What happened

Shares of Nordic American Tanker (NAT 0.67%) climbed more than 11% on Monday, and shares of Teekay Tankers (TNK 0.80%) and Teekay (TK 1.18%) were both up more than 9%, after Nordic American reported "strong market improvement" for its Suezmax tankers. If so, that's good news for a number of shipping stocks, and investors are celebrating by bidding up the company responsible for the prediction as well as one of the largest Suezmax operators.

So what

In a letter to shareholders, Nordic American referenced past company predictions concerning a rebound in the tanker market, but said "seeing is believing." The company noted a report from international ship brokerage Clarksons Platou reporting "the largest week-on-week increase in the history of their freight index."

Nordic American says that from Thursday to Friday last week, reported Suezmax rates jumped 60% overnight, and the company believes the strength is sustainable.

Image source: Getty Images.

"A seasonal upturn was already in the making," Nordic American wrote in its letter to shareholders. "However, the additional combination of increased demand from refineries around the world ramping up their production to supply low sulphur fuels for 2020 and reduced supply of new vessels are important structural factors."

The temporary uncertainty stemming from a drone attack on Saudi Arabian oil infrastructure created additional demand pressure, NAT said. Charter rates to Asia also jumped after the U.S. imposed sanctions in late September on two units of China Ocean Shipping (COSCO), relating to allegations that COSCO is trying to maneuver around Iran sanctions.

North American Tanker said that current Suezmax spot market rates are around $68,000 per day, compared to company operating costs of about $8,000 per day per ship.

Teekay Tankers, as the largest operator of midsize tankers including Suezmax, Aframax, and Long Range 2 (LR2) vessels, is also getting a lift from the bullish outlook. Its parent, Teekay Corporation, stands to benefit from an upswing at Teekay Tankers -- and also from a separate deal for another subsidiary, Teekay Offshore Partners, which will be acquired by Brookfield Business Partners for more than $600 million in cash.

Now what

Investors should note that while the trends are moving in the right direction, the increases will take some time to add to the bottom line. North American Tanker said that third-quarter results "will not be much different from our second quarter results," saying the upturn seen in the final weeks of the third quarter should filter into fourth-quarter results.

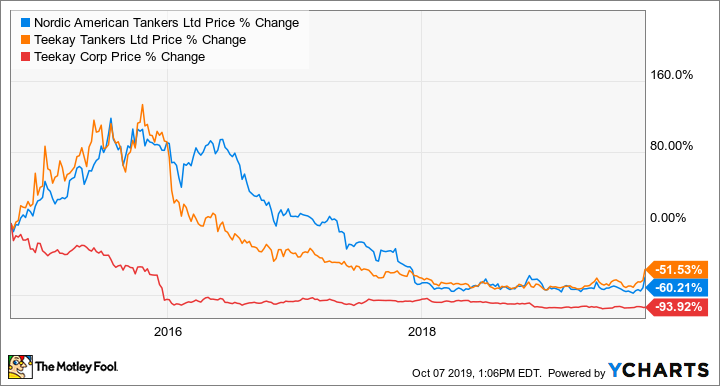

Shipping stock data by YCharts.

It's been rough sailing for investors in these shipping companies, with each losing more than half of their value over the past five years. The stocks still have a long way to go to make up those losses, but at least for now, the current appears to be pushing them in the right direction.