Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking: Dividend payments have made up about 40% of the market's average annual return from 1936 to the present day. But few of us can invest in every single dividend-paying stock on the market, and even if we could, we might find better gains by being selective. That's why we'll be pitting two of the Dow Jones Industrial Average's (^DJI -0.11%) dividend payers against each other today to find out which is the true dividend champion. Let's take a closer look at our two contenders now.

Tale of the tape

Boeing (BA -2.87%) is a 26-year veteran of the Dow. The Seattle-based aviation kingpin is always in contention to be both the world's largest aircraft-manufacturer -- it might overtake Airbus this year -- and the world's largest defense contractor, although it's more often the silver medalist in both categories. Frequent fliers around the world are intimately familiar with Boeing's work, as are many thousands of air force troops in many nations' militaries. This integral position in two critical parts of the global economy (military spending is part of the global economy, after all) makes Boeing's dividend one you can expect to hold up over the long haul.

Caterpillar (CAT 0.07%) is to construction and extraction industries as Boeing is to aviation. This 22-year Dow veteran hails from the American heartland town of Peoria, Ill. It's the self-proclaimed world leader in construction and mining equipment, and it's also the world's leading manufacturer of diesel engines and locomotives, as well as natural-gas turbines and engines. While competition is a bit fiercer here than it is in large-body commercial aviation or cutting-edge military hardware, Caterpillar's market dominance should also provide a stable basis for long-term dividend payouts.

|

Statistic |

Boeing |

Caterpillar |

|---|---|---|

|

Market cap |

$76.2 billion |

$56.9 billion |

|

P/E ratio |

18.7 |

11.7 |

|

TTM profit margin |

5% |

7.9% |

|

TTM free-cash-flow margin* |

6.6% |

1.9% |

|

Five-year total return |

40.4% |

21.3% |

Source: Morningstar and YCharts. TTM = trailing-12-month.

*Free-cash-flow margin is free cash flow divided by revenue for the trailing 12 months.

Caterpillar has profit margins and valuation on its side, but Boeing has growth and a stronger rate of free cash flow, which is important to dividend payouts. Let's see which company really deserves the dividend crown today.

Round one: endurance

Boeing has been paying annual dividends since 1942 and quarterly dividends since 1954 for an annual streak of 71 years. Caterpillar had been paying dividends since at least the 1950s as well, but it ceased payments at the end of the 1960s for more than a decade; its streak only begins in 1982. This one goes to Boeing.

Winner: Boeing, 1-0

Round two: stability

Paying dividends is all well and good, but how long have our two companies been increasing their dividends? The same dividend payout year after year can quickly fall behind a rising market, and there's no better sign of a company's financial stability than a rising payout in a weak market (so long as it's sustainable, of course). Boeing last cut its payouts in 1970, around the same time Caterpillar ceased paying dividends entirely, and the quarterly payment has grown since 1974. However, Caterpillar last cut its dividend in 1992, which puts it at a disadvantage once again

Winner: Boeing, 2-0

Round three: power

It's not that hard to commit to paying back shareholders, but are these payments enticing or merely token? Let's take a look at how both companies have maintained their dividend yields over time as their businesses and share prices grow:

BA Dividend Yield data by YCharts.

After the financial crisis spike, both companies settled into a similar groove -- but until recently, Caterpillar trailed its highflying foe. Although the tables are now turned, it's too early to throw this one into Caterpillar's corner, so we'll have to call it a...

TIE: 2-0, Boeing

Round four: strength

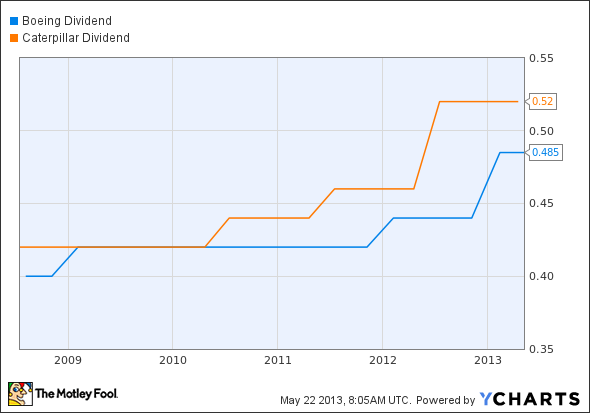

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts over the past five years. If you bought in several years ago and the company has grown its payout substantially, your real yield will likely look much better than what's shown above.

BA Dividend data by YCharts.

Caterpillar's recent surge brings it into the lead against Boeing.

Winner: Caterpillar, 1-2

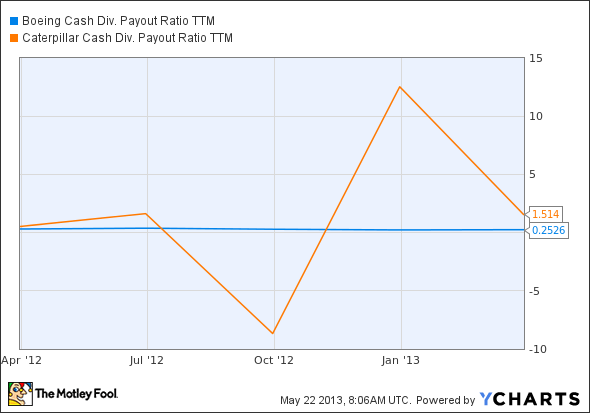

Round five: flexibility

A company -- even one so well-positioned as Boeing or Caterpillar -- needs to manage its cash wisely to ensure that there's enough available for tough times. Paying out too much of free cash flow in dividends could be a warning sign that the dividend is at risk, particularly if business weakens. This next metric analyzes just how much of their free cash flows our two companies have paid out in dividends over the past four quarters:

BA Cash Div. Payout Ratio TTM data by YCharts.

Caterpillar's all over the place! This wild fluctuation is out of character for Caterpillar, which until recently was often neck and neck with Boeing in free-cash-flow payouts. Unfortunately, that recent yo-yo action reflects poorly on Caterpillar, which means Boeing takes this round -- and the win.

Winner: Boeing, 3-1

Do you think the aircraft builder is really the better dividend bet, or does Caterpillar have a stronger claim? No matter which stock you choose, you're likely to be rewarded with years of stable payouts -- but with limited resources, it's important to buy the best stocks possible.