Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

A better-than-expected survey on conditions in the services sector was not enough to pull the markets higher today. As of 1:20 p.m. EDT the Dow Jones Industrial Average (^DJI 0.69%) is down 64 points, or 0.41%, to 15,594. The S&P 500 (^GSPC 1.20%) is down 0.27% to 1,705.

There was just one U.S. economic release today.

|

Report |

Period |

Results |

Previous |

|---|---|---|---|

|

Non-Manufacturing ISM Report |

July |

56% |

52.2% |

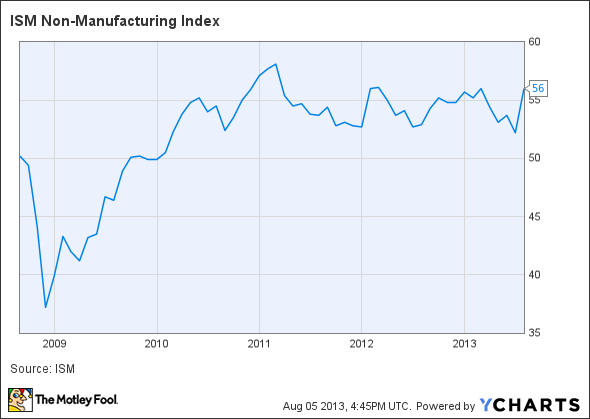

The Institute for Supply Management reported its nonmanufacturing purchasing managers' index today. The survey showed that more respondents believe the economy is growing than did in July. This is the 43rd consecutive month in which the index showed an expanding services sector.

ISM Non-Manufacturing Index data by YCharts.

Also expanding at a faster rate are production, new orders, and prices. The survey showed that employment and inventory are both expected to grow but at a slower rate than in June. For future demand, the survey respondents reported seeing backlogs contracting in July following growth in June.

Source: Institute for Supply Management.

While the economy continues its slow growth, the market is down today as investors pay less for stocks today than they did on Friday.

Today's Dow leader

There's one Dow stock today for which investors are paying 1.4% more than they were on Friday: Today's Dow leader, UnitedHealth (UNH -1.03%). UnitedHealth's business differs from other Dow stocks' in that its results are dependent on government policy -- particularly Obamacare -- rather than on the growth of the economy. This could be seen two weeks ago when UnitedHealth reported better-than-expected earnings. The health care giant reported earnings of $1.40 per share, a 10% increase year over year. The company expects full-year earnings of $5.35 to $5.50 per share.