So far, 2012 has already been quite a historic year for Apple

The software giant topped out around $613 billion in December 1999 amid the height of the tech bubble, sporting a price-to-earnings ratio of 72.6. That's much pricier than the 14 times earnings Apple trades at today. Conglomerate General Electric

Banking on net income

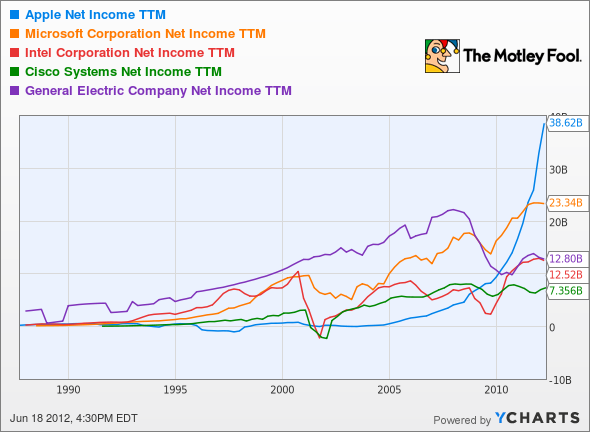

More importantly than market-cap figures that are influenced by fickle investors and active traders, Cupertino might even set a new record in stock market history this year with something investors can actually bank on: net income. Topeka Capital Markets analyst Brian White, a rather vocal Apple bull with a $1,111 price target, came out with a research note predicting that Apple's projected net income in calendar 2012 could make it the "most profitable company ever."

Ever.

White is the same analyst who said in May that Apple could easily become a multitrillion-dollar company, and he echoed that sentiment this week: "We believe investors should think of Apple's market cap potential in terms of trillions, not billions." The $500 billion market cap threshold seems to be a psychological barrier for many investors, questioning whether the massive company can continue to grow with sustained earnings momentum.

Party like it's 1999

He also compares Apple with numerous other companies whose valuations had approached these levels, including Microsoft, GE, Intel

Other than Exxon, these companies had rather lofty multiples when they peaked, a potential indication that their valuations weren't sustainable. In addition, they had "monopoly-like market share positions" at the time. Microsoft owned more than 90% of the PC operating system market when it maxed out, Cisco claimed in excess of 70% share of networking, and Intel occupied north of 80% of the processor market.

Apple represented just 4.7% of the PC market in the first quarter, and 8.8% of the mobile-phone market, although in fairness it dominates the burgeoning tablet market with an estimated 68% market share. White found very few similarities between Apple and the other tech giants when they peaked.

Dollars and sense

White's forecast for calendar 2012 calls for $46.2 billion in profit. Microsoft actually also saw its most profitable trailing-12-month sales last September of $23.5 billion.

AAPL Net Income TTM data by YCharts

The rest of these stalwarts' bottom lines combined doesn't even equal Apple's.

White also points out that Apple is cheaper than the S&P 500, which is something I've pointed out before. At the same time, it's grown earnings per share by 86% each year for the past seven years and is expected to similarly put up around 71% earnings growth in 2012.

It's different this time

Here's something else to consider for additional perspective if Apple achieves this feat. The company inherently doesn't make things that consumers need. It's not like oil baron Exxon, which you more or less have to visit once a week to get your gas fix. It doesn't have near monopolies in most of its markets. It's not dominating a market driven by IT managers with deep corporate pockets.

Almost all PCs in the '90s ran Windows powered by Intel chips, and today Google Android sits on more than half of all smartphones sold in the world. Even in the budding tablet market, Apple's hegemony isn't for lack of choice. There are plenty of alternatives out there, with dozens jumping in each quarter to challenge the single model that Apple releases each year.

Apple is a consumer-electronics company in a market with buyers mostly making discretionary purchases. Buyers of Apple products certainly have plenty of options, yet they choose to pay premium prices for higher-end products.

Mission accomplished, Mr. Jobs.

The real question you have to ask yourself right now is: Should I buy or sell Apple? If you're a believer that Apple will cross a trillion-dollar market cap, then the answer is easy. However, there are still some risks to keep an eye on that could threaten Apple's ascent, and we've laid it all out for you right here. This special report discusses some heavyweights with sustainable business models that give it back to shareholders. And the report is absolutely free.