We believe investing is by far the most important thing you can do to secure your financial future. And getting the best investing results is much easier when you have one of the best brokerage accounts.

Our list below is the result of hundreds of hours our experts spent reviewing and rating the best stock trading platforms. These are the brokerage accounts we recommend to Aunt Sarah at the family reunion, the trading platforms we can't stop talking about. Below, we'll break down what you should know about online brokerages to compare the best trading platforms.

3 Featured Picks From Our Best Stock Brokers

If you're looking for a place to start, these top stock brokers are recommended by our experts:

- Robinhood: Standout low-cost mobile investing brokerage

- SoFi Active Investing: Exceptional broker for one membership ecosystem

- Fidelity: Well-rounded brokerage for beginning and advanced investors

Our 10 Best Trading Platforms of April 2024

| Broker/Advisor | Best For | Commissions | Next Steps | |

|---|---|---|---|---|

|

Featured Offer

|

Best For:

Low fees |

Commission:

$0 for stocks, ETFs, and options; $5 monthly for Robinhood Gold |

||

|

Best For:

Managing your finances under one roof |

Commission:

$0 for stocks, $0 for options contracts |

||

|

Best For:

New investors |

Commission:

$0 commission for online U.S. stock and ETF trades; trade fractional shares for as little as $1 |

||

|

Best For:

Account bonus |

Commission:

$0 per trade |

||

|

Best For:

Mobile platform |

Commission:

Commission-free; other fees apply |

||

|

Best For:

Active traders |

Commission:

As low as $0 stock trades |

||

|

Best For:

Mobile investing |

Commission:

$0 per trade |

||

|

Best For:

Customer support |

Commission:

$0 for online stock and ETF trades |

||

|

Best For:

Retirement investors |

Commission:

$0 stock, ETF, and Schwab Mutual Fund OneSource® trades |

||

|

Best For:

Passive investors |

Commission:

$0 online; $25 broker-assisted fee for some phone trades of stocks and ETFs from other companies (Less than $1 million) |

When we researched online brokers to create this list of the best online brokerages, here are a few essential features we looked for:

- Low costs: You don't want fees and commissions taking a bite out of your investment. We believe the best online brokers don't charge exorbitant fees.

- Variety of account types: Everyone's investment journey is different, and your investing needs can also change over time. In our opinion, the best online brokerages offer a range of account types, from custodial accounts to IRAs.

- Customer service: Investing can be intimidating! The best online brokers offer great customer service, so there's always someone there to lend a helping hand.

What is an online stock broker?

An online stock broker is a company that helps people buy and sell stocks.

These stocks are bought and sold using an online trading platform. And just like your savings are held in a savings account, stocks are held in a special type of financial account: a brokerage account.

What is a trading platform?

A trading platform is a type of software. Investors use trading platforms to buy and sell stocks.

Different brokerages have different trading platforms, so it's important to find one you like.

How to choose the best trading platform

It's important to choose a trading platform that fits your investing style. Do you want something complex -- are you a frequent trader? Or do you want something straightforward and simple to start out with?

The best trading platforms help investors make informed decisions. Sometimes, this means giving investors extra information, like research on stocks, news alerts, and more.

The best trading platform for you will be different from the best trading platform for someone else -- it all depends on your personal investing strategy and goals.

With no commission fees, access to trade fractional shares, and cryptocurrency through Robinhood Crypto, Robinhood is a no-frills but efficient brokerage account.

$0 for stocks, ETFs, and options; $5 monthly for Robinhood Gold

$0

On Robinhood's Secure Website.

SoFi has built a robust and valuable ecosystem to help manage your money in one place. SoFi Active Investing enhances that ecosystem with $0 stock commissions and low account minimums.

$0 for stocks, $0 for options contracts

$0

Get up to $1,000 in stock when you fund a new Active Invest account.

On SoFi Active Investing's Secure Website.

Fidelity is one of the largest and one of the most well-rounded brokerages available in the U.S. today. Importantly, Fidelity offers $0 commission for online stock and ETF trades, plus a high-quality mobile app that's good for both beginners and seasoned investors.

$0 commission for online U.S. stock and ETF trades; trade fractional shares for as little as $1

$0

On Fidelity's Secure Website.

E*TRADE manages to cater to active traders with multiple trading platforms, while also appealing to long-term investors with thousands of mutual funds and ETFs that can be traded commission-free.

Commission-free; other fees apply

$0

Open and fund and get up to $1,000

On E*TRADE's Secure Website.

One of the best brokerage accounts for active traders and has some of the lowest commissions and margin rates around.

As low as $0 stock trades

$0

On Interactive Brokers' Secure Website.

Webull is a mobile-first investing platform that stands out with the quality and simplicity of its experience and no commissions.

$0 per trade

$0

On Webull's Secure Website.

Merrill Edge® Self-Directed offers easily one of the biggest cash bonuses we’ve seen. It’s a standout brokerage with $0 online stock and ETF trades, strong research offerings, and excellent customer support. Owned by Bank of America, you can also get access to its fantastic Preferred Rewards program.

$0 for online stock and ETF trades

$0

Schwab has aggressively slashed fees on its mutual funds and ETFs, eliminated common account fees, reduced commissions to $0 per trade, and allows investors to buy fractional shares of stock, making it extremely affordable.

$0 stock, ETF, and Schwab Mutual Fund OneSource® trades

$0

It's not the best stock broker for more active traders, but Vanguard remains a top option for passive investors with excellent zero-commission options for index funds and ETFs.

$0 online; $25 broker-assisted fee for some phone trades of stocks and ETFs from other companies (Less than $1 million)

$0

TD Ameritrade has been acquired by Charles Schwab, and the company expects all accounts to be transitioned by the end of 2024. We've removed TD Ameritrade from our best-of lists to align with this development. Here at The Ascent, you can trust that we're constantly evaluating our top broker picks to bring you current recommendations.

Firsthand reviews of the best online brokerages

Our investing experts reviewed each of the best brokers on this list. Here's our brokerage comparison, with all the nitty-gritty of what we found when looking for the best trading platform around.

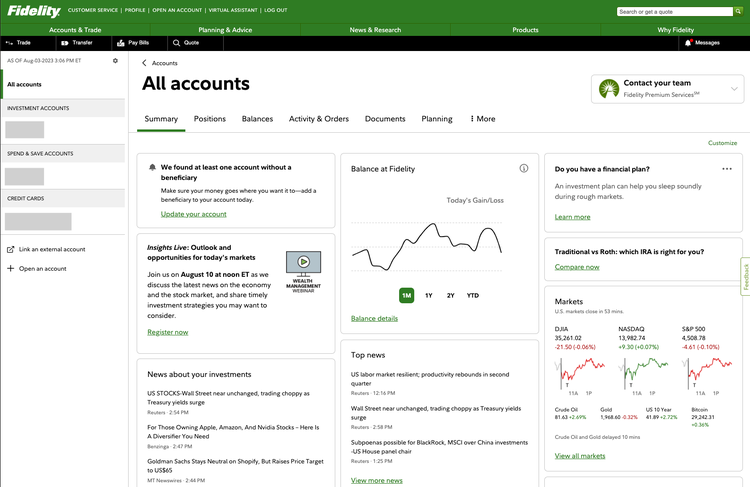

Fidelity

Why we picked it: Fidelity is at the top of the list for everything we look for in brokerage firms -- $0 commissions, a wide range of investment options, investor research, and an easy-to-use mobile and desktop platform. It's our choice for best trading platform because truly, it's hard to beat.

