Shares of Rackspace Hosting

Is this a sell signal or a buy-in opportunity?

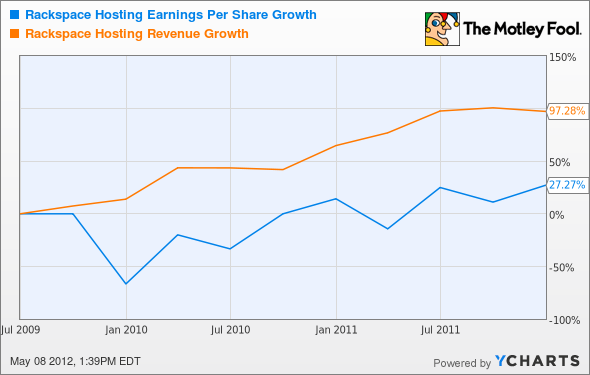

First off, I'd like you to feast your Foolish eyes on this chart:

RAX Earnings-per-share growth data by YCharts.

Rackspace is riding the cloud computing trend like a champion rodeo artist. That chart doesn't include the latest figures, where sales growth dipped due to seasonal order patterns but earnings surged anyhow. On a trailing basis, both the top and bottom lines are accelerating.

And if you listen to Rackspace's management talking about the business, you'll come away thinking that the exciting part of this S-curve growth is just starting. "The shift toward cloud computing represents a massive multi-billion-dollar revenue opportunity that Rackspace has only just begun to tap," said CEO Lanham Napier in this week's earnings call.

More specifically, Rackspace's OpenStack cloud architecture is gaining support across the computing industry. Data giant IBM

The platform is in many ways a comparable alternative to Amazon.com's

Napier admits that Rackspace might see some short-term turbulence along the way, but the path to long-term profits is wide open. "The technology industry is in the midst of a tectonic architectural shift. Massive technology disruptions like this create once-in-a-lifetime opportunities for companies to seize the moment, take the initiative and lead the revolution," he said. "Our goal is to lead the revolution."

Skeptics would pin a "spin" sticker on that kind of big talk, but Rackspace walks the walk. So yeah, shares dropping back to January prices created a buy-in opportunity this week. You can quote me on that because I have a very profitable thumbs-up CAPScall riding on Rackspace. If I didn't, I'd start one today.

This isn't your grandfather's computer industry. Technology is evolving quickly and cloud computing is far from the only game-changing megatrend today. In a special report penned by the Fool's finest analysts, you'll learn about the only stock you need to profit from the new technology revolution in big data and business intelligence. The report is totally free but it won't be available much longer, so get your copy right away.