The Dow Jones Industrial Average (^DJI 0.67%) has been around for more than 120 years, and it provides a simple measure of how the stock market is doing. The Dow doesn't make changes to its component stocks very often, but when it does, investors watch them very closely and track them to see whether they were good choices for the benchmark to make. Apple (AAPL 0.51%) is the newest member of the Dow, having come into the average in 2015, while Nike (NKE -0.36%), Goldman Sachs (GS 3.30%), and Visa (V 0.95%) were all in a batch of new Dow stocks in 2013. Yet the surprising thing is that these stocks haven't behaved the way that many investors would have thought.

Apple's difficulties

Apple had to wait a long time to become a member of the Dow, and gaining admittance required some major moves from the iDevice giant. Notably, a 7-for-1 stock split brought Apple's share price down to a range at which it wouldn't have too high an influence on the price-weighted benchmark, and many believe that it either paved the way for inclusion in the Dow or was negotiated prior to the event as a precondition for Dow admittance.

Apple went through tough times in 2015 and early 2016 as increasing doubt about whether the company would be able to come up with another revolutionary consumer electronics device following the death of Steve Jobs led to share price declines. Yet so far, simply pushing forward with evolutionary iterations of its iPhone, iPad, Apple Watch, and other devices has been enough to support profits. Areas like artificial intelligence have also provided a boost to Apple stock. It hasn't been enough to close the gap entirely with the Dow's performance, but Apple has finally started participating more fully in the Dow's bull market in the past year.

Image source: Apple.

Visa soars while Nike, Goldman stay close

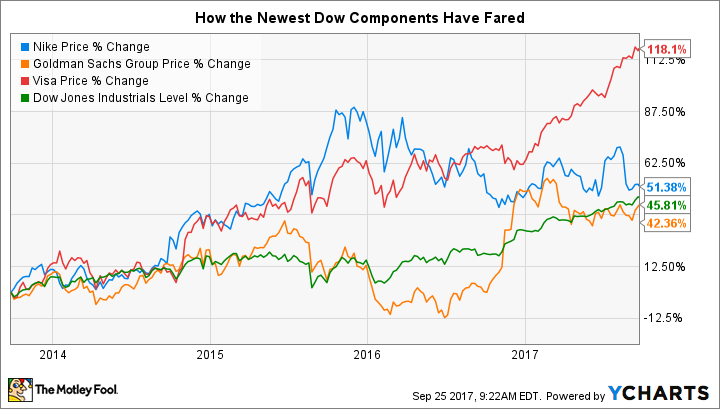

Meanwhile, the performance of the other three of the Dow's four newest components has been mixed. Goldman Sachs and Nike have posted price changes that are within a few percentage points of the Dow's overall gains over the past four years. Only Visa has distinguished itself with truly market-crushing performance over the same time period.

Visa's gains have come from the ongoing expansion not just of the U.S. economy but of worldwide commerce in general. It's hard for many U.S. investors to imagine a world without the card-based transactions and electronic payments that have become commonplace, but across many areas of the globe, cash remains the only viable way to conduct transactions. Visa has moved to take advantage of the fertile growth environment in facilitating payments abroad, seeking to tap the power of mobile devices to skip past card-based payment systems entirely. With its recent purchase of Visa Europe, Visa has regained its worldwide scope, and investors are optimistic about its ability to cash in on getting customers to give up cash.

Nike and Goldman have faced more difficult conditions. Nike is still the leader of the athletic apparel industry, but peers have attacked its market share and appear to be on the ascendancy. Even though Nike's chief domestic opponent has fallen back somewhat, international competition has climbed dramatically, and rival brands have become popular even in the U.S. market. Nike knows how to defend its brands while being aware of cyclical issues, but shareholders want proof that the athletic leader can adapt before they'll be willing to get more positive about the stock.

Goldman Sachs has been a leader on Wall Street for a long time, so it's a bit incongruous for the investment banking giant to be underperforming the Dow. Weakness in the commodity markets during 2015 and early 2016 weighed on the company, and Goldman also had to deal with some internal challenges that affected its returns. Yet late in 2016, Goldman soared on the prospects for less regulation and more freedom to do business, and that has helped the bank nearly catch up to the Dow in recent months.

It's surprising to most investors that new members of the Dow Jones Industrials don't automatically do well, and it can take a while for even the best companies to regain their footing. In the long run, investors can expect big things from Apple, Nike, Goldman, and Visa as they help to continue the Dow's bull market move far into the future.