Quick hits:

- Account minimum: $0

- Commissions: $0 commission for online U.S. stock and ETF trades

- Customer service: 24/7 phone and virtual assistant support, live chat from 8 a.m.-10 p.m. ET M-F and 9 a.m.-4 p.m. ET Sat-Sun

What we think you need to know about Fidelity:

Fidelity has been around for decades and its reputation precedes it. Known for being the gold standard in the brokerage industry, Fidelity has millions of customers and a reliability that's undeniable.

It offers a wide selection of tradable assets: stocks, ETFs, mutual funds, options, and as of 2023, cryptocurrency. Fidelity meets the industry standard of $0 stock and ETF commissions, but really shines with over 3,000 no-transaction-fee mutual funds, which is only the standard for a handful of brokers on this list.

Fidelity also offers more independent research than pretty much any other discount broker. Plus, it has a good amount of educational resources and offers fractional share trading, making it a great choice for beginner investors.

Where investors often have to choose which features are important to them -- low costs, extensive research, good investment selections, beginner-friendly education -- Fidelity checks the boxes for almost all of the big requirements. We consider this one of the best trading platforms because it's a good choice for both beginner and seasoned investors, and really anyone in between.

What the platform looks like:

First-hand review from one of our employees, who uses Fidelity personally:

"I've been using Fidelity for over a decade, and my experience has been excellent. I've found it to be an easy-to-use platform, has great customer service, and the fees are low or nonexistent. An underrated feature is the ability to change your core cash position to high-yielding options including a money market fund or a treasury fund. The yields on these funds are very attractive and it means you can feel comfortable keeping cash here that you're waiting to invest -- these funds currently earn a rate similar or higher than many high-yield savings account options. Note, you need to change your core cash position to one of these funds -- it is not automatic. These funds are not FDIC insured but I think they're pretty darn safe -- but if you want extra peace of mind, park your cash instead in an FDIC-insured high-yield savings account."

-Brendan Byrnes, Managing Director of The Ascent, a Motley Fool service

Pros:

- Commission-free stock and ETF trades

- Offers fractional share investing

- Wide selection of mutual funds

- High-quality mobile app

Cons:

- Higher-than-average options contract fees

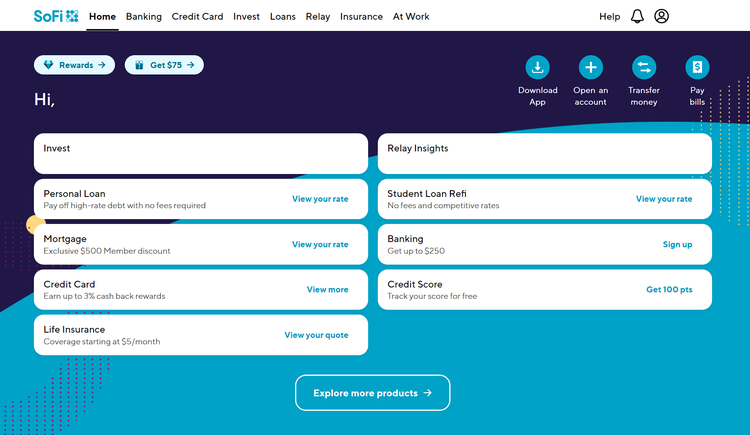

SoFi Active Investing

Why we picked it: SoFi Active Investing is a good option for beginner stock and ETF investors who also want access to other financial products in one ecosystem.

Quick hits:

- Account minimum: $0

- Commissions: $0 commission for stocks, ETFs, and options

- Customer service: Phone support or live chat available from 5 a.m.-5 p.m. PT, M-F, closed on weekends.

What we think you need to know about SoFi Active Investing:

If you're a beginner investor who wants to invest in stocks or ETFs with $0 commissions, SoFi Invest is a good option. It's one of the only brokerage firms that lets you buy fractional shares of a stock, meaning you don't need a ton of money to start trading stocks.

It's a low-frills broker, meaning you don't have all the heavily customizable charts and third-party data that a broker like E*TRADE offers. It's designed for beginners, so if you're an experienced investor who wants to do heavy stock research, this is probably not the best broker for you.

The real advantage of SoFi Invest is the ability to keep all your finances in one place. Once you open a SoFi Invest account, you're a SoFi member, so you'll have access to all your different financial accounts in the same ecosystem. You may even qualify for discounts on other products. For example, if you end up taking out a personal loan, you can get a discounted interest rate because of your relationship with the company.

On the downside, SoFi Invest does not offer mutual funds or stock option trading. If you want to invest in mutual funds, or pretty much anything other than stocks or ETFs, you'll have to look at other brokerage firms.

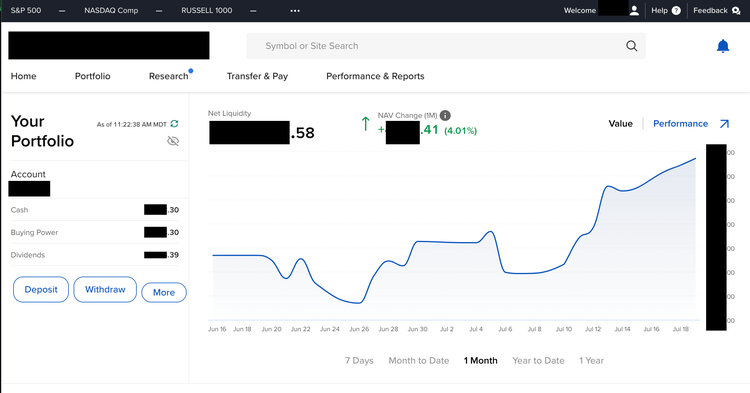

What the platform looks like:

First-hand review from one of our employees, who uses SoFi Active Investing personally:

"My experience with SoFi Active Investing isn't extensive, but it's been positive so far. I primarily use this account for hobby investing, and I'd recommend it for folks who want to experiment with retail trading. Their experience and reputation isn't strong enough for me to put my retirement funds there. One tip I have is to look for a welcome bonus, as you can usually get a free share of stock or two."

