Rising corporate earnings and news of an improving job market helped stocks post fresh highs last week as both the Dow Jones Industrial Average (^DJI -1.59%) and the S&P 500 (^GSPC -1.21%) passed 10% gains so far on the year.

Looking ahead, hundreds of companies will post second-quarter reports over the next few days. A few announcements -- including from Disney (DIS -1.91%), TripAdvisor (TRIP -0.04%), and NVIDIA (NVDA 1.93%) -- could produce big stock price swings for investors. Here's what to look for in the reports.

Disney's movie slate

Disney shareholders are trailing the market this year as the entertainment giant has been putting up underwhelming operating results. Net income declined over the past six months as revenue held flat, which puts the company on track for an unusually slow-growth year. In fact, consensus estimates peg sales gains at just 1% in fiscal 2017 compared to 6% in the prior year.

Image source: Getty Images.

While the House of Mouse faces challenges, particularly in its ESPN-anchored media-networks segment, a big portion of this year's slump can be blamed on temporary factors. Its consumer-products division, for example, is shrinking mainly because of a brutal comparison against a prior-year period that included hit releases in both the Star Wars and Frozen franchises.

Booming demand at the parks and resorts segment has helped offset most of that decline, and investors will be looking for more gains in the division this week. Meanwhile, CEO Bob Iger and his team will likely discuss the upcoming fiscal year that -- with 11 films slated for release including a major installment in the Star Wars saga -- should help Disney return to its market-thumping ways.

TripAdvisor's hotel shopping trends

Online travel-specialist TripAdvisor is hoping to turn things around this week after a brutal start to 2017. Shares slumped through the first half of the year on surprisingly weak sales and profits. Earnings plunged 55% at its latest quarterly check in as the business continued to struggle from its shift to an instant-booking operating model.

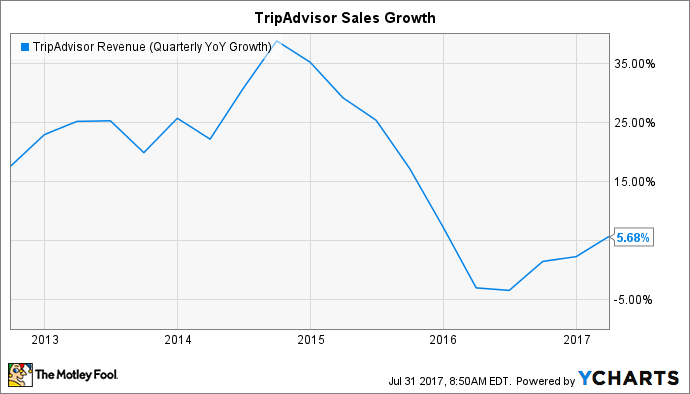

TRIP Revenue (Quarterly YoY Growth) data by YCharts.

Sales growth is accelerating, though, and the company announced healthy engagement metrics in May, including spiking visitor traffic and user-review postings. Executives believe these trends show that their product changes, while painful to short-term profits, are improving the shopping experience and, thus, will deliver positive long-term results.

TripAdvisor is aiming to continue that overall momentum with help from a large advertising campaign. Beyond the headline results, investors will be looking for click-based transaction growth to post its fifth straight improvement this quarter after bottoming out at a 21% decline in the first quarter of 2016.

NVIDIA's outlook

Investors could hardly be more optimistic headed into NVIDIA's second-quarter earnings results on Thursday. The stock is the single-best performer on the S&P 500 over the past year, after all -- up almost 200% in 52 weeks.

Image source: Getty Images.

The rally so far has been supported by sharply improving operating trends. Sales spiked 48% last quarter thanks to soaring demand in the chip giant's gaming and data-center segments. At the same time, emerging divisions, including artificial intelligence and autonomous automotive tech, show excellent long-term promise.

In May, NVIDIA surprised Wall Street by predicting a 36% sales spike this quarter, to $1.95 billion. Consensus estimates have only crept higher since then, which is another illustration of rising optimism on the part of investors. In that context, even a hint of a growth slowdown could send shares lower this week.