Growth stocks don't always have to be tiny upstarts, with a big risk of falling flat. As a matter of fact, some of the best growth stocks are established companies, and often with dominant market positions in their industries.

Case in point: Priceline Group Inc (BKNG 2.05%), Activision Blizzard, Inc. (ATVI), and Trex Company Inc (TREX 2.68%) are all leaders in their respective industries, and solidly profitable. Yet all three also have wonderful prospects for many more years of growth ahead of them -- at least according to three of our contributors. Keep reading to learn why they like these three companies for investors who love growth.

Looking to rocket your portfolio into the stratosphere? Check out these growth stocks. Image source: Getty Images.

This travel giant keeps flying higher

Dan Caplinger (Priceline Group): The online travel industry has continued to gain traction, and Priceline Group has emerged as the leader of the pack. The company had the foresight to move beyond the U.S. travel realm and make strategic inroads into popular international markets. As a result, Priceline was faster in building key relationships that opened up the world to travelers.

Moreover, Priceline hasn't been afraid of using acquisitions to spur its growth. Major purchases have included hotel listing company Booking.com in 2005, travel aggregator site Kayak in 2013, and most recently, restaurant reservation specialist OpenTable in 2014. Each of these purchases helped to broaden Priceline's reach and added new avenues for it to grow.

Priceline does face some risks to its growth, such as the increasing popularity of Airbnb and other accommodation-sharing sites. However, Priceline has already taken steps to make its platform available to private owners, and its extensive marketing and brand awareness give Priceline an edge over its competitors.

With the company having done so well, even with a substantial part of the world facing tough economic times, Priceline has a huge opportunity for growth. It also has the track record of capitalizing on similar opportunities to give investors the confidence that Priceline will get the job done again.

This video game company still has huge growth potential

Keith Noonan (Activision Blizzard): Video game stocks have been a great place to look for growth over the last five years, and Activision Blizzard continues to stand out as one of the best investment options in the space. With the strongest franchise portfolio of any third-party publisher, and favorable industry trends working in its favor, the company looks poised to continue posting impressive sales and earnings growth going forward.

Activision's revenues rose to $6.61 billion in 2016, up 42% from the prior year, even as key releases in its important Call of Duty and Skylanders gamesunderperformed compared to previous entries. Meanwhile, diluted earnings increased 8%, to a record $1.28 per share, and operating cash flows increased 71%, to $2.2 billion -- also a record for the company.

The transition from retail to digital sales has been, and will likely continue to be, a major boon for the publisher. Thanks to its acquisition of mobile games publisher King Digital and increased online distribution for its console games lineup, digital sales increased more than 94% in the last fiscal year, and Activision is still in the early phases of taking advantage of mobile advertising opportunities.

Looking ahead, the games company has big growth potential in Asian markets and should see new revenue streams from its recently opened consumer-products division, as well as emerging video game segments, including virtual reality and e-sports. With signals that Activision is also looking to make major acquisitions in the near future, the stock looks to be a great choice for investors on the hunt for growth.

This green home-improvement market leader is just getting started

Jason Hall (Trex Company): Trex is, by far, the largest manufacturer of wood-alternative decking in the U.S., commanding well over 40% of the market, and growing its share every year. And over the past several years, management has done an excellent job accelerating the company's growth.

A few years back, management took major steps to grow its distributor base and has leveraged its relationships with builders and contractors to grow sales. More recently, the company has stepped up its game with end users, investing major marketing resources to build up brand awareness with consumers. This has led to Trex being the most widely recognized brand of wood-alternative decking in America.

If these efforts pay off in the same manner prior initiatives have, the upside is massive, and much, much larger than Trex's current market share would make it appear. This is because, while Trex commands almost half of wood-alternative decking sales already, that segment makes up a small fraction of total decking sales each year.

On a board-foot basis, wood still makes up nearly 90% of decking volumes sold each year. And Trex's new marketing campaign is squarely going after wood, not its wood-alternative competitors.

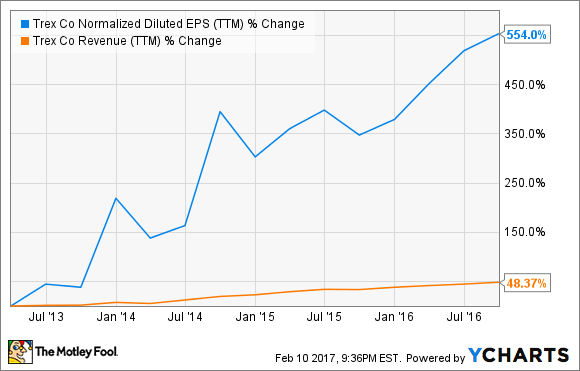

Maybe the most impressive thing investors should consider about Trex's growth prospects is that it won't take a lot more revenue to drive much bigger profit growth. Relatively moderate sales growth has produced giant profits over the past several years:

TREX Normalized Diluted EPS (TTM) data by YCharts.

In short, Trex is in a position to generate massive operating leverage, where even modest incremental sales generate outsize incremental profits. And with less than 10% of the total addressable market, Trex could ride modest sales growth to much bigger profits for years to come.