-Brittney Myers, Writer here at The Ascent, a Motley Fool service

Pros:

- $0 stock and ETF commissions

- Low account minimum

- High-quality mobile app

Cons:

- No mutual funds

- No stock option trading

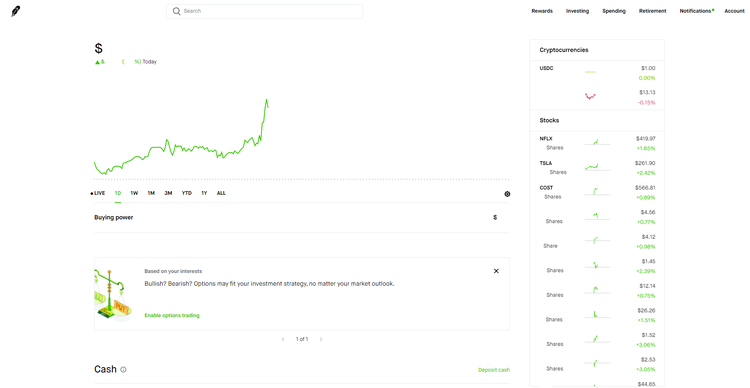

Robinhood

Why we picked it: Robinhood is a good option for investors who don't want all the bells and whistles of a full-featured broker but still want access to affordable and diverse investment options on the go.

Quick hits:

- Account minimum: $0

- Commissions: $0 commission for stocks, ETFs, and options

- Customer service: 24/7 support by phone or live chat.

What we think you need to know about Robinhood:

Robinhood was designed to be a mobile-first, no-frills investing platform. With $0 commissions and a whole suite of fractional share options, it's an one of the best broker accounts for folks looking for low-cost trading.

In fact, while most of the brokerage firms that have dropped their standard stock trading commission have also dropped the base commission on options trades, a lot of them still charge a small per-contract commission. Robinhood allows traders to buy and sell as many options contracts as they want with no commissions at all, making it a great option for people wanting to trade options.

On the downside, Robinhood doesn't support mutual fund and fixed-income investing, which most other brokerage firms on the list offer.

What the platform looks like:

First-hand review from one of our employees, who uses Robinhood personally:

"I've been using Robinhood since they launched. At the time, they were one of the only platforms to offer zero-fee trades. Their platform was developed to be mobile-first, so the app is clean and easy to use. They also recently launched an IRA product, which is built in to the existing app. The account was easy to open, and since I was already familiar with the platform, it's intuitive to fund the IRA and buy stocks."

-Louis Feldsott, Data Analyst here at The Motley Fool

Pros:

- $0 commissions

- High-quality mobile investment app

- Fractional shares investing

- Cryptocurrency investing through Robinhood Crypto

Cons:

- Consumer perceptions around trading restrictions

- No access to mutual funds and fixed income products

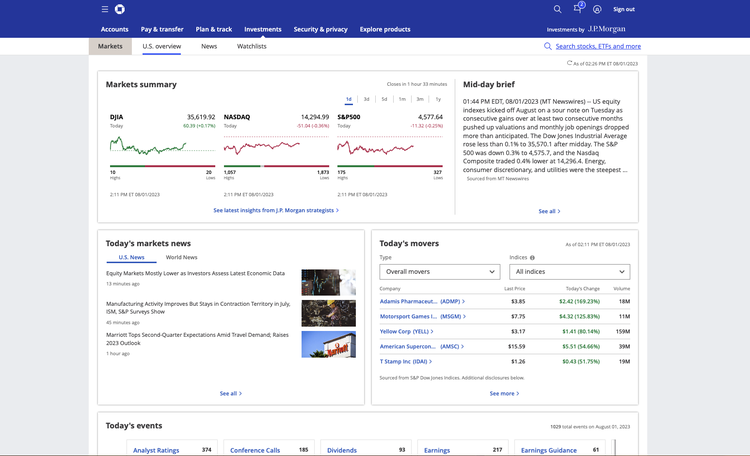

J.P. Morgan Self-Directed Investing

Why we picked it: With the standard $0 commissions on stocks and ETFs and no transaction fees for mutual funds, J.P. Morgan Self-Directed Investing is a good option for mutual fund investors and existing Chase customers.

Quick Hits:

- Account minimum: $0

- Commissions: $0 commission for online U.S. stock and ETF trades

- Customer service: Phone support available from 8 a.m.-9 p.m. ET Monday-Friday and 9 a.m.-5 p.m. ET on Saturdays.

What we think you need to know about J.P. Morgan:

Like SoFi, Ally, and Merrill Edge, J.P. Morgan offers convenience to investors who want all their financial accounts in one place. The J.P. Morgan Self-Directed Investing platform integrates into all Chase accounts, so existing Chase customers are able to sign up for an investment account right from the app.

As is the industry standard, J.P. Morgan offers $0 commissions for stock and ETF trades. But what really sets J.P. Morgan apart is its no-transaction-fee mutual fund offerings. We believe it's one of the best stock brokers because it's one of the only brokers that offers $0 commissions on all mutual funds, not just a subset of no-transaction-fee funds.

J.P. Morgan Self-Directed Investing does not offer cryptocurrency, futures, or forex trading, so if those are on your list, you'll want to look at other options. It also only offers fractional investing on reinvested dividends, so for beginner investors without a lot of capital to get started, that could be something to consider.

What the platform looks like:

Pros:

- No minimum for self-directed investing

- $0 commissions for stocks and ETFs

- No-transaction-fee mutual funds

Cons:

- Limited account types

- Trading platform

- Robo-advisory services are more expensive than many competitors

Interactive Brokers

Why we picked it: Interactive Brokers was designed for active traders and more advanced traders. While it could be intimidating to beginners, the range of tradable securities and its advanced trading platform make it one of the most comprehensive trading platforms on the market.

Quick Hits:

- Account minimum: $0

- Commissions: As low as $0 commission for online U.S. stock and ETF trades

- Customer service: 24-hour phone and live chat support on business days. Live chat is also available from 1 p.m.-7 p.m. ET on Sundays.

What we think you need to know about Interactive Brokers:

With Interactive Brokers, investors can trade stocks, ETFs, options, futures, forex, cryptocurrencies, and mutual funds in over 150 markets. That's the widest range of tradable securities on this list by far, and the most comprehensive access to global markets among our best brokers.

Interactive Brokers boasts $0 commissions on stock and ETF trades, as is the industry standard, but where it really shines are substantially lower margin rates than most of the brokerage firms we've reviewed. This makes it an excellent choice for margin traders.

The desktop platform offers advanced charting and technical analysis tools, which could be intimidating for beginner investors or investors who trade infrequently, but for those who actively trade, this platform is hard to beat. It's truly one of the best online brokerages we've seen.

It's worth noting that Interactive Brokers has both IBKR Pro and IBKR Lite offerings, depending on how much research and advanced features are important to you. The fee structure for both are more complicated than most brokers on this list, so be sure to look into which tier makes the most sense for you and what fees correspond to that tier before making a decision.

