Propane distributor Suburban Propane Partners (SPH -0.31%) has a juicy distribution yield of around 12%. That's an awfully enticing number for income-focused investors. Indeed, in the low-yield world we live in today, Suburban stands out in a big way! The problem is that weather trends haven't been good lately, a key competitor has already been forced to cut its distribution, and Suburban is burning through cash... So the big question on many investors' minds is can Suburban Propane Partners' big distribution survive?

The bad news

Let's get the bad news out of the way right up front; It's going to be tight. And there are a host of reasons for that, but one of the biggest is the vagaries of the weather. Fiscal 2015 and 2016 were historically warm years. Although propane is also used for things like drying crops and powering forklifts, its biggest use, by far, is for heating. When the winter is warm, Suburban simply doesn't deliver as much propane. To put a number on that, the company sold roughly 14% less propane last year than it did the year before.

Image source: Suburban Propane Partners

The company made sure to point out that it was able to cover all its costs with cash on hand, including paying for an acquisition. However, the trend in the company's cash balance tells a concerning tale. At the start of fiscal 2016, the company had $152 million in cash. By the end of the year, it was down to $37 million. In other words, Suburban ate into its cash to support its business and distribution.

That said, one piece of bad news that's not as worrisome is the distribution cut at Ferrellgas Partners (FGP). Although warm weather certainly didn't help Ferrellgas' situation, the real problem for that propane distributor was that it made an ill-timed investment in the oil and gas midstream business. That's a one-off event that isn't in play at Suburban Propane. That doesn't mean Suburban won't be forced to cut its disbursement, only that you shouldn't see Ferrellgas' move as a harbinger for similar cuts across the entire propane space.

Bring an umbrella

So how bad is it right now? Well, for the fiscal first quarter, Suburban Propane offered up mixed results. For example, the partnership's cash balance fell to just $4.5 million over the three month span. The company is still burning cash at an alarming rate.

The weather, meanwhile, started off the quarter relatively warm, but then got cold in the final month of the span. That led to a swift jump in demand, increasing the amount of propane that Suburban sold by 8% year over year. And that led to a massive 25% increase in adjusted EBITDA. So things are getting better, but a lot depends on the weather.

SPH EBITDA (TTM) data by YCharts

To be honest, whether or not Suburban will cut its distribution is something of a toss up. If the rest of the winter heating season turns out to be really warm, Suburban will have trouble covering the payout. In the end, a lot depends on management's commitment to returning value to its unitholders. But on that score, there's some good news.

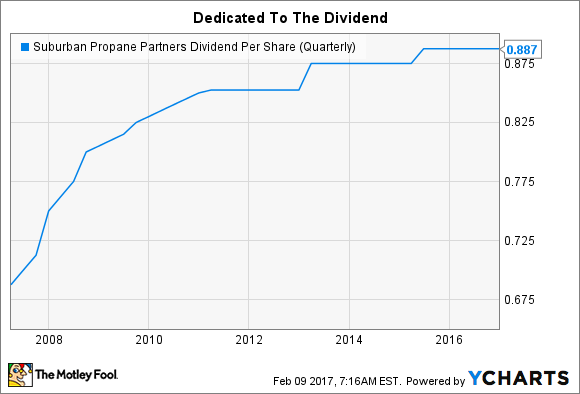

During its last two conference calls, Suburban has been asked about the sustainability of the distribution. During the first-quarter call, CEO Mike Stivala said "the sustainability of our distribution is what we are here for." He made a similar comment during the fourth0quarter call. And while the company didn't increase its payout in 2016, it had an over decade-long run of increases prior to that.

Moreover, the company recently replaced debt yielding 7.375% with debt yielding 5.875%. That should help free up some cash for it to use elsewhere ... like for the distribution. And in a worst-case scenario, the company could increase leverage by tapping its revolving credit facility or issuing more debt. Although that would weaken the balance sheet, it would, presumably, be a temporary move. The company has also been reducing costs, which fell 5% year over year in the first quarter. So it's working hard to put itself in a position where it can maintain its distribution.

SPH Dividend Per Share (Quarterly) data by YCharts

To cut or not to cut

There's no way to sugarcoat the situation at Suburban Propane: There's a real risk that the partnership's distribution could be cut. However, management has shown a commitment to returning value to unitholders, continues to make moves that should help support the current payout, and has some leeway on the balance sheet if it needs it. In the end, though, a lot will depend on the weather this winter. At this point, Suburban Propane is a high-risk income investment that you'll want to watch very closely. And another historically warm winter would be bad news. Conservative investors should probably tread cautiously or avoid it until things improve.

Get the latest Suburban Propane Partners stock news and facts.