Investors like the stability of the consumer products space, and Philip Morris International (PM 1.39%) and PepsiCo (PEP 3.62%) have built up huge customer bases that have high demand for their products. Philip Morris does all of its business overseas, and although PepsiCo has a thriving U.S. business, it has also emphasized the need to expand internationally. Yet both PepsiCo and Philip Morris face similar challenges, and that has prompted both to take steps forward in new directions. Investors want to know which stock has the better prospects going forward. Accordingly, we'll look at Philip Morris and PepsiCo and do some analysis to see which stock is the smarter pick right now.

Valuation and stock performance

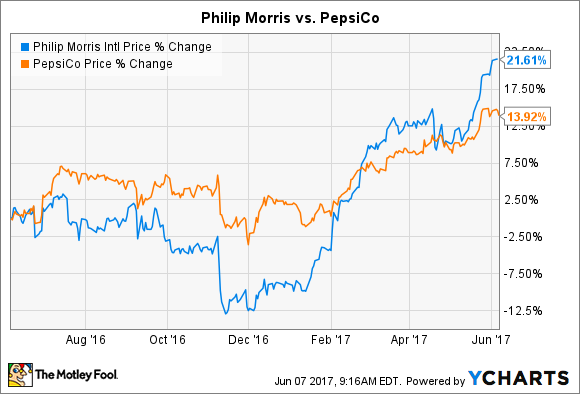

Both Philip Morris and PepsiCo have given their shareholders nice gains over the past 12 months, but the tobacco giant has a slight edge. Its stock has climbed 22% since June 2016, compared to a 14% rise for PepsiCo.

As you might expect, Philip Morris' slight outperformance has also led to its having a slightly richer valuation than PepsiCo. When you focus on trailing earnings over the past year, Philip Morris trades at 27 times its earnings, compared to an earnings multiple of 25 for PepsiCo. Incorporating future expectations for earnings leads to similar results, with PepsiCo's forward multiple of 21 being slightly less than Philip Morris' 22. Those valuation differences are small, but PepsiCo has a slight upper hand.

Dividends

Income investors like dividends, and there, Philip Morris has a solid lead over PepsiCo. The tobacco company has a current dividend yield of 3.4%, compared to 2.7% for the beverage and snack manufacturer.

However, there are ways in which PepsiCo looks more attractive than Philip Morris. The beverage maker's payout ratio is only around 65%, compared to more than 90% for the tobacco company. That gives PepsiCo greater opportunities for dividend growth without overly taxing its earning capacity.

Indeed, that's something we've seen recently. Philip Morris has raised its dividend by just 2% in each of the past two years, as its earnings have been stretched to the limit by adverse currency impacts and fundamental business challenges. By contrast, PepsiCo's most recent dividend increase was 7%, and it was the 45th year in a row that the beverage giant has rewarded shareholders with higher dividends. That track record and future potential outweighs PepsiCo's current yield disadvantage, making it at least as attractive on the dividend front.

PepsiCo's products go beyond its namesake cola. Image source: PepsiCo.

Growth prospects and risks

The main question facing Philip Morris and PepsiCo is where future growth will come from. For Philip Morris, falling cigarette shipments have been a big challenge as of late, and the tobacco giant's most recent quarter showed the rapid descent in the sales volume trajectory. Shipments were down 11.5% in the first quarter of 2017 compared to the year-ago period, and that sent net revenue from the company's combustible products division down 7%. Only the success of the reduced-risk heated tobacco product iQOS prevented Philip Morris from seeing larger overall declines. But flat earnings from year-ago levels were disappointing, and it appears that Philip Morris will have to work even harder to find new avenues for growth in the years to come.

PepsiCo has done a better job of fostering growth, reporting net income gains of more than 40% in its most recent quarter. Yet revenue growth has been sluggish, weighing in at less than 2%, and those increases came almost entirely from PepsiCo using its pricing power to raise what it charges its consumers. Some players in the beverage space are dealing with backlash from the potential health effects of sugary soft drinks, but PepsiCo has done a good job of plowing ahead in the health-conscious space on both the beverage and snack sides of its business. Better conditions in Latin America have been noteworthy lately, and although PepsiCo remains cautious in the near-term, it's still optimistic about its prospects for longer-term success.

For investors looking at both stocks now, PepsiCo looks like the more solid pick. With a slight valuation advantage, dividend growth prospects, and better industry conditions, the beverage giant is in a position to catch up with Philip Morris International's outsized share-price gains over the past year.