As we get deeper into 2017, the dividend raise train just keeps rolling. Many companies are using the initial months of the year to bump their shareholder distributions -- in several cases, quite substantially.

Here are three recent raisers -- one Dividend Aristocrat, and a pair of familiar stock market names.

Kimberly-Clark

Among our three featured stocks, Kimberly-Clark's (KMB -0.98%) quarterly dividend raise has to be considered the least surprising. That's because it's a Dividend Aristocrat -- a small group of companies that have lifted their payouts at least once annually for a minimum of 25 years running. This year's move is a 5% hike, to $0.97 per share.

The company is one of the most reliable dividend payers -- and raisers -- on the market. This decade alone, its quarterly distribution has risen from just over $0.63 per share to the present level.

KMB Dividend data by YCharts.

What's slightly less encouraging is Kimberly-Clark's recent results. For the entirety of fiscal 2016, its net sales slid by 2% from the previous year's result to land at just over $18 billion. Net income more than doubled (to $2.17 billion), but that was in line with analyst expectations and was due in no small part to cost-cutting.

Meanwhile, the company is a cash cow, as ever. And that cow has been fat as of late -- its operating and free cash flow numbers were up sharply last year. The latter was more than enough to cover both dividend payouts and share repurchases, so in the proximate future, the company shouldn't have any problem maintaining its vaunted aristocrat status.

Kimberly-Clark's new dividend is to be paid on April 4 to stockholders of record as of March 10. At the current share price, it would yield 2.9% -- comfortably above the 1.9% average of dividend-paying stocks on the S&P 500.

Hanesbrands

Underwear purveyor Hanesbrands (HBI -8.03%) has announced a mighty 36% increase in its quarterly payout, to $0.15 per share.

In contrast to Kimberly-Clark, Hanesbrands is a relative newcomer to the world of dividends. It only initiated its payout in 2013. Since then, adjusted for a 2015 stock split, it's risen from $0.05 per share to the current level.

Although by many standards, the company had a strong fiscal 2016 as a whole, its fourth-quarter numbers and 2017 guidance came in under its own and analyst expectations. That didn't help the sagging stock price much. Still, the company did a decent job of growing both net sales (up by 5% on a year-over-year basis to $6.03 billion) and bottom-line profit (26% higher, at $539 million).

Those increases had a very positive effect on the company's operating and free cash flow; the latter grew over four-fold to $522 million for 2016. Yet Hanesbrands has been a spendthrift -- during the year, it coughed up nearly $550 million in dividend payouts and share repurchases.

Using the midpoint of its guidance ranges, the company is expecting net sales growth of around 8% year over year, filtering down to an increase in operating cash flow of 11%. If it wants to keep raising its dividend at this pace and repurchasing its stock, it'll have to at least come close to hitting those numbers.

Hanesbrands' upcoming dividend will be dispensed on March 7 to shareholders of record as of Feb. 15. It would yield a theoretical 2.9% on its most recent closing stock price.

Canadian National

One of two incumbent railroad companies operating in our vast northern neighbor, Canadian National (CNI 1.56%), has boosted its quarterly dividend by 10%. It will now pay out slightly over 0.41 Canadian dollars ($0.31) per share.

Few investors equate big railroad operators with efficiency, yet Canadian National has been quite good at shaving costs lately. As with Kimberly-Clark, this is a key reason its fiscal 2016 net income rose by nearly 3% (to CA$3.64 billion, or $2.77 billion) while revenue dropped 5% (to CA$12.04 billion, or $9.16 billion).

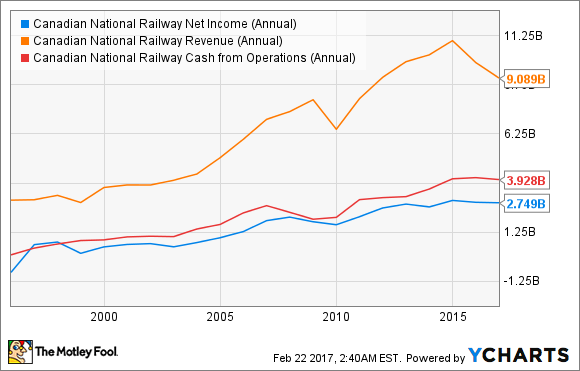

As the top and bottom lines went, so went cash flow. The company booked its all-time high annual operating cash flow figure of CA$5.2 billion (nearly $4 billion) for the year. Although that was only marginally higher than the previous year's tally, it still represents an improvement. This is typical for Canadian National; as a big, established operator, it grows relatively slowly and steadily.

CNI Net Income (Annual) data by YCharts.

The company tends to shell out more than its free cash flow on share buybacks and dividends, which would concern me if I were an income investor considering it for my portfolio. That said, it has managed to grow its distribution on an annual basis for many years running, so I'd imagine it'll continue to find ways to do so. I think those dividend raises will persist into the foreseeable future.

Canadian National's enhanced dividend is to be distributed on March 31 to investors of record as of March 10. The new amount would yield 1.7% on the current stock price.