Right now, we're experiencing a frothy stock market, home to countless well-performing companies. We're also in the middle of earnings season. This combination has resulted in a host of dividend increases, particularly over the course of the past week.

Here are three of the more notable recent dividend raises.

Johnson & Johnson (JNJ 0.30%)

This monster healthcare multinational has a tradition of raising its quarterly dividend in the early spring. It's also a dividend aristocrat -- one of a small number of stocks that have lifted their payouts at least once annually for a minimum of 25 years in a row.

The latest raise is a 7% hike to $0.75 per share.

Although Johnson & Johnson's first-quarter revenue was down by nearly 5% year over year, the company continues to grow its core pharmaceutical segment, which inched 3% higher and would have grown by 10% if not for the strengthened U.S. dollar. Diabetes medication Invokana led the way, recording $278 million in sales against Q1 2014's $94 million. Cancer treatments Imbruvica and Zytiga also saw encouraging increases.

Going forward, Johnson & Johnson has indicated that it will seek further growth through acquisitions. It likely won't have to grovel before lenders in order to fund these acquisitions; for 2014, it had free cash flow of nearly $15 billion.

Meanwhile, its dividend payout for the year was barely half that amount. Considering that, I think it's a pretty safe bet that the company will maintain its aristocrat status and continue to boost its distribution going into the forseeable future.

Johnson & Johnson's upcoming dividend is to be paid on June 9 to shareholders of record as of May 26.

Regions Financial (RF 0.94%)

True to its name, this banking group is a big regional player in its chosen battleground of the Southeast. It's pointing its quarterly dividend northwards, though, having just raised it by 20% to $0.06 per share.

Like every other major American bank, Regions Financial is not entirely the master of its own destiny as far as its dividend is concerned. The Federal Reserve must approve all capital allocation plans; it waved through Regions' without objection.

If only the bank's operations were going as swimmingly. Operating in the present low-interest-rate environment is tough for the regionals, because, unlike the big nationwide incumbents (think Bank of America or JPMorgan Chase), they typically don't have large ancillary businesses in lucrative areas like investment banking.

In its Q1, Regions saw a 26% year-over-year drop in net profit to $234 million on slightly higher revenue of almost $1.3 billion.

The bank aims to emulate its larger rivals somewhat by ramping up those higher-margin services. That's a good strategy, but it'll take some time to build out. What will have more of an impact (and almost certainly a positive one) is the rise in interest rates all of them are expecting from the Fed -- although it's anybody's guess when this might happen.

Meanwhile, the bank is profitable and, to my mind, sensibly and conservatively managed. I think it'll stay comfortably in the black and keep producing enough cash to sustain that dividend, at the very least.

Region Financial's new payout will be dispensed on July 1 to shareholders of record as of June 12.

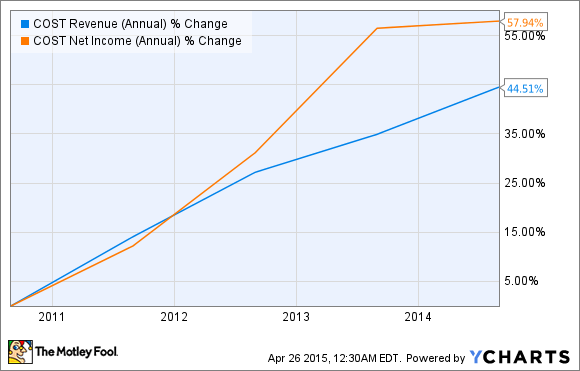

Costco Wholesale (COST 0.97%)

This popular retailer is ringing up a dividend increase of nearly 13% to $0.40 per share. Costco is a company that likes cranking up its payout; this is the latest in a series of annual raises it has made since initiating the distribution in 2004.

The company has been performing well lately. Its Q2 saw a robust year-over-year 29% increase in net profit, thanks in no small part to cheaper gas prices, which made customers more willing to motor to its stores and led to higher sales of fuel (Costco is a major gas reseller). Membership fees also saw a nice increase of 6% over that stretch of time.

If gas prices don't rebound anytime soon, those visitor numbers should hold up nicely.

Also, the company recently changed its credit card co-branding partner American Express to Visa, so it stands to bring in more customers when that partnership kicks in less than a year from now -- after all, according to recent figures, there were roughly 281 billion outstanding Visa cards, versus 55 billion for AmEx.

The retailer has always been a spendthrift in terms of its dividend. It made sizable special distributions earlier this year and in late 2012. However, much like its business operations, Costco keeps its finances nice and tight: It's consistently free cash flow positive, and it usually has little problem covering dividend payments with its own resources. I wouldn't worry too much about the future of this current payout.

Speaking of which, it'll be paid on May 15 to holders of record as of May 1.