Many investors love dividend stocks – and for good reason. Reinvesting dividends can turbocharge total capital appreciation over the long term. And, naturally, the passive income streams they generate make them a great fit for investors who want current income.

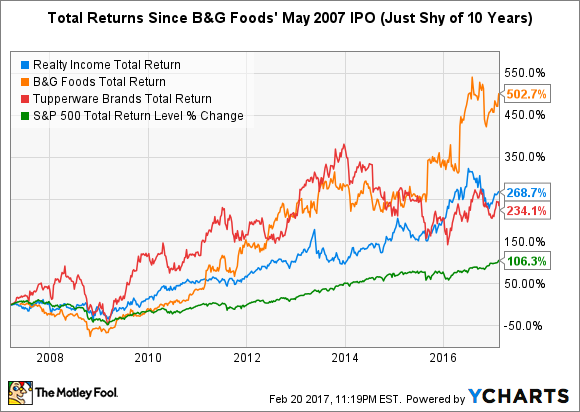

Let's look at three dividend stocks that are currently yielding 4% or more yet are relatively stable, or at least not overly risky, as many higher yielders tend to be. They've also outperformed the market over the past 10 years. The names: Realty Income Corp. (O -0.71%), B&G Foods, Inc. (BGS 0.09%), and Tupperware Brands (TUP -0.96%).

Data source: YCharts.

A high-quality REIT yielding 4.2%

Realty Income is a real estate investment trust (REIT) primarily focused on free-standing retailing occupancies in the United States. It pays its attractive dividend -- a 4.2% yield which is more than twice the yield of the S&P 500 -- on a monthly basis. The company has increased the size of its total annual dividend payout for 23 consecutive years.

Realty Income's portfolio consists of more than 4,700 properties located in 49 states plus Puerto Rico, with a 79% retail/13% industrial/8% other occupancy mix at the end of the most recently reported quarter. Its occupancy rate is an enviable 98.3%.

Image source: Realty Income.

Like many other REITs, Realty Income has benefited from the historically low-interest-rate environment over much of the past decade. However, the stock has been a strong performer even within its class of business and should hold up better than lesser-quality REITs in a rising-interest-rate environment.

An acquisition-hungry packaged-food company yielding 4%

B&G Foods is a fast-growing maker of branded shelf-stable foods. The acquisitive company has an appetite for nostalgic food brands that are expected to quickly be accretive to its earnings and cash flow. It's paid a dividend each quarter since its 2007 IPO and has increased its dividend each year since 2011.

Image source: B&G Foods.

B&G's portfolio of brands include many that have been mainstays among Americans for generations, such as Cream of Wheat hot cereals, Maple Grove Farms syrups, and the iconic Green Giant brand of canned and frozen vegetables. B&G acquired the latter brand, along with the Le Suer brand, from General Mills in late 2015 for a whopping $765 million in cash plus an inventory adjustment at closing.

The company has just a 10-year dividend-paying history, so let's dig in a bit to see how secure its dividend appears to be. B&G's cash dividend payout ratio (dividends paid divided by free cash flow) was 45.7% at the end of the most recently reported quarter. While several factors come into play, a general rule of thumb is that a ratio of about 65% or less suggests that a company can comfortably afford its dividend and investors can probably count on future dividend increases.

B&G Foods' business is performing well. Fueled by the Green Giant acquisition, its sales soared nearly 57% in the first three quarters of 2016, while adjusted earnings per share (EPS) surged more than 61%. Analysts expect the company to grow EPS at an average annual rate of 17.9% over the next five years.

A relationship-selling pioneer yielding 4.7%

The word "Tupperware" probably brings to mind colorful plastic bowls with snap-tight lids and other food storage and related products. You might also think of Tupperware parties, where the Tupperware-selling hosts demonstrate their wares to invited guests. Well, Tupperware Brands is still using relationship-based selling to hawk its products, but it's expanded into the beauty and personal-care realm and now has seven brands.

Image source: Tupperware.

Tupperware's stock was chugging away until 2014. Then the company's financial performance started suffering, largely because of economic and political instability in emerging markets, which caused the U.S. dollar to rise relative to many currencies. The lion's share of the company's business is outside the U.S. -- with a full two-thirds of its revenue now generated in emerging markets -- so it's quite sensitive to swings in exchange rates.

Along with overall conditions in emerging markets, Tupperware's financial performance has started to improve. In the fourth quarter of 2016, year-over-year sales increased 1% as reported and 3% in constant currency, though the company did receive a 4% benefit from having one extra week in this quarter than in the year-ago period. Adjusted EPS was up 7%, and 9% in constant currency. Moreover, analysts expect Tupperware to grow EPS at a solid average annual rate of 12% over the next five years.

Tupperware's dividend is currently yielding a fat 4.7%. The company's cash dividend payout ratio was 78.4% at the end of the fourth quarter of 2016. So investors won't be getting a dividend increase for some time. However, if the company's performance continues steadily improving -- as analysts predict -- a dividend cut is unlikely. The cash dividend payout ratio -- which rose above the 65% level in early 2015 -- has come down over the past year, as it was above 83% at the end of 2015.