Engineered biology conglomerate Intrexon (PGEN 1.43%) has perfected the storytelling aspect of being a publicly traded company that wields a potentially transformative portfolio of technologies. Need more information on genetically engineered mosquitoes that could control disease and reduce the need to spray harmful pesticides? Investors can easily look up presentation slides and white papers favoring their adoption. The same is true for non-browning apples, fast-growing salmon, and bacteria that turn methane from natural gas into next-generation transportation fuels, among a host of other potential products.

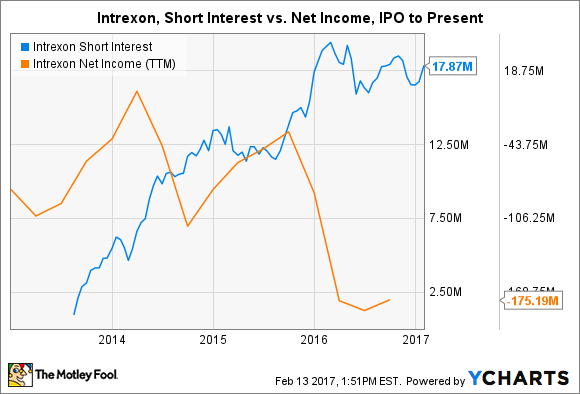

But telling a captivating story is the easy part of developing novel technologies. The number of presentation slides available to download hasn't correlated very well with successful commercialization outcomes, as several regulatory delays demonstrated for Intrexon investors last year. Now it seems some investors are growing wary of the company's endless pitches without results to back them up: Over 30% of floated shares are being shorted -- a number that has steadily risen in recent years. Investors are clearly betting big against Intrexon. Here's why they're right to be skeptical.

Image source: Getty Images.

Feeling the pressure

Intrexon's financials are a mixed bag for investors. On one hand, the company has essentially no debt, a strong cash position, a demonstrated history of revenue growth, and only slightly negative operating cash flow. Indeed, investors will be quick to point out that total revenue grew 141% to $173.6 million in 2015 from the prior-year period. Full-year 2016 revenue is likely to eclipse the previous year total yet again, although it may be a struggle to reach double-digit growth this time around.

On the other hand, there are several less appealing financial metrics investors must confront. Revenue growth slowed tremendously last year, while an uncomfortably high percentage of revenue continues to be generated from unstable sources. In 2015, nearly 44% of all non-product revenue was derived from companies worth less than $1 billion -- and the dependence increased through the first nine months of 2016.

Meanwhile, the company's net income has steadily deteriorated in its short life as a publicly traded stock, which has coincided with a sliding share price and increasing short percentage.

XON Short Interest data by YCharts.

These trends may continue, considering that although new products will begin generating revenue this year, it will take several years for genetically engineered mosquitoes and non-browning apples to become significant contributors to the top or bottom line. Intrexon's healthcare portfolio is even further away from commercializing its first product, which means it will be unlikely to help in the near term barring an acquisition or major milestone payments. Throw in steadily rising operating expenses, and I think it's safe to continue expecting to see red ink at the bottom of the income statement.

That said, I think most investors are aware that Intrexon is a story stock with an amazing amount of long-term potential. Some may think continued losses and negative operating cash flow are par for the course and worth an awesome future payoff. I can certainly see such a scenario taking place, but defending short-sellers in the near term is easy to do for one simple reason: analyst expectations.

Record revenue coming?

Six analysts are expecting an average of $197.5 million in full-year 2016 revenue, according to targets compiled by Yahoo! Finance. Intrexon would need to announce fourth-quarter 2016 revenue of $52.6 million to meet expectations. That's not impossible, but would require the second-highest quarterly revenue total in the company's history. Three of the last four quarters saw revenue under $49 million, and two of those notched less than $43.5 million. In other words, investors may want to prepare for the possibility that the company falls short of analyst expectations.

That could be the case in 2017, too. Six analysts currently expect Intrexon to reach an average of $249.5 million in total revenue in the current year. That would represent a year-over-year growth rate of 26% (assuming 2016 revenue falls somewhere close to current analyst expectations) -- nearly twice the clip achieved over 2015. Given a lack of major growth catalysts last year and a lack of identifiable catalysts in the upcoming year, it seems likely that analysts will need to reduce revenue expectations for the year ahead.

What does it mean for investors?

Intrexon is a difficult company to pin down. It operates a complex web of businesses and technology platforms that are accompanied by complex financial transactions. While it's possible that the company outgrows its dependence on microcap companies and successfully courts stronger collaboration partners, such a transition would take at least a few years to complete. That, coupled with numerous headwinds and a lack of identifiable catalysts capable of making immediate impacts, makes it likely for the stock to continue its mediocre performance in the near term. Although I've never shorted a stock in my investing career, I think short-sellers may be right about their position heading into the announcement of full-year 2016 earnings.