Investing in gold stocks is one of the easiest ways to bet on gold prices, but you could also get caught on the wrong foot if you're buying stocks that are on the pricier side. For a volatile commodity like gold, a prudent approach to investing is to look for cheaper stocks with limited downside risk.

Of course, that doesn't mean every gold stock that appears undervalued is worth your money. Also, when I say "cheap" in the context of gold stocks, I'm not looking at valuations based on the otherwise popular price-to-earnings ratio. That's because asset writedowns are a part and parcel of the gold mining business and can distort the true picture of a miner's earnings capabilities. Instead, I believe operating cash flows and the corresponding price-to-operating-cash flow ratio is a far better and reliable metric to value gold stocks.

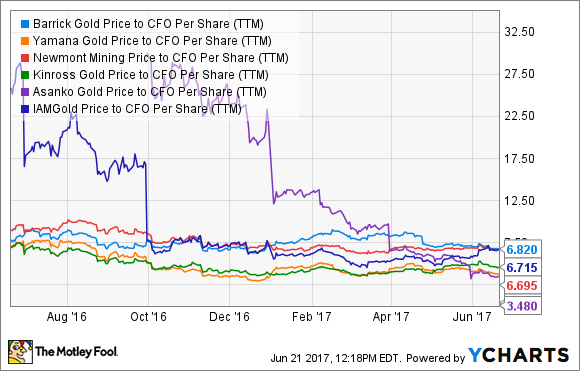

Currently, several gold stocks are trading at a single-digit P/CF and appear incredibly cheap, including Barrick Gold Corp (GOLD 1.64%), Yamana Gold Inc (AUY), Kinross Gold (KGC 1.39%), IAMGold Corp (IAG 6.30%), Asanko Gold Inc (GAU 0.69%), and Newmont Mining (NEM 0.67%), to name a few. Among these, the following three gold stocks are your best bets today.

If you find a goold gold stock cheap, buy it. Image source: Getty Images.

Barrick Gold: a top growth gold stock

Barrick Gold stock was trading red hot until a surprisingly disappointing first-quarter report and a muted outlook in April sent investors scurrying for cover. The stock has lost almost 19% since its earnings release on April 24 and is trading at under 7 times P/CF. I'd say that's a steal for a company at such a strong pace.

I believe the market overreacted to Barrick's first-quarter report for several reasons, and that the miner is in a better shape than ever, having slashed its all-in-sustaining costs (AISC) by 12% to $730 per ounce last year to become the lowest-cost gold producer in the industry. Barrick also cut down debt by $2 billion, generated record free cash flow worth $1.5 billion, and passed on the benefits to shareholders in the form of a surprise 50% dividend hike, all in fiscal-year 2016.

ABX Price to CFO Per Share (TTM) data by YCharts.

Barrick's immediate financial goals include reducing debt by another $2.9 billion by next year, turning FCF-positive at $1,000 per ounce of gold, and keeping AISC below $770 per ounce through 2019. On the growth front, Barrick recently partnered with Goldcorp to jointly operate its Cerro Casale mine at Chile and joined hands with China's leading gold miner to explore the high-potential El Indio Gold Belt on the Argentina-Chile border, among other moves. Given all of the things Barrick is doing, I don't see why it should disappoint investors in the long run.

Newmont Mining: strong production upside

Newmont Mining stock was on a roll until the gold miner reported wider losses for FY 2016 end-February -– the stock has lost roughly 8% since and is trading at a P/CF of only 6.7 times currently. What investors overlooked, though, is that Newmont suffered one-time impairment charges last year and is otherwise in a transformational phase, much like Barrick.

Newmont made huge headway last year as it brought two key projects online at lower-than-estimated costs. At the same time, Newmont divested a mine in Indonesia for $1.3 billion and more than doubled its FCF, part of which went to shareholders' pockets in the form of a twofold jump in dividends. Management adopted a new dividend policy, fixing dividends for different gold price points based on the average quarterly London Bullion Market Association P.M. prices.

Newmont has already made considerable progress so far this year, and it's on track to bring its Tanami Expansion Project in Australia online anytime now while advancing two key projects in Ghana. Newmont's production could jump up to 10% this year. Higher potential AISC remains a concern, but Newmont also boasts a solid balance sheet with nearly $2.9 billion in cash and cash equivalents as of March 31, 2017, and FCF worth $1.6 billion in the trailing 12 months. At current prices, the stock appears a good bargain for long-term investors.

Yamana Gold: the cheapest gold stock

Much like Newmont Mining, Yamana shares have been under tremendous pressure ever since the gold miner announced its FY 2016 and full-year outlook mid-February -- the stock is down a whopping 30% since and trading incredibly cheap at just 3.8 times P/CF. That's not an opportunity to be overlooked given Yamana's growth catalysts.

Yamana projects its gold production to grow 10% by 2019 as it brings more projects online, including its seventh mine at Cerro Moro in Argentina by early next year. If everything goes as planned, Cerro Moro could be a game-changer for Yamana, especially on the cost front, considering that the average AISC for the mine for 2018-2019 is expected to be below $600 an ounce. That should help the company bring down its otherwise high AISC substantially.

Image source: Yamana Gold.

These cost-effective growth moves, coupled with initiatives to strengthen its balance sheet like the recent spinoff of and the subsequent part-stake sale in Brio Gold could drive Yamana's cash flows substantially higher in coming years. That should reflect in the company's stock price, too, which could mean solid long-term returns for investors who buy the stock today.