What the platform looks like:

First-hand review from one of our employees, who uses Interactive Brokers personally:

"I've used Interactive Brokers for 5 years, as my advisor uses it to manage my SMA (Separately Managed Account -- the advisor manages the trades in this account on my behalf), and overall I think it has improved a lot in that time. I still find their two-factor authentication the most clunky of all the brokerages I use, but I think their PortfolioAnalyst feature is very good and is not something you can get elsewhere. Overall, I think it has excellent advanced features, but seems to be lacking easy access to the basics of checking on your individual positions. I'd recommend it more to advanced brokerage users."

-Tim White, Tech Leader here at The Ascent, a Motley Fool service

Pros:

- Low margin rates

- Robust trading platform

- Commission-free trading

- No-transaction-fee mutual funds

Cons:

- Complicated pricing structure

- Some research tools incur a fee

E*TRADE

Why we picked it: E*TRADE is a full-featured broker that's a one-stop shop for investors wanting a diverse selection of investment options. It's a great option for investors who want flashy, in-depth charts on an intuitive desktop platform.

Quick Hits:

- Account minimum: $0

- Commissions: $0 commission for online U.S. stock and ETF trades

- Customer service: 24/7 customer support by phone.

What we think you need to know about E*TRADE:

E*TRADE is known for its intuitive platform and huge array of investment options, including $0 online stock, mutual fund, and ETF commissions.

And if you're an investor who loves data, you'll love the analysis you can do on the platform. We're talking customizable charts with up to 16 columns, 65 different metrics to choose from, and the ability to sort and prioritize metrics that are most important to you. That's pretty impressive if you're an active trader who likes to really do your research. We think it's one of the best online brokers for analytical, research-driven investors.

On the downside, E*TRADE's customer service is less noteworthy than some of the other full-featured brokers like Fidelity and Schwab. Plus, while you can invest in fractional shares for the top 100 ETFs, you can't invest in fractional shares for stocks, which is often a draw for beginner investors.

Also note that E*TRADE doesn't offer trading on international exchanges, so if that's part of your investing strategy, you will want to consider a different option.

What the platform looks like:

First-hand review from one of our employees, who uses E*TRADE personally:

"E*TRADE is a powerful platform that's easy to use, especially for someone new to investing like myself. I've run into errors when connecting my external accounts with other brokers, but E*TRADE made it simple to open and fund a new account. The homepage gives me a comprehensive overview of my accounts while providing a real-time look at the market (although the index looks to be only slightly behind)."

-Kathryn Mallari, SEO Content Strategist here at The Ascent, a Motley Fool service

Pros:

- $0 online stock, mutual fund, and ETF commissions

- Trading platform

- No minimum deposit

- Branch network

Cons:

- Margin rates

- Limited foreign market trading

Merrill Edge® Self-Directed

Why we picked it: Merrill Edge® Self-Directed has low fees, strong research offerings, and 24/7 customer support. It's a solid option for all investors, but especially attractive for Bank of America customers.

Quick Hits:

- Account minimum: $0

- Commissions: $0 commission for online U.S. stock and ETF trades

- Customer service: 24/7 phone support available, as well as live chat.

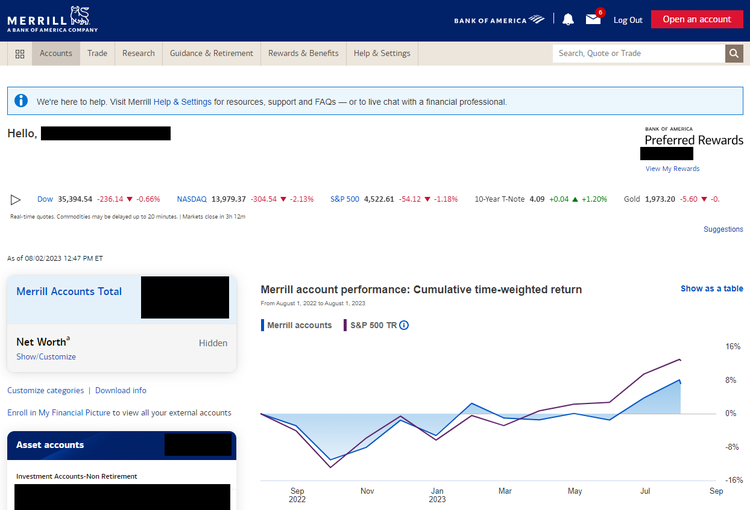

What we think you need to know about Merrill Edge® Self-Directed:

Merrill Edge has all the things we look for in the best investment brokers -- $0 stock and ETF commission fees, diverse account types, and a wide range of investment vehicles, including stocks, ETFs, options, mutual funds, CDs, and bonds. It's a solid choice for ETF and stock investors who value research and customer service.

But the real advantage of Merrill Edge comes if you're a Bank of America customer. Merrill Edge is owned by Bank of America, which means investing in Merrill Edge gives you access to the Bank of America Preferred Rewards program and the many national branches of Bank of America for in-person customer support.

Any customer with at least $20,000 in their BoA accounts and Merrill Investment accounts combined is eligible for the Bank of America Preferred Rewards program, where you can get rate and fee discounts for most of the bank's products (plus bonus credit card rewards!). Preferred Rewards has three tiers, and bigger balances mean better perks.

If you're a Bank of America customer, you could earn more interest and save money on other financial products with a Merrill Edge account.

What the platform looks like:

First-hand review from one of our employees, who uses Merrill Edge® Self-Directed personally:

"It's been more than seven years that I've been on the Merrill Edge platform. I chose it because Merrill was early to the game in terms of $0-commission equity investing (for Bank of America customers). I stay with it because the platform has offered everything I need for long-term investing, without extra noise or distractions. I also like how easily it integrates with my other Bank of America banking products."

-Matt Koppenheffer, General Manager here at The Ascent, a Motley Fool Service

Pros:

- $0 stock and ETF commissions

- Diverse account types offered

- Investment vehicles offered

- National branch access

- Preferred Rewards program

Cons:

- Trading platform can be beat

- Margin rates are higher than other brokers

Webull

Why we picked it: Webull is a great option for active traders who want to trade stocks and options on the go.

Quick Hits:

- Account minimum: $0

- Commissions: $0 commission for online U.S. stock and ETF trades

- Customer service: 24/7 support available by phone.

What we think you need to know about Webull:

Webull is a good option for people who prioritize mobile experience. Similarly to Robinhood, Webull is a mobile-first brokerage with less focus on educational resources and more focus on providing an affordable, easy-to-use trading experience.

Like most brokers, Webull has $0 commission stock and ETF trades. But unlike most other brokers, there are no per-contract fees for options trading, making it a good option for options traders.

It's worth noting that Webull has only been around since 2017, so you miss some of the reliability and brand equity that comes with big brokers like Fidelity or Charles Schwab. It also does not trade in mutual funds or over-the-counter (OTC) stocks.

What the platform looks like:

First-hand review from one of our employees, who uses Webull personally:

"I've had my Webull trading account for three years and primarily did my trading using my mobile device. I love that the app allows you to check your individual account's risk level based on your investments. Trading isn't too complicated on it, but beyond the risk assessment component, it was pretty similar to other platforms I've used. It could be worthwhile for people seeking to buy OTC and fractional shares."

