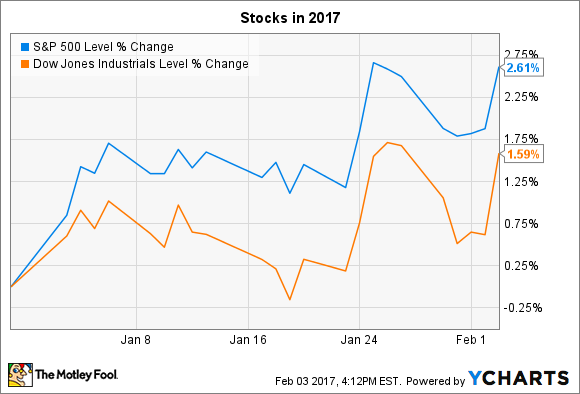

Stocks were little changed last week, yet the Dow Jones Industrial Average (^DJI 0.67%) and the S&P 500 (^GSPC 0.87%) enter the first week of February close to record highs and up solidly so far in the year.

Earnings seasons promises to continue powering big swings in individual stocks, and a few of the most anticipated reports will come from Walt Disney (DIS -0.55%), Twitter (TWTR), and Coca-Cola (KO 0.63%) over the next few trading days.

Disney's off year

With the stock up 20% over the last three months and pushing into new highs, investors are optimistic heading into Disney's earnings release this week. The entertainment giant just wrapped up its sixth consecutive year of record-high sales and profits as a booming studio business made up for weakness in its core broadcast-TV media segment.

Image source: Disney.

Fiscal 2017 will be a "anomaly" in Disney's growth trajectory, executives warned in early November. By that, they meant that sales and profit gains will likely be weaker than usual as the company laps difficult comparison periods that were pushed higher by booming demand for movies and consumer products tied to the Star Wars Episode VII release in late 2015.

A record box office run should continue lifting results this quarter, though, as will profits that are finally beginning to flow from the company's exclusive content deal with streaming video giant Netflix. Beyond that, investors will be listening for details on how CEO Bob Iger and his team aim to get back to a more Disney-like growth pace beginning in the second half of this year.

Twitter's profit plans

Twitter shares had a volatile few months as rumors swirled that the company might be selling itself. Instead, the social media specialist in late October announced disappointing user growth metrics and a paltry increase in revenue. Advertising sales rose by just 6%, compared to nearly 60% for Facebook.

Like its larger rival, Twitter is excited about the potential for video delivery to boost both engagement levels and advertising effectiveness. Yet executives are at least as focused on slimming down its operations to a more manageable size. "We're getting more disciplined about how we invest in the business," Chief Financial Officer Anthony Noto said in last quarter's earnings report. Twitter aims to achieve profitability in 2017 through a mix of defensive moves like cost cuts and growth strategies tied to boosting its audience size. Investors will be looking for evidence of success in both areas in Thursday's release.

Coke's new profit formula

Coca Cola was one of just two Dow stocks to end 2016 below where it started the year. The beverage king slipped 3% even as the broader market charged forward by 13% last year.

Image source: Getty Images.

Volume growth has slowed to a crawl as consumers reject several core ingredients, like sugar, upon which Coke built its beverage empire. Its main challenge going forward will be tweaking its formulas to recapture those lost sales without jeopardizing the incredible brand value it has built up over the last century of slinging drinks to the world.

Incoming CEO James Quincey should be the right man for that job, given that his prior position tasked him with reformulating Coke's beverage portfolio. Current CEO Muhtar Kent said Quincy's "acute understanding of how consumer tastes are changing make him the ideal candidate to lead us forward." With consensus estimates calling for a 9% revenue decline and a slight drop in profits this quarter, investors will be eager to hear about the company's plans for getting those numbers back up over the coming years.