On Feb. 6, Clean Energy Fuels Corp. (CLNE -2.97%) issued an SEC filing announcing that the company was repurchasing $25 million in debt, due in 2018. There were two particularly positive aspects of this move. First, the debt is Clean Energy's most expensive, paying a 7.5% interest rate. Second, the seller agreed to accept a 13% discount, taking only $21.75 million for $25 million in debt.

It's also notable that the seller was T. Boone Pickens, Clean Energy Fuels' co-founder and largest shareholder, who has sold off a lot of his stake in the company over the past year, raising cash as many of his other investments in the oil and gas industry continue to struggle through the ongoing oil-price downturn.

Clean Energy may have stretched too far by paying off debt so early. Image source: Getty Images.

This is potentially a great deal for Clean Energy Fuels. The company will not only pocket the $3.25 million discount on the face value of the debt, but it will also save $1.9 million in interest expense over the next year by retiring this debt early. But the company has used a lot of its cash cushion to retire debt early recently, and that may not turn out to have been a good thing.

The company recently expanded its "at the market" program, meaning it may issue a lot of new shares -- arguably at a terrible price for current shareholders -- to raise capital in the coming quarters. Let's take a closer look at how this could work out for investors.

Recent debt payoffs and the balance sheet

It's almost always a good thing when a company is able to pay down debt, and Clean Energy Fuels has done a lot of this over the past six quarters:

Data source: Clean Energy Fuels. Numbers in thousands. February 2017 debt and cash/equivalents are author estimates based on company press releases. Chart by author.

The company has cut its total debt by more than half. On one hand, this will take a big bite out of the company's recurring expenses, saving it more than $20 million per year in interest expense. This is a notable improvement that should help the company live within its operating cash flows.

However, this debt reduction -- particularly over the past several quarters -- has resulted in a pretty substantial reduction to the company's cash balance, reducing its margin of safety. This is particularly concerning, with the company heading into 2017 without a major excise-tax credit in place that provided $31 million in cash inflows in 2015 and should generate $25 million in 2016.

Stock sales have funded much of the debt reduction

Clean Energy Fuels also issued and sold a lot of new shares in 2016 to pay off all that debt:

Data source: Clean Energy Fuels. Chart by author.

As painful as it has been, much of that dilution was necessary. Clean Energy was faced with $150 million in debt due in August 2016, and the company could not have afforded to use all of its cash to pay off that debt.

So between selling shares on the open market to raise cash and making deals directly with note holders to exchange debt for stock, Clean Energy's share count has gone up 42.5% over the past year.

How much more stock will management sell, and at what price?

The share count could go up even more in the coming quarters. On Dec. 21, the company announced that it had expanded its at-the-market program, allowing it to potentially raise another $90 million by issuing and selling more stock. Since the expansion was announced, the company has spent $64.5 million in cash to retire $75 million in debt.

But it's important to note that there's a very important number we don't have access to at this point: How much Clean Energy's balance sheet changed in the fourth quarter. After all, the company has significantly improved its operating costs and steadily seen fuel volume sales growth drive operating cash flows higher over the past year.

In other words, the cash balance estimate in the preceding table could be overly conservative, based on the positive cash flows the company has generated recently, and the likelihood that the fourth quarter's cash flows were even better, with a full quarter of lower debt expense factored into the equation. If that proves to have been the case when the company announces its fourth-quarter results in a few weeks, that would make it less necessary for the company to issue new shares at current prices.

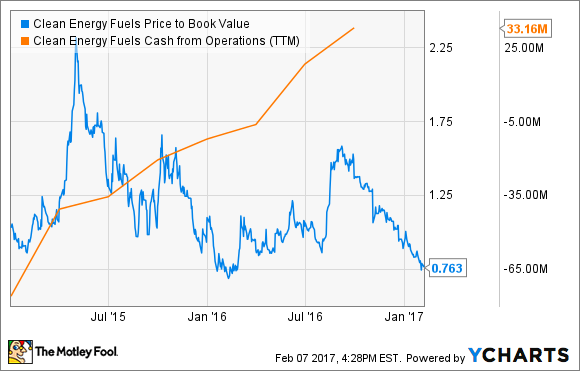

And the worst time to issue new shares is in this situation:

CLNE Price to Book Value data by YCharts.

Not only is the company generating positive cash flows and growing them, but its stock is also trading at fire-sale prices, far below the book value of the company's assets.

Will cash flow growth keep management from being forced to sell more stock?

The people in management are in an unenviable position. They owe it to shareholders to generate per-share returns that add value, but the first priority must be keeping the company liquid. And if there's a hiccup with cash flows, this could force management's hand to sell more shares to generate cash.

But that doesn't alter the fact that this is absolutely the worst time for management to take that action. If that's the case, then the discount the company has been able to attain on its recent debt deals won't really be good for investors, because the fire-sale price the stock is trading for will wipe out any value those deals created. At best, shareholders should probably hope for a net-zero result, where the discount to debt and the discounted price of the stock offset one another.