-Sharice Wells, Editor here at The Motley Fool

Pros:

- $0 stock and ETF commissions

- Big potential bonus

- No account minimums

- Excellent mobile platform

- Competitive margin rates

Cons:

- No mutual funds

- Limited account types

Charles Schwab

Why we picked it: Charles Schwab can go toe to toe with any broker on this list and often come out on top. It's a standout full-featured broker with a reliable reputation, $0 commissions, and international offerings. If you're a fund investor, this is one of the best on the market.

Quick Hits:

- Account minimum: $0

- Commissions: $0 commission for online U.S. stock and ETF trades

- Customer service: Available 24/7 by phone. Live chat is available, or help is also available at Schwab's branches.

What we think you need to know about Charles Schwab:

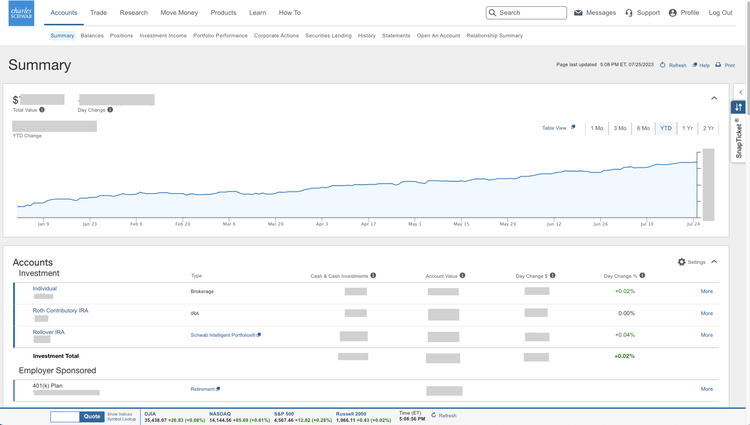

We think Charles Schwab is a solid pick for seasoned investors and beginners alike. It has a reliable brand, a wide array of investment options, and is one of the most affordable brokers on the market.

While similar to the big names on this list like Fidelity and Vanguard, what really sets Schwab apart is its fund offerings. Schwab offers one of the largest marketplaces for low-cost ETF and index investing, including its own line of branded ETFs that rival the lowest cost options we've come across.

Schwab also rivals brokers like SoFi and Merrill by offering other financial products all within one ecosystem, such as the Charles Schwab High Yield Investor Checking account, CDs, and credit cards.

It's important to note that Schwab does not offer cryptocurrency trading, so if you're interested in venturing into the world of crypto, you won't be able to do that through Schwab.

What the platform looks like:

First-hand review from one of our employees, who uses Charles Schwab personally:

"I opened my Charles Schwab account as a brand-new investor who knew almost nothing about investing, and I've learned a lot through their educational resources. While the website isn't the most modern, it's easy to use. I've spent a good amount of time using their customer service support as well as a Schwab Financial Consultant and both have been tremendously helpful. I like both the active trading experience but have also enjoyed using their robo-investing option, Schwab Intelligent Portfolios."

-Brooklyn Welch, SEO Content Strategist here at The Ascent, a Motley Fool service

Pros:

- $0 commission trading

- Robust mutual fund access

- Investing and banking all in one

- Nationwide branch network

- High-quality investment app

Cons:

- Margin rates aren't the lowest

- No cryptocurrency trading

Vanguard

Why we picked it: Vanguard is a good option for long-term investing at a low cost. Especially for investors interested in mutual funds, Vanguard offers thousands of no-transaction fee fund options.

Quick Hits:

- Account minimum: $0

- Commissions: $0 commission for online U.S. stock and ETF trades

- Customer service: Phone support available from 8 a.m.-8 p.m. ET, Monday-Friday.

What we think you need to know about Vanguard:

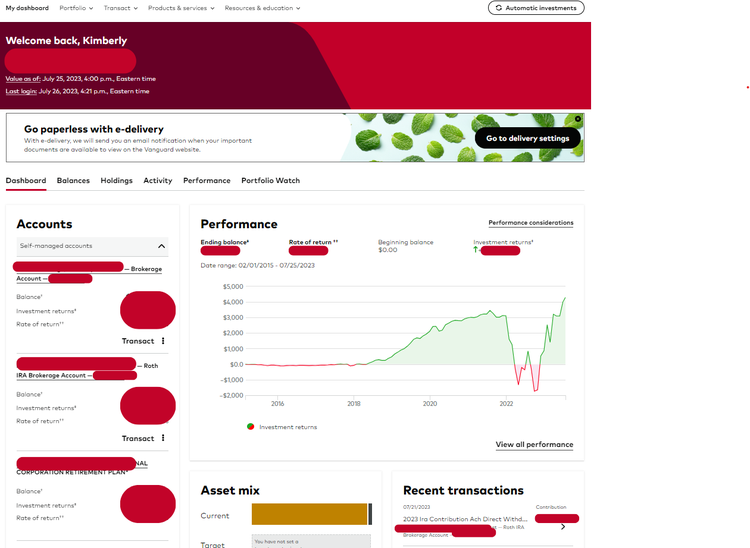

Vanguard has been around for a long time, and therefore has a reliable reputation in the market. It's a retirement-focused broker that's highly regarded among investors with a long-term investment philosophy.

In fact, the whole platform is optimized for buy-and-hold investors. The design is focused primarily on performance over the long term and the balance of your holdings. Unlike many other brokerages on this list, Vanguard doesn't offer real-time streaming news or advanced charting tools, as buy-and-hold investors may not benefit from those like active traders would. Active traders may find this limiting, but for investors who align with Vanguard's strategy, it's a simple and easy-to-use platform.

While Vanguard meets the standard $0 commission stock and ETF trading, where it really shines is in its mutual fund offerings. Its own suite of Vanguard mutual funds offer some of the lowest expense ratios on the market, as well as thousands of no-transaction-fee funds from other firms.

If you're a buy-and-hold investor who wants low costs over the long term, this may be the right platform for you.

What the platform looks like:

First-hand review from one of our employees, who uses Vanguard personally:

"The thing I like the most about Vanguard is their willingness to provide help and guidance. I'm not an expert when it comes to brokerages and investment accounts, and I know a lot of people are just like me. It's easy to get a knowledgeable person on the phone at Vanguard, and they walk me through every question I have. They score highly in my book for their ability to help novice investors like me who want to learn more. Also, I'm very sensitive to fees and pay zero whenever possible. Vanguard has given me all the fee-free options I've needed."

