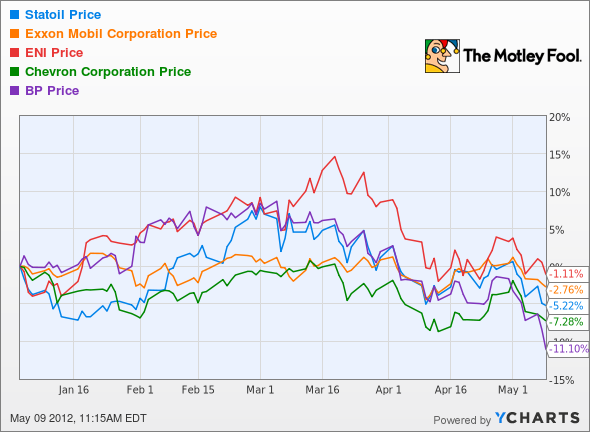

This year has not been especially kind to Big Oil shareholders. In fact, not one oil major has generated a positive return year to date. Battling disappointing earnings, gas leaks, and ongoing legal troubles, many of our favorite energy giants are stuck in the mud right now. However, one company that I think is poised to bounce back sooner rather than later, and not just because I own it, is Norway's Statoil

When compared with peers ExxonMobil

Though it is down about 6% on the year, Statoil reported a strong first quarter yesterday, and recent deals and discoveries are giving many investors reason enough to remain bullish.

Earnings

Increased production and high oil and gas prices resulted in a successful first quarter for Statoil. Production increased by 11% over last year, and quarterly adjusted earnings of about $10.2 billion set a new Statoil record for one quarter.

The company completed 12 exploration wells in the first quarter and announced three important offshore oil discoveries in Norway, Tanzania, and Brazil. The recent finds continue the exploration success from last year, as Statoil adds much-needed resources to its reserve base.

Russian partnerships

Statoil recently signed a deal with Russia's state-owned Rosneft to explore the frigid waters of the Russian Arctic. The agreement is very similar to other "I'll show you mine if you show me yours" type deals that Rosneft has also inked with ExxonMobil and Eni.

Under the terms of the deal, Statoil and Rosneft will team up to explore the Russian side of the Barents Sea, as well as the Sea of Okhotsk. The estimated recoverable resources from the combined projects are about 15 billion barrels of oil. Rosneft will also join Statoil on projects in the Norwegian side of the Barents Sea, Siberia, and the Stavropol shale oil play in southern Russia.

Statoil is also in the middle of a postponed project with Gazprom, Russia's other state-owned energy company. The two companies, along with France's Total

Foolish takeaway

Though the price of oil has been falling recently, the global price per barrel still sits over $100, meaning developing these complicated offshore assets is still feasible for Statoil and the rest of the international majors. Check out this free report for the background on three more stocks that thrive when oil is priced higher than $100 barrel.