Up 80% so far in 2017, Activision Blizzard (ATVI) shareholders are sitting on impressive capital gains. In fact, their company is currently the fourth best-performing stock on the S&P 500 this year.

A quick run-up like that always raises the risk of a sharp pullback. However, it would be a mistake to sell Activision stock today simply because the price has jumped.

Image source: Getty Images.

In good company

For starters, the surge doesn't look so crazy when stacked up against industry peers. Electronic Arts (EA) has gained over 50% this year and Take-Two (TTWO) has more than doubled. Like Activision, these video game developers are benefiting from favorable industry trends that are lifting sales and profitability to new highs.

Those trends include a change from a release-driven launch model to one that, through expansion packs and upgrades, spreads out a game's content sales over an entire year -- or longer. As a result, revenue growth is becoming more predictable and the useful life of each new title is being extended in ways that weren't possible just a few years ago.

Activision has led the industry in this shift and is continuing to push the boundaries. It recently launched a major content update for its Call of Duty: Black Ops III title, marking the first time the developer has made such a large investment in a game over two years after launch.

Profit momentum

Thanks to its massive subscription-based business that's anchored by the World of Warcraft franchise, Activision is even better positioned than its peers to cash in on the surge toward digital gaming purchases. You can see the healthy impact that shift is having on the bottom line, with operating margin improving by 2 full percentage points to 25% of sales through the first half of 2017.

Notably, the company's $500 million of operating profit last quarter came despite Activision's having no full game release in any of its core franchises. If record earnings and a spike in profitability is what characterizes a slow seasonal quarter for this business, investors are probably right to be optimistic about the company's potential when big releases, including in the Destiny and Call of Duty franchise, begin impacting results later this year.

Playing the long game

Finally, there are Activision's longer-term opportunities that span a wide range of growth avenues including e-sports, consumer products, game broadcasting, and advertising. Sure, a few of these initiatives likely won't pay off. But it's clear that this developer has its pick of attractive ways to monetize its growing portfolio of content across its pool of over 400 million highly engaged users.

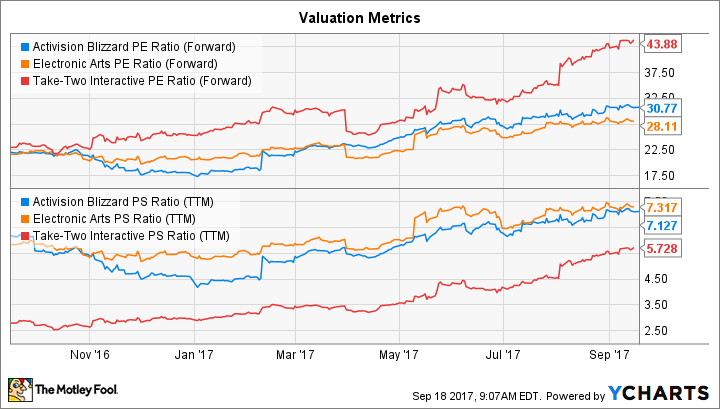

That's not to say that investors haven't priced loads of optimism into video game stocks in general and Activision's especially. Yet the shares aren't valued at much of a premium to rivals. Its price-to-forward earnings ratio is 31, compared to EA's 28 and Take-Two's 44. Activision is valued at 7.1 times the past year of revenue, which again puts it right between EA (at 7.3 times) and Take-Two (at 5.7 times).

ATVI P/E Ratio (Forward) data by YCharts.

If anything, that valuation might underestimate Activision's unique gaming portfolio and leadership position in this attractive industry, which means shareholders could still see market-thumping growth over the next few years. In my view, those long-term gains should dwarf the stock price jump shareholders have enjoyed over the last year.