Image source: Take-Two Interactive.

Video game publisher Take-Two Interactive (TTWO -0.01%) has posted stellar gains over the past year, with shares trading up roughly 70% over the stretch. The company has benefited from strong performance for its core software lineup, increasing digital sales, and a promising upcoming release slate. And it appears to be on track to continue benefiting from favorable trends in the video game industry.

While Take-Two has been on a serious roll, big gains raise the question of what the remainder of 2017 will hold for the stock, and whether it's too late to see significant upside. Let's take a look at what 2017 might hold for Take-Two and what the company's performance will depend upon.

Take-Two's gains bring increased risk, but the company is stronger than ever

Looking at price-to-earnings ratios, Take-Two is the most expensive of the major video game publisher stocks, with a forward P/E of roughly 31, compared to 22 for Electronic Arts (EA -0.18%) and 23 for Activision Blizzard (ATVI). On the other hand, Take-Two's price-to-sales ratio of 3.4 compares favorably against Activision's P/S of 5.1 and EA's P/S of 5.8, and the company still has significant deferred revenue to waiting to be recorded.

Take-Two remains more dependent on a single franchise (Grand Theft Auto) than either of its larger competitors, but the rise of recurring revenue generated by Grand Theft Auto V's online mode and the strengthening of the company's overall lineup have created business momentum that appears to be sustainable.

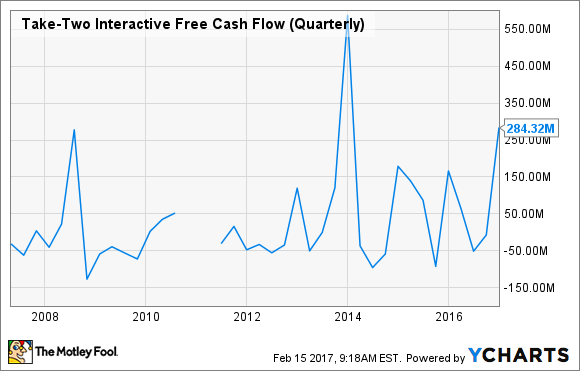

TTWO Free Cash Flow (Quarterly) data by YCharts.

The free cash flow spikes shown in the graph above during 2008 and 2013 stemmed from the release of mainline Grand Theft Auto entries, but the company's most recent quarter actually achieved higher FCF than the 2008 peak without the debut of a new title in the company's core franchise. Take-Two appears to have turned a major corner when it comes to performance during periods that are not in close proximity to the release of a Grand Theft Auto game.

Key games for Take-Two in 2017

Grand Theft Auto V has proved to be a monster hit with incredible staying power, shipping more than 75 million copies since the first versions of the game debuted in 2013, and will continue to be a major factor in Take-Two's stock performance this year. Continued engagement with the game's online mode has done a great deal to boost the company's performance, and, based on statements that the mode is still growing engagement and bookings, it looks like the game will continue to deliver strong sales. Overperformance or underperformance on that front will likely be reflected in the company's share price.

As for new releases, Take-Two stock will probably be most affected by sales of Red Dead Redemption 2, which is scheduled for a fall release. Expectations for the title are high. The last entry in the series shipped roughly 15 million copies, and Cowen & Company is targeting for the upcoming sequel to move 15 million copies -- with a note that its estimate could be conservative. With Take-Two's share price at record levels, even slight underperformance for the game could result in significant sell-offs, but the game's developer has a strong track record of delivering quality releases, and the title also looks poised to benefit from the introduction of an online model similar to the one in Grand Theft Auto V.

The company's NBA 2K basketball franchise is also seeing positive momentum, with the last entry in the series now expected to become the best-selling sports title in company history and spurring strong in-game content sales. Take-Two's recent third-quarter report showed that recurrent consumer spending within the series increased 56% over the prior-year period. Reviews and audience reception for NBA 2K17 proved to be very strong, and Electronic Arts' competing NBA Live series continues to be a virtual non-entity, so it's reasonable to expect that Take-Two's basketball franchise can continue to grow this year.

The company could also benefit from a successful rollout of its recently announced e-sports league for the NBA 2K series, with live events and sponsorship deals creating new revenue streams and media coverage working to promote the series.

Digital sales and mobile present big growth opportunities

Take-Two expects that roughly 25% of its current-generation console games will be purchased digitally in the current fiscal year -- an impressive figure, but one that also leaves room for growth down the line. Because the publisher doesn't have to deal with physical production expenses for digital copies of its software and because direct-to-consumer sales mean that retailers don't take a cut, increasing digital sales should continue to have beneficial effects on margins. Digital bookings for the fiscal year ending March 31 are expected to have increased 20% over the prior year, and continued growth on this front could continue to push its stock higher in 2017.

Take-Two also has substantial growth opportunities in free-to-play games. The latest mobile entries in core properties including NBA 2K and WWE 2K have posted record sales and engagement, and the recent acquisition of mobile developer Social Point should help to increase mobile output and improve Take-Two's ability to leverage other core franchises outside of console and PC platforms. Social Point is already profitable (the company recorded EBITDA of $19.9 million on revenue of $90.8 million in calendar 2016) and has multiple successful gaming properties, so the purchase looks to have an immediately beneficial impact on earnings in addition to creating growth opportunities down the line.

Take-Two Interactive can still be a winner in 2017 and beyond

Take-Two stock's strong performance over the last several years makes it more risky to buy in at current prices, and it's not wise to count on share price gains matching those from the last couple of years. However, the company still has avenues to outperformance and remains a solid long-term investment. With its core properties looking strong, an increasingly diversified business, and industry momentum providing tailwinds, Take-Two looks like it can continue to deliver wins for investors this year and further down the line.