For years, the PIMCO Total Return Fund (PTTRX 0.24%), which describes itself as "a true core bond holding," was the largest mutual fund in the U.S., peaking with almost $300 billion in net assets in 2013. It remains one of the largest mutual funds, with more than $110 billion in assets, but it has fallen from grace over the past few years, as interest rates are at historical lows and longtime fund-manager Bill Gross is no longer at the firm.

However, investing in bonds is about much more than capturing the interest payment. Not holding bonds could leave you exposed to a lot more risk than you realize. With that in mind, let's take a closer look at the PIMCO Total Return Fund and see why an investor would want to hold bonds in their portfolio -- even in today's low-yield environment.

Dismissing bonds out of hand today could lead to a hard lesson down the road about the importance of fixed-income assets in your mix.

Image source: Getty Images.

Why hold bonds?

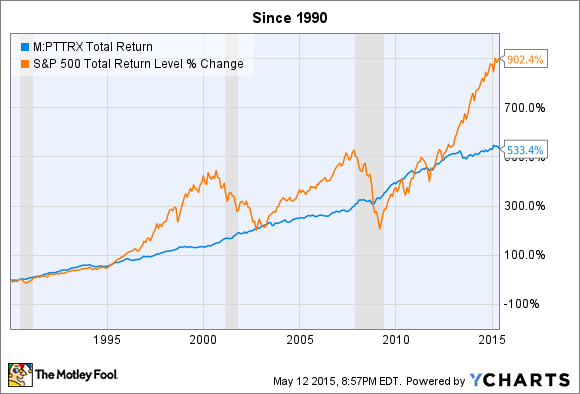

Investing in bonds is about risk mitigation as much as anything else. Using the Total Return Fund as a stand-in for bonds in general, here's a look at how bonds have performed versus the S&P 500 over the past 34 years:

As you can see, the "price" of the Total Return Fund has essentially stayed flat, while the S&P 500, a great proxy for the stock market in general, has gone up significantly. However, note that the Total Return Fund didn't significantly drop in value at any point, while the S&P 500 experienced some major slumps. You can see how much less volatile bonds are through this chart: The orange line, representing stocks, is very "spiky," while the blue line is basically flat.

But that's how bonds work. You buy a bond for a fixed price, and in return you're paid interest over a certain period, and then you get your capital back at the end of the period. The PIMCO Total Return Fund is an easy, affordable way to invest in a broad mix of bonds and other fixed-income instruments without having to do the research and pick out the separate bonds you want to buy.

But that's only part of the story, because the chart above doesn't show the value paid to you in interest, measured as dividends when you invest in a bond fund:

Stocks, over long periods of time, have historically outperformed bonds and other interest-bearing instruments, but as you can see in the total return above, there's still money to be made with bonds. But most importantly, you don't see the big short-term losses (see all the little peaks and valleys in the orange line?) that stocks can experience.

That's where bonds pay off: capital preservation.

Doesn't the current rate environment make it different now?

Those are famous last words when it comes to investing. Really, the only thing that's different today is that interest rates are at historically low levels:

To stress the point above, owning bonds is about more than just the rate of return: It's also about preserving principal, especially at stages in your investing career when you may not have another decade to recover from a stock market downturn.

Frankly, holding some mix of bonds makes sense for just about everyone. Even those of us with multiple decades to grow our portfolios can benefit from using bonds and bond funds to hold some "dry powder" in.

Is the PIMCO Total Return Fund right for you?

Under PIMCO co-founder Bill Gross, who ran the fund from inception through late 2014, the PIMCO Total Return Fund was widely considered the best way to invest in bonds. Gross has since left PIMCO, and the fund has relatively high fees due to its active management, which does not guarantee superior performance to other, cheaper alternatives.

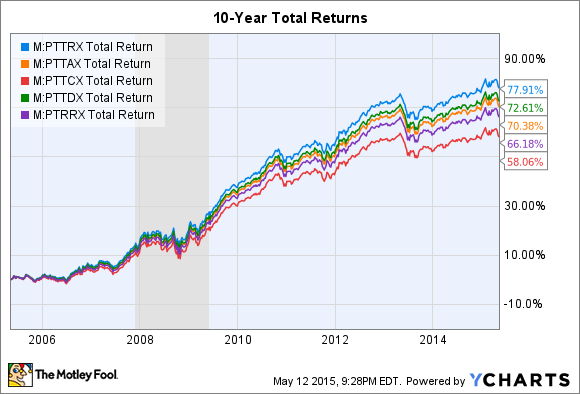

Furthermore, it depends on which kinds of shares you can buy:

The table above shows the 10-year total returns of all five different share classes of the PIMCO Total Return Fund, each with different levels of loads and expense ratios that eat into the dividends that investors hold.

The blue line represents institutional shares, which start at about $1 million in minimum investments and have an expense ratio of 0.47%. By comparison, the purple line represents "R" shares, which have higher fees and are the class you could buy in your 401(k) at work. That's a significant difference in returns, owing solely to fees.

Expenses can be game changing. The chart below compares the PIMCO Total Return Fund's institutional shares (blue); the PIMCO Total Return Fund's "R" shares (yellow); the Vanguard Total Bond Market Index Fund (VBMFX 0.21%) (red line), which is now the largest bond mutual fund; and the Vanguard Total Bond Market ETF (BND -0.66%), which is the same as the Vanguard Index fund but in low-cost ETF form, with an expense ratio of 0.07%.

The point? There's something to be said for low fees, especially when you're trying to capture your returns from dividends or interest. Add in the absence of Gross, and there's no clear indication that the PIMCO fund will remain a stellar performer going forward.

Foolish bottom line on bonds and bond funds

Fixed income and capital preservation aren't phrases you often hear around The Motley Fool, but you do need to understand the benefits of an investment that experiences almost no volatility. As you get closer to the day when you'll depend on your nest egg for income, you'll want to de-risk more of your holdings, consider how much you'll need to turn into cash in the next few years, and probably increase your portfolio's mix of bonds.

For investors still decades away from retirement, allocating a small percentage of a portfolio to bonds is a great way to continue capturing some return while also keeping some "dry powder" handy for the next market downturn.

If the PIMCO fund is all you have available to you through an employer-provided retirement program, it remains a solid choice, but the Vanguard Total Bond Market ETF, with its lower fees, strikes me as the better option going forward.