When United States Steel Corporation (X -1.43%) reported earnings, management's lousy outlook took the entire steel industry down with it. But don't get too caught up in the negative news -- there are some really great steel stocks that deserve a second look. Two of the top steel stocks for 2017 are Nucor Corporation (NUE -0.75%) and Steel Dynamics, Inc. (STLD -0.79%).

The industry giant

Nucor is one of the biggest steel industry players in the United States. The company has a relatively low debt level (roughly 30% of the capital structure), modern electric arc steel mills, and a pay structure that includes a variable profit-sharing component. Taken together, these features afford the company a huge amount of flexibility -- which helps explain why Nucor managed to remain profitable through most of the recent steel industry downturn (it lost money in 2009, but has been profitable since). No other major steel company can make that claim. It also managed to keep increasing its dividend annually through the deep downturn, with a streak that's now up to 44 years.

Image source: Steel Dynamics, Inc.

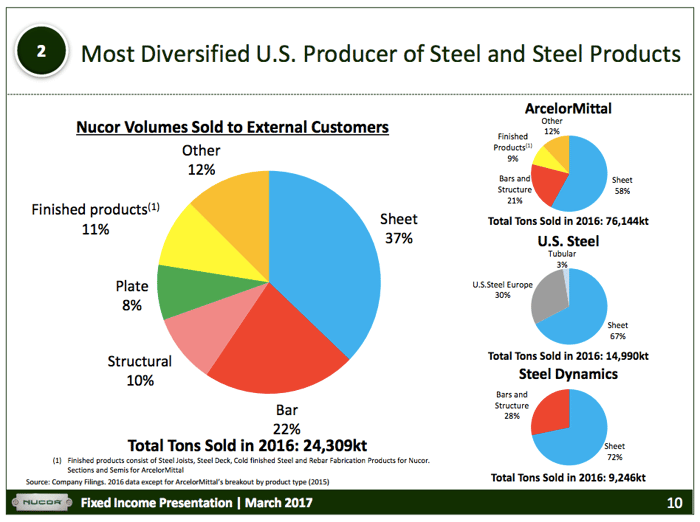

An important differentiating factor is Nucor's use of downturns to expand its business into new areas of the steel industry (for example, it recently inked its third acquisition in the steel tubing space, quickly building scale in a new business segment) and even enter new countries (Canada and Mexico). At this point, Nucor is easily one of the most diversified and well-positioned U.S. steelmakers. That gives it plenty of avenues for profitable growth as the U.S. steel market starts to strengthen.

To put some numbers on that, Nucor's first-quarter earnings came in at $1.11 a share, up from $0.27 in the year-ago period. The first quarter's tally was also more than double the $0.50 a share the company earned in the fourth quarter of 2016. In other words, the results prove that Nucor's focus on financial strength and business diversity is working. If you are looking to own an industry leader, Nucor is the name for you.

A similar playbook

Steel Dynamics doesn't have as diverse a business as Nucor. However, it has learned a thing or two from its larger peer (the company's CEO and co-founder spent 12 years at Nucor). For example, Steel Dynamics makes use of electric arc furnaces and has been investing during the downturn to expand its capabilities. Electric arc furnaces are, to vastly simplify things, easier to turn on and off than the blast furnaces that underpin U.S. Steel's business. That helped Steel Dynamics turn a profit in six of the last eight years. (U.S. Steel, for reference, has bled red ink in seven of the last eight years).

The diversification of Nucor and its peers, including Steel Dynamics. Image source: Nucor Corporation.

Expanding during the lean years, meanwhile, is a statement to the company's strength (long-term debt is roughly 45% of the capital structure) and long-term focus. And, like Nucor, using the downturn to improve the business has prepared Steel Dynamics well for the upturn. First-quarter earnings rang in at $0.82 a share, up from $0.26 a year ago and an adjusted $0.43 a share in the fourth quarter of 2016. Like Nucor, Steel Dynamics appears ready for an upturn.

That said, it's a smaller and less diverse company than Nucor. However, it's easier to grow off of a small base than it is to grow from a large one. So Steel Dynamics might be a good option for investors with more of a growth focus.

The outlook is improving

The problem with U.S. Steel is that it appears to have underinvested during the downturn, leaving it playing catch-up now that the steel industry is starting to pick up again. Nucor and Steel Dynamics had a different approach and are now starting to reap the rewards of the investments they made during the downturn. Meanwhile, both use modern and flexible electric arc furnaces, which helped them muddle through the downturn more profitably than peers -- and should soften the blow if the industry starts to struggle anew. If you are looking for a steel company to buy in 2017, Nucor and Steel Dynamics should be on the top of your wish list.