Shares of Take-Two Interactive

How it got here

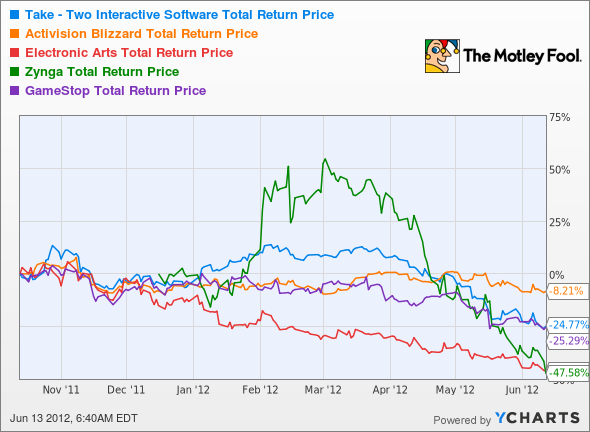

Let's face it, this hasn't been a great year for game makers and publishers. Few have remained in the black for the past 52 weeks, with the exception of Activision Blizzard

TTWO Total Return Price data by YCharts

Take-Two's felt the pain of delays for top-tier franchises Grand Theft Auto and BioShock. It probably hasn't helped that the company's latest Max Payne release had a head-to-head, launch-day battle with Diablo III, either. Over the past year, revenue, net income, and free cash flow have all taken a dive, and the company's outlook remains muted.

What you need to know

The industry has seen its share of ups and downs, with companies swinging wildly between profit and loss. Electronic Arts, for example, only recently returned to positive earnings territory after years of losses, thanks in part to the blockbuster performance of its Star Wars MMO. Take-Two sits in the red today after posting one of its worst quarterly losses in years.

|

Company |

Forward P/E Ratio |

Price to Sales |

Price to Free Cash Flow |

Gross Margin (TTM) |

|---|---|---|---|---|

| Take-Two | 8.9 | 1.1 | NM | 36.0% |

| Activision Blizzard | 10.9 | 3.0 | 14.7 | 63.0% |

| Electronic Arts | 9.9 | 1.0 | 39.0 | 70.8% |

| Zynga | 13.5 | 1.5 | 24.3 | 71.1% |

|

GameStop |

5.6 | 0.3 | 5.6 | 28.1% |

Source: Morningstar. NM = not material due to negative earnings.

Take-Two hasn't had a streak of two consecutive years with net income since 2004-2005, and unless Grand Theft Auto miraculously makes a 2012 release date it may not happen until 2014 at the earliest. Free cash flow doesn't look much better -- Take-Two has a five-quarter streak of negative results on that front, which is worse than much-loathed Zynga and its consistent streak of positive cash flow. Its gross margins are rather puny for the software industry as well, more closely resembling bricks-and-mortar retailer GameStop than its fellow developers.

What's next?

Where does Take-Two go from here? That will depend on how quickly they can put out blockbuster releases, and also on whether or not the public is as excited about those releases as they have been in years past. There's also another possibility, perhaps remote: a big buyout.

Fellow Fool Rick Munarriz thinks this smaller fish in the big video games pond might be a good buyout target for Activision or for Electronic Arts, the latter of which has made overtures in the past. Joining with a larger publisher might give Take-Two the resources it needs to publish big titles on a faster timeline. That would certainly be helpful to GameStop, which has seen key metrics flatten out in the absence of more huge physical-media releases like Grand Theft Auto.

The Motley Fool's CAPS community has given Take-Two a coveted five-star rating. An impressive 93% of CAPS All-Stars expect the stock to outperform the market in the future, and every single Wall Street analyst tracked on CAPS concurs with them. Our CAPS players are quite excited about the next Grand Theft Auto, whenever it might arrive.

Interested in tracking this stock as it continues on its path? Add Take-Two to your Watchlist now for all the news we Fools can find, delivered to your inbox as it happens.

Some companies are poised for success no matter which game developer comes out on top. They're the ones powering gaming hardware on millions of consoles, desktops, and mobile devices. Find out which company has the inside track to win in "The Next Trillion Dollar Revolution," The Motley Fool's popular free report on the future of technology. Click here to get your copy of this important report today.