Many investors see dividend stocks as a conservative way to generate income from their investment portfolios, with less appeal for those who really want to own the fastest-growing companies in the market. Yet even though you typically don't see large dividends from up-and-coming newcomers to key growth industries, many dividend stocks are able to generate strong long-term returns for their shareholders. In fact, the dividends that many stocks pay make up a considerable portion of their total return over time.

What dividends have meant for the stock market

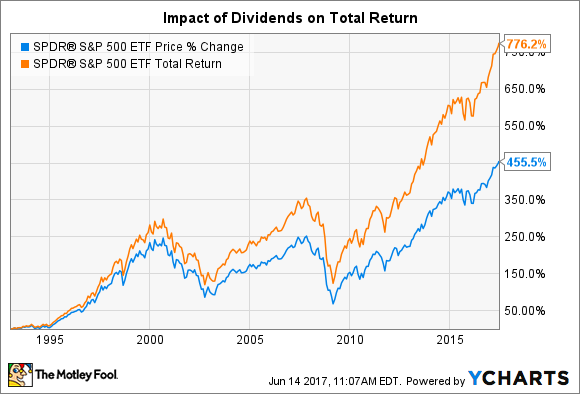

Even when you look broadly at the stock market as a whole, dividends have been a key component of long-term success for investors. For instance, the SPDR S&P 500 ETF (SPY -0.54%) has been in existence for about a quarter century, and over that time, the market has gone through the bull market boom of the 1990s, the tech bust of 2000 to 2002, the housing boom in the mid-2000s, the financial crisis in 2008 and 2009, and the subsequent expansion that we've experienced over the past eight years.

Image source: Getty Images.

In that time, the SPDR ETF has seen its price more than quintuple, following the rise in the S&P 500 Index (^GSPC -0.56%), which the ETF tracks. But if you had invested in the ETF at its formation and taken the dividends and reinvested them into more fund shares, then your total returns would have been more than 300 percentage points higher, as the following chart shows.

Without dividends, the S&P 500's return would have been far less. By contrast, if you had a long time horizon and bought and held shares of the ETF, putting dividend payments toward buying additional shares, then you would have reaped the full benefit of the market's strength.

How reinvesting dividends can turn good to great

The impact is even more evident when you look at some of the most successful individual stocks in the market. For instance, Coca-Cola (KO 1.24%) has a long track record of not only paying dividends but increasing them over time, with consistent annual dividend increases that go back for decades. Over the past 45 years, Coca-Cola's stock price has jumped almost 3,200%. But with dividends, the cumulative total return more than doubles, climbing above the 6,400% mark.

Many strong dividend payers have charts that closely resemble this one. What it proves is that even if you don't need the cash that dividends generate because you have a long time horizon, a dividend stock can still provide extremely good long-term returns in which quarterly payouts make up an essential part.

Be smart about dividend stocks

Most investors think of dividends as being primarily for income investors, and growth investors might see dividends as simply a drag on performance because of their tax implications. However, the companies that are best able to sustain and grow their dividends over time are the ones that find consistent growth opportunities and take full advantage of them. Even if you don't need current income, finding high-quality dividend stocks and reinvesting dividend payments into additional shares can be a ticket to long-term riches for your investment portfolio.