-Kimberly Rotter, Writer here at The Ascent, a Motley Fool service

Pros:

- Zero-commission trading

- Low cost ETFs and mutual fund investing

- No account minimums

- Account types offered

Cons:

- Options commissions

- Active trading platform isn't as robust as competitors

Fees for the best brokerage accounts

With so much competition among the best stock broker companies, consumers benefit in one of the most important areas for successful long-term investing: commissions and fees. The best trading platforms today offer commission-free online trading for stocks and ETFs. It's becoming even more common to see $0 commissions for mutual funds, cryptocurrencies, and fixed-income investments with the best brokerage accounts, too.

Here's a rundown of common broker fees for our picks of the best brokerage accounts.

| Brokerage | Stock/ETF Commission | Options Fee (Per Contract) | Cryptocurrencies |

|---|---|---|---|

| Robinhood | $0 | $0 | $0 |

| Webull | $0 | $0 | $0 |

| SoFi Active Investing | $0 | $0 | N/A |

| Fidelity | $0 | $0.65 | N/A |

| Interactive Brokers | $0 | $0.15 - $0.65 | N/A |

| E*Trade | $0 | $0.50 - $0.65 | N/A |

| Merrill Edge | $0 | $0.65 | N/A |

| Charles Schwab | $0 | $0.65 | N/A |

| Vanguard | $0 | Up to $1.00 | N/A |

| J.P. Morgan Self-Directed Investing | $0 | $0.65 | N/A |

The lowest commission stock broker will depend on the type of trading you do in your brokerage account. Interactive Brokers combines robust trading software with low commissions and competitive margin rates. Robinhood, SoFi Invest, and Webull are the lowest commission brokerage accounts across stocks, ETFs, options, and cryptocurrencies -- they don't charge commissions.

Other Best Broker Picks

How do online brokerage firms work?

You can think of an online stock broker as a conduit to the stock exchanges. In exchange for a commission on every trade, the best stock trading platforms send your orders on to stock exchanges and market makers, which actually do the heavy lifting of matching your buy order with someone who wants to sell, or vice versa.

But you can't just buy a stock through your bank account or call the company and buy shares -- you need to find one of the best stock brokers to make a trade.

Fortunately for everyday investors, the brokerage industry has changed dramatically over the past couple of decades. To buy a stock, you used to have to call an individual known as a stock broker, who placed the order on your behalf. This process was complex -- and expensive.

You and I can't knock on the doors to the stock exchanges and make a trade without a stock broker. In truth, the stock exchanges as we think of them from their depictions in movies and on TV don't really exist today. Most trading in the best online stock brokers actually takes place between computers in dimly lit server rooms in New Jersey, a few miles from New York City's financial district.

With the best online stock brokers, placing a trade is similar to other types of online banking. It's much more convenient than it used to be -- and more accessible, too. You might say all you need is a brokerage account and a dream.

What is the difference between investing and trading?

Here at The Motley Fool, we believe in long-term investing as a proven strategy for investors to build wealth over time. That means we believe in buying and holding stocks for at least five years. Why? Because a buy-and-hold strategy ignores short-term volatility in the market and makes the most of the long-term potential of investing.

Trading, on the other hand, involves buying and selling after holding them for short periods of time. It's considered riskier than long-term investing. In the short-term, anything can happen. Investing consistently over many years, conversely, has a much higher likelihood of success.

Types of brokerage accounts

Today, instead of using the term "stock broker" as an all-encompassing term for any person or brokerage firm that deals in stocks, we generally divide brokerages into two categories: "discount brokers" and "full-service brokers," labels that better describe what stock broker companies actually do.

Discount brokers

Online brokerages are discount brokers. They aren't in the business of giving you advice or phoning you up with stock picks. Instead, discount brokers focus on the very basic service of helping you buy or sell a stock (or other type of investment) from the convenience of your own home.

Because discount brokers forgo many of the frills, they can charge rock-bottom prices for their services. Virtually all online stock brokers charge $0 to place a stock trade -- a bargain, especially considering what traditional brokers charge, and also charge low fees for other products and services. In addition, discount brokers tend to have lower minimum investment requirements (or no minimums at all), making them accessible to everyone.

Full-service brokers

Brokerage firms we label "full-service brokers" are more closely related to the stock brokers of days gone by. Full-service brokers often employ human brokers who can help you make a trade, find mutual funds to invest in, or make a retirement plan.

That said, full-service brokers are costly, since people are inevitably more expensive than computers. A popular full-service broker charges a minimum of $75 to place a stock trade, and that can jump to as high as $500 or more to buy a large amount of stock. Buying a mutual fund through a full-service broker can potentially set you back thousands of dollars, since they often charge fees equal to a portion of the amount you invest. Full-service brokers are more likely to have higher account minimums; some advisors only work with clients who have $1 million in assets or more.

Realistically, the lines between the two types of brokers are starting to blur. Discount brokers now have wealth-management services that offer the help of a human advisor at a full-service price. Some full-service brokers also offer a basic level of service at discounted prices. For example, Merrill Edge® Self-Directed is the discount brokerage arm of the full-service brokerage Merrill Lynch.

Which type of brokerage account is right for you?

The best online brokerage account for you depends on your needs. Here are a few things you might want to consider when comparing trading platforms:

- If you plan to simply buy and hold stocks, you probably don't need a full-featured trading platform.

- If you primarily plan to buy mutual funds, you should look for the best mutual fund broker, since these brokerage accounts offer low to $0 commissions to buy and sell mutual funds.

- If you are a brand-new investor and only want to invest a few hundred dollars at first, you'll probably want to look for the best brokerage firms with no minimum investment requirement.

If you plan on trading bonds or stock options, or plan on making trades over the phone as opposed to online, be sure to look at what each of the top brokers charge for these activities. Comparing the best investment brokers on our list can help you determine which platform has the features you're looking for.

What to consider when comparing top brokers

Like most financial products, there is no brokerage firm that is a perfect fit for all investors. But here are some of the factors to keep in mind when you're deciding which is the best online broker for you:

- Commissions and fees: Basic, online stock and ETF trades should be free. The best stock trading platforms shouldn't charge you these extra fees. Investors now pay $0 commissions at most online stock brokers, and some trading platforms even offer options trading for free, which can be particularly valuable for active traders. Most online brokerages charge commissions for mutual fund trades and other services you might need, so it's still important to compare fee structures between stock brokers.

- Mutual funds: While most online brokers charge a commission for mutual fund trading, it's also important to know that most trading platforms have a list of hundreds or even thousands of funds that trade with no commissions at all.

- ETF investing: The best ETF stock brokers will not only have $0 online commissions for ETF investing, but they also tend to offer access to a wide array of branded, low-cost ETFs. These branded ETFs are managed by the stock broker's analyst teams themselves and they often include rock-bottom expense ratios.

- Options investing: A well-rounded stock brokerage account will not only offer access to investing in stocks, ETFs, and mutual funds, but also options. Some options trading platforms include $0 commissions for online options trades and high-quality trading software across online, desktop, and mobile devices, although many still charge a per-contract fee for options trading.

- Account minimums: Many of the top online stock brokers don't have account minimums, but a few do. If you're a beginner investor, it's important to verify that you can meet any minimum investment requirements before you select a broker.

