gains to nearly 350% since this time last year. Going forward, investors can't expect any further share-price gains from Ariad given the buyout bid, and although few expect roadblocks to the deal, there's at least some chance that a rejection of the merger could send Ariad shares back downward.

U.S. Steel enjoys the commodity rebound

U.S. Steel's big gains have come from steady upward movement throughout the past year. Even before the presidential election, prospects for healthier economic conditions across the globe had investors getting more excited about the steel industry. Moreover, favorable rulings from the U.S. Department of Commerce imposed anti-dumping tariffs on foreign competitors, creating greater opportunities for U.S. Steel to compete more effectively against foreign competition.

The presidential election also led to a big bounce for U.S. Steel. Plans to boost infrastructure spending were bullish for the construction industry, and steel will likely play a substantial role in any infrastructure rebuilding or new construction that takes place. Exactly how far that can pull U.S. Steel's profits higher remains to be seen, but investors are excited enough to have given the stock a more than 375% return over the past 12 months in anticipation of better times ahead. Shareholders shouldn't expect another quadruple in the near future, but the stock hasn't necessarily hit its top just yet.

AMD chips away at the competition

Finally, Advanced Micro Devices has been the winner of this group, with its stock climbing more than 435% since this time last year. Several victories have helped propel the semiconductor company higher, including a couple of deals to create joint ventures with partners in Asia. The sale of its semiconductor assembly and test assets to Nanton Fujitsu Microelectronics gave AMD about $320 million in cash to launch strategic efforts of its own, and another deal with Tianjin Haiguang earned AMD almost $300 million more for licensing its x86 server chips for the Chinese server market.

The biggest win for Advanced Micro Devices came from its Polaris graphics cards, which have helped it become an even bigger player in the graphics processing unit market. Major customers have replied by using AMD chips in their own products, eating into the commanding lead that NVIDIA has had for years. Even if Advanced Micro Devices maintains only modest market shares in key markets, the opportunities there are big enough for the stock to keep climbing sharply in 2017 and beyond.

Investors can't count on any stock they own quadrupling in such a short period of time. Although Ariad's upside is almost nonexistent, both AMD and U.S. Steel could continue to see gains if things keep going well in their respective markets.