If you are looking for ways to generate more income during your golden years, owning a few high-quality dividend-paying stocks can make a lot of sense. AbbVie (ABBV 1.06%), Enbridge (ENB 2.83%), and Pebblebrook Hotel Trust (PEB 1.95%) are all rock-solid dividend payers that offer above-average yields and promise long-term growth. Here's why I think they could be terrific choices for any investor who wants more spending money.

Image source: Getty Images.

This biotech giant is built for growth

While biotech giant AbbVie has been trading on the markets for only a few years, it actually boasts a long and storied past. AbbVie was spun off from the Dividend Aristocrat Abbott Laboratories in 2013, and it has turned into a great long-term investment. Shares have climbed more than 87% since the split, which is a return that beats both the S&P 500 and its former parent.

AbbVie's success can be traced to its top-selling autoimmune disease drug, Humira. This megablockbuster product grew by nearly 15% last year to ring up more than $16 billion in total sales. When adding the gains of the company's other drugs such as cancer hit Imbruvica, total revenue and earnings per share (EPS) grew by 13% and 12%, respectively, in 2016.

While looming biosimilar competition for Humira is a cause for concern, AbbVie continues to appear poised for growth. The company has 12 late-stage clinical trials currently underway and another 21 drugs in the mid-stage development. I'm particularly excited about the cancer drug Rova-T, the leukemia drug Venclexta, and the autoimmune disease drug risankizumab since some analysts believe they each hold billion-dollar blockbuster potential. If that's true, they could go a long way toward offsetting any future weakness from Humira.

In total, Wall Street expects AbbVie's EPS to grow by more than 14% annually over the next five years. Despite the double-digit growth potential, shares are currently trading for about 10 times forward earnings. Those are attractive figures for a company that throws off a dividend yield of 3.9%.

A pipeline to prosperity

While the recent energy downturn provided many investors with a wake-up call, I still find plenty of reasons to warm up to companies that are focused on energy transportation. One of my favorites from the industry is Enbridge, a Canadian pipeline operator that primarily transports petroleum-based products.

While Enbridge has been around for decades and has grown into an industry giant, the company recently took a significant leap forward thanks to its acquisition of Spectra Energy. The markets loved this deal in part because Spectra Energy is primarily focused on natural gas. That provides the combined company with a broader mix of products, which should provide an extra layer of diversification. The acquisition also transformed the company into the largest energy infrastructure company in North America.

With the deal now completed, Enbridge looks built for growth. The company has more than 26 billion Candian dollars' ($19 billion) worth of projects under development and another CA$48 billion of future projects lined up. As these projects come online, Enbridge's bottom line should swell. The company plans on sharing its extra profits with investors in the form of an ever-growing dividend payment. The plan is to boost the dividend by 15% this year and by double digits annually through 2024. Since 96% of the company's cash flow is supported by long-term fee-based contracts, I think these estimates are reasonably secure. With shares offering up a dividend yield of over 4%, there are plenty of reasons for income investors to give this company a closer look.

A high-end hotel flipper

Pebblebrook Hotel Trust is a real estate investment trust, or REIT, that is focused on hotels. However, Pebblebrook operates a slightly different playbook than other hotel REITs. The company's business model is to buy high-end hotels that have been poorly managed and then renovate them to increase their profits. Once a project is completed, the company finds a buyer who is willing to pay a premium for the upgraded hotel. The company then banks a healthy profit for its efforts and searches for its next target.

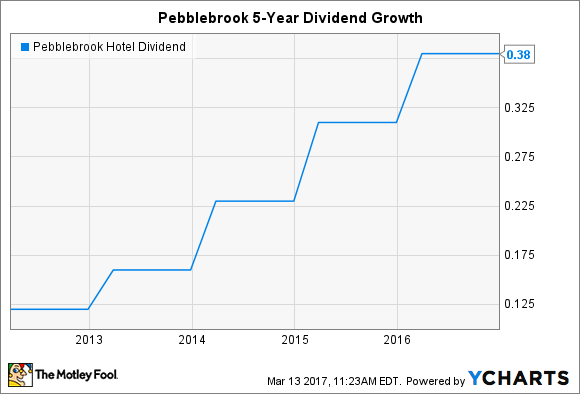

This strategy has worked like a charm. Over the past five years, Pebblebrook's adjusted funds from operations (AFFO) -- which is a REIT's proxy for earnings -- have grown by 22% annually. Management has returned that growing cash stream to investors in the form of a fast-growing dividend.

PEB Dividend data by YCharts.

And yet, despite the stock's history of success, shares have sold off the last two years. That could be owed to declining growth of AFFO as management continues to shed assets in order to repay debt and redeem preferred shares. In fact, when adding in some recent weakness in the business travel market, the company is guiding for AFFO to be negative over the next year.

While the next few years could be slow, I think that an investment today still makes sense. Management believes that the company's net asset value (NAV) currently lies between $36 and $40 per share. Meanwhile, shares are currently trading hands for about $28. That means that investors can buy into this high-quality REIT at a 20% discount to the low end of management's NAV range. Add in a dividend yield of 5.5%, a winning business model, and a management team that has proven its chops, and I think income-seeking investors have good reasons to buy this stock right now.