- Trading platform: Some stock brokerage accounts have full-featured and complex online stock trading platforms and software available to frequent traders, as well as managed portfolio services from robo-advisors. Other stock brokers take a more simplistic, user-friendly approach. And many have top-notch investing apps that could come in handy if you want to buy and sell stocks from anywhere in the world.

- Research and screeners: One key reason to have an online brokerage account is that you can access a second opinion when you need it. Many of the best brokers offer a full suite of third-party research as well as stock and fund screeners. With the best brokerage accounts, for example, you should be able to find the annual fees for investing in a fund, or get help sorting through your choices via parameters like price-to-earnings ratio.

LEARN MORE: How to Choose the Right Brokerage For You

Are online brokerage accounts safe?

Online brokerages are safe, and that's especially true when it comes to all of the brokers discussed on this page. All of the best brokerage firms listed here are members of the SIPC, which stands for Securities Investor Protection Corporation, and this means that the cash and securities in your account are protected up to $500,000 in the event that the brokerage firm fails. Essentially, SIPC protection is to brokerage accounts what FDIC insurance is to bank accounts, but with one big difference.

The SIPC does not protect against losses that result from declines in the market value of securities. It protects as much as $250,000 in cash in your brokerage account, and while it doesn't cover things like unauthorized trading activity, most of the best brokerage accounts have fraud protection guarantees that cover you in the event your account is hacked, as long as you notify them in a timely manner.

How to open a brokerage account

In most cases, the process of opening a brokerage account is rather quick and straightforward. But here are the general steps to opening a brokerage account once you've found the best stock trading platform for you:

- Learn about different types of brokerage accounts, and determine what type of brokerage account you need (individual, IRA, etc.)

- Compare different brokers to find the best brokerage accounts for you.

- Decide which brokerage firm is best for you.

- Fill out the new account application, and be ready to provide identifying information such as your Social Security number.

- Add funds to the account. Most brokers offer several ways to do this.

- Start investing!

TIP

Buying your first stocks: Do it the smart way

Once you’ve chosen one of our top-rated brokers, you need to make sure you’re buying the right stocks. We think there’s no better place to start than with Stock Advisor, the flagship stock-picking service of our company, The Motley Fool. You’ll get two new stock picks every month, plus 10 starter stocks and best buys now. The average stock pick inside Stock Advisor is up 661% — more than 4x that of the S&P 500! (as of 4/15/2024). Learn more and get started today with a special new member discount.

What is the best stock broker mobile app?

Since so many people use their mobile devices for financial activities these days, it's worth noting that most of our favorite online brokers are also the ones with the best free trading apps. Some are mobile-focused, like Robinhood, while others simply use mobile apps to offer their customers an additional way to trade stocks.

Unfortunately, there's no one-size-fits-all answer for which brokerage firm has the best mobile app. For some people, the best broker should have a user-friendly app that makes it easy to buy and sell stocks. For others, the best broker is one with a mobile app packed with features for active traders and serious investors. But if you anticipate doing a fair amount of trading through your mobile device, looking at each stock broker's mobile app should be a large part of your evaluation process. Finding the best platform to buy stocks can be tricky -- but committing to a broker that fits your lifestyle is worth the time it takes to compare online brokers.

LEARN MORE: Best investment apps

What is the best stock trading platform for beginners?

Most brokers on this page are good options for beginner investors, but in terms of the best platform to buy stocks if you're a beginner, our top pick for beginners is SoFi Active Investing. It has one of the best user experiences available, and SoFi offers all-in-one investing, banking, and budgeting.

What are the best trading platforms?

Many of the top brokerage firms are well represented on our list of brokerage accounts to consider. If you're looking for the best broker accounts, keep reading. Below we've included a rundown of our top five brokerage firms based on assets under management as of August 2023.

- Vanguard: $8.2 trillion

- Charles Schwab: $8.02 trillion

- Fidelity: $4.5 trillion

- J.P. Morgan: $3.9 trillion

- Bank of America/Merrill Lynch: $3.6 trillion

MORE RESEARCH: The largest stock brokerage firms

Our brokerage methodology

Broker products are rated on a scale of one to five stars, primarily focusing on fees, ease of use, and quality of the trading platform and research offerings. The best brokerage accounts generally include the following:

1. Low costs to invest

We run a comprehensive review of routine fees, since account management costs can have a meaningful impact on your ability to invest profitably. When we look for the best brokers, we keep an eye on:

- Stock, ETF, and mutual fund commissions

- Margin rates

- Maintenance and transfer fees

2. Great customer support and service

A high level of scrutiny is put on a brokerage's service and support, especially considering that a customer will likely interact with their brokerage's support team on multiple occasions. Factors we look at when considering a brokerage firm for our best brokers list include:

- Presence (or not) of branch offices

- Quality of online and phone support

The best online brokerages should have high-quality customer service.

3. Strong product quality and features

Today's best online brokerages need a well-rounded suite of products and features to stand out in our ratings since we think brokerages need to provide a one-stop shop that meets an investor's comprehensive needs. Items assessed may include:

- Trading platform and mobile app quality

- Research offering quality

- Broad access to ETFs and mutual funds

FAQs

-

Most online brokers don't charge commissions for online stock trades. However, there may be commissions for other types of investments like mutual funds and options, and brokers have their own fee schedules for various other services. The best pick for you depends on what services and investments you anticipate using the most.

-

Thanks to zero-commission online stock trading and many brokerage firms offering fractional shares, it's easier than ever to diversify your investments. If your goal is to create a diverse portfolio of individual stocks without a large upfront capital commitment, be sure the broker you choose has both of these features.

-

Yes. If your account is with a brokerage firm that is a member of the Securities Investor Protection Corporation (SIPC), cash and securities in your account are protected from loss due to broker failure, up to $500,000 ($250,000 for cash). However, your money is not insured against losses that result from declines in value of the investments in your account.

-

This depends on your goals. If you simply want the best platform to buy and sell stocks, a standard (taxable) brokerage account could be the best choice for you. If you want to save for retirement and/or reduce your taxes, a retirement account like a traditional or Roth IRA might be better. There are other specialized brokerage account types as well, and you can usually find a list of the types offered on your broker's website.

-

There's no broker that is inherently safer than all the rest, but there are some important things to look for. First, make sure that your broker is covered by SIPC protection, which insures the cash and securities in your account in the event of a broker's failure. Second, make sure that your broker has a fraud protection guarantee, which will make you whole in the event that someone hacks into your account and makes unauthorized trades or withdrawals.

Expert Opinions

Irena Vodenska, Ph.D., CFA

Professor of Finance, Director, Finance Programs, Administrative Sciences Department, Metropolitan College, Affiliate Faculty Global Development Policy Center

What advice do you have for a first-time investor?

