Illinois Tool Works Inc. (ITW -1.43%) rose by nearly a third in 2016, and the company's earnings prospects look good in 2017. On a risk/reward basis, however, the stock looks fully valued. While it looks cheap relative to peers like 3M Co (MMM -0.66%) or Lincoln Electric Holdings, Inc (LECO -4.07%), it's not necessarily a good value in itself. Let's take a look at what you need to know before buying or selling the stock.

Illinois Tool Works' automotive segment faces an uncertain year. Image source: Illinois Tool Works.

Illinois Tool Works' plan is getting the job done

The really interesting thing about Illinois Tool Works is that most of its earnings upside relies on initiatives that management has taken in order to improve growth and productivity. As such, the company is relatively better positioned to deal with any unexpected slowdown in its end markets. For example, in the company's investor day presentation in December, management outlined its belief that the company had the potential to deliver organic revenue growth of 200 basis points -- where100 basis points equals 1% -- above its end markets.

In other words, even if its end markets decline around 2%, Illinois Tool Works could still eke out growth -- not something that can be said for many industrial companies. In addition, management expects its recent history of margin expansion -- largely due to its 2012-2017 enterprise-strategy plan -- will continue in the coming years.

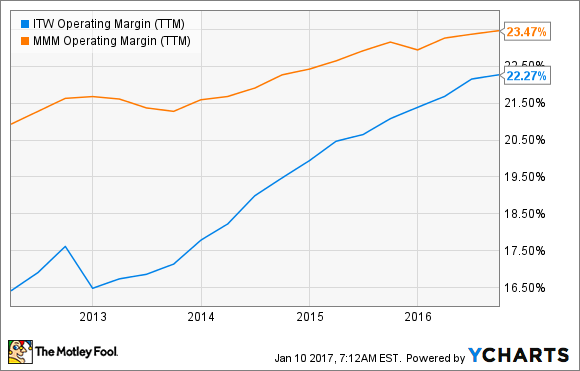

As you can see below, margin expansion has been impressive in recent years, and alongside 3M Co, Illinois Tool Works is seen as a high-quality stock in the sector. Moreover, management expects operating margin to be above 22.5% for full-year 2016, rising to above 23.5% for 2017 and expanding to 25% by 2018.

ITW Operating Margin (TTM) data by YCharts.

Management expects its enterprise initiatives to account for 100 basis points of margin expansion in 2016 and 2017, and it's this ability to generate earnings growth across a range of market conditions that makes the stock attractive.

Growing, ready to grow, and could grow more

On top of that, there are three reasons to believe investors can look forward to growth in 2017:

- Illinois Tool Works' management expects organic sales growth of 1.5% to 3.5% for 2017, pretty much in line with 3M Co's forecast of 1% to 3% organic sales growth.

- 85% of its products are classified as being "ready to grow" compared to just 60% at the end of 2015.

- Evidence from a key competitor, Lincoln Electric, suggests that the worst may be over for Illinois Tool Works' weakest segment (welding).

Clearly, top-line growth is expected for 2017, and given plans for margin expansion, earnings per share (EPS) are forecast to grow in the range of 6%-11.5%, to $6-$6.20. However, if the company is going to beat growth estimates and end-market growth remains as expected, then it's likely to come from its growth initiatives.

By "ready to grow," management means that the products have gone through an optimization process -- involving product-line simplifications and strategic sourcing -- so that they're positioned to grow at what's called "Illinois Tool Works caliber margins and returns."

Finally, as you can see below, the welding segment has continued to be weak in 2016.

Data source: Illinois Tool Works Inc. presentations. Chart by author.

There are signs of hope -- largely as a consequence of declining U.S. industrial production and capital spending cuts in the oil and gas industry. For example, Lincoln Electric CEO Chris Mapes discussed his company's Americas segment on the third-quarter earnings call:

We saw improvement especially in our Americas segment as we move through the quarter" and "we saw improvement in those demand trends on a year-over-year basis moving from the first quarter of this year to the second quarter to now completing our third quarter. As we look at the fourth quarter, we believe that trend is going to continue.

Fully priced in

Adding it all together, Illinois Tool Works is clearly an attractive stock from an operational perspective, but it's had a great run, along with 3M and Lincoln Electric. All three stocks are trading on forward PE ratios of around 20 times earnings or above. In other words, most of the good news in 2017 looks like it's already been priced in.

ITW PE Ratio (Forward) data by YCharts.

If the company can find a way to beat expectations, or end markets grow more than expected, there's upside potential -- but how much at these levels? Meanwhile, any growth disappointment will leave the share price exposed to a fall. In my view, it's an attractive company, but on a risk/reward basis, Illinois Tool Works stock is no more than fairly valued.