First-time investors could be very different, so a single piece of advice is probably not appropriate for all of them. If we assume that the first-time investor is a young professional, for example, in their first job right after school, they have a long investing horizon in front of them. Hence, they could be more aggressive in selecting a portfolio, mainly comprising domestic (U.S.), or even international equity. These young investors are in their savings part of the investment horizon and do not require short-term liquidity so that they can afford riskier investments, at least with a portion of their portfolio. Another consideration is the level of the risk-averseness for these first-time investors. Even if they have a long-term investing horizon and low liquidity requirements, first-time investors may opt for safer investments if they are very risk-averse. In that case, instead of equity (stocks), fixed income securities (bonds) will be more appropriate.

What is a common misconception about investing?

Investing is an individual choice. One of the common misconceptions about investing is that investments always have positive returns, i.e., if you invest, you will earn money at all times. This belief might be true on average, measured as a cumulative return over many years. However, the performance of an investment portfolio could be volatile, i.e., experiencing both negative and positive returns periodically. Another misconception about investing is that anyone who invests in financial markets will become rich quickly. While this might happen, it is not the norm but rather an exception. A third misconception could be that investing is trading, which is not the case. One can think of trading as short or very short-term investing; however, investing, per se, implies a long or a very long-term holding of the purchased securities, accompanied by a low-frequency rebalancing of the portfolio.

How can investors feel more confident when choosing a brokerage?

Excellent question. Investors should consider very carefully whom they will be choosing to trust with their investment decisions. There is a distinction between a brokerage and an investment advisory firm. Brokers engage in the business of effecting transactions in securities for the account of others, for which they receive compensation. When brokers recommend securities to their clients, they must ensure that the investment is "suitable" for the client. On the other hand, investment advisors advise others about investing in securities and receive compensation for the advice. When investment advisers recommend an investment to their clients, the investment needs to be in "the best interest" of the client. These differences are essential and create two different standards of conduct: 1) Suitability for brokers and, 2) Fiduciary ("best interest of the customer") for investment advisers. Investors should know the difference, and before entrusting their investments to securities professionals, they should ask whether they are a "fiduciary"? Investors can be confident if the answer is "Yes, I am a fiduciary."

Reena Aggarwal, Ph.D.

Director, Center for Financial Markets and Policy at Georgetown University

What advice do you have for a first-time investor?

One should start investing as early as possible, even if it is with a small amount of money. The magic of compounding is real and in the long run even this small amount can grow into a large amount. You should consider how much risk you are willing to take, and risk-taking also depends on the stage of your life cycle. Generally, young investors can afford to take more risk than retired people who are counting on their savings during retirement.

What is a common misconception about investing?

A common misconception is that I can beat the market and make a quick buck. It is rare for anyone to beat the market on a consistent basis. Markets don't always keep going up; you should consider the implications of both bull and bear markets on your portfolio. It is a good idea not to put all your eggs in one basket and instead have a diversified portfolio.

What are some investing trends that new investors should be aware of?

Retail investors have become more active participants in the financial markets, particularly during COVID. There has been a lot of interest around platforms for retail investors, allocation of IPOs, and popularity of products such as special purpose acquisition companies (SPACs) and crypto products. It is important to do your due diligence before investing in any asset. Regulatory agencies such as the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) provide useful alerts and bulletins that are worth checking.

Our Brokerages Experts

Brokerages we evaluated for consideration on this page: Acorns, Ally Invest, Axos Self-Directed Trading, Betterment, Cash App Investing, Charles Schwab, Delphia, Domain Money, Ellevest, Empower, eToro Brokerage, E*TRADE Core Portfolios, E*TRADE, Fidelity, Fidelity Cash Management, Fidelity Go®, Firstrade, FOREX.com, Interactive Brokers, J.P. Morgan Self-Directed Investing, M1 Finance, Magnifi, Marcus Invest, Merrill Edge® Self-Directed, moomoo, NinjaTrader, Personal Capital, Plynk, Prosperi Academy, Public, Robinhood, Rocket Dollar, Schwab Intelligent Portfolios, SoFi Active Investing, SoFi Automated Investing, Stash, Stockpile, Tastytrade, Titan, Tornado App, TradeStation, Tradier, Vanguard, Vanguard Digital Advisor®, Wealthfront, Webull, Zacks Trade.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Vanguard disclosures

Visit vanguard.com to obtain a prospectus or, if available, a summary prospectus, for Vanguard and non-Vanguard funds offered through Vanguard Brokerage Services. The prospectus contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

Options are a leveraged investment and are not suitable for every investor. Options involve risk, including the possibility that you could lose more money than you invest. Before buying or selling options, you must receive a copy of Characteristics and Risks of Standardized Options issued by OCC. A copy of this booklet is available at theocc.com. It may also be obtained from your broker, any exchange on which options are traded, or by contacting OCC at 125 S. Franklin Street, Suite 1200, Chicago, IL 60606 (888-678-4667 or 888-OPTIONS). The booklet contains information on options issued by OCC. It is intended for educational purposes. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. For further assistance, please call The Options Industry Council (OIC) helpline at 888-OPTIONS or visit optionseducation.org for more information. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading.

Commission-free trading of Vanguard ETFs applies to trades placed both online and by phone. All ETFs are subject to management fees and expenses; refer to each ETF's prospectus for more information. Account service fees may also apply. All ETF sales are subject to a securities transaction fee. See the HYPERLINK "https://investor.vanguard.com/investing/transaction-fees-commissions/etfs" Vanguard Brokerage Services commission and fee schedules for full details.

Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc., and are not protected by SIPC. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

Vanguard Marketing Corporation, Distributor of the Vanguard Funds

Robinhood disclosure

All investments involve risk and loss of principal is possible.

Securities are offered through Robinhood Financial LLC, member FINRA/SIPC. Cryptocurrency services are offered through an account with Robinhood Crypto, LLC (NMLS ID 1702840). Robinhood Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Cryptocurrency held through Robinhood Crypto is not FDIC insured or SIPC protected. For more information see the Robinhood Crypto Risk Disclosure.

Trades of stocks, ETFs and options are commission-free at Robinhood Financial LLC. Other fees may apply. Please see Robinhood Financial’s Fee Schedule to learn more.

Fractional shares are illiquid outside of Robinhood and are not transferable. Not all securities available through Robinhood are eligible for fractional share orders. For a complete explanation of conditions, restrictions and limitations associated with fractional shares, see the Fractional Shares section of our Customer Agreement.

Robinhood Gold is an account offering premium services available for a $5 monthly fee. Not all investors will be eligible to trade on Margin. Margin investing involves the risk of greater investment losses. Additional interest charges may apply depending on the amount of margin used. Bigger Instant Deposits are only available if your Instant Deposits status is in good standing.

Fidelity disclosure

Fractional share quantities can be entered out to 3 decimal places (.001) as long as the value of the order is at least $1.00. Dollar-based trades can be entered out to 2 decimal places (e.g. $250.00)

J.P Morgan Disclosure

INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT • NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

E*TRADE services are available just to U.S. residents.