Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Ford (F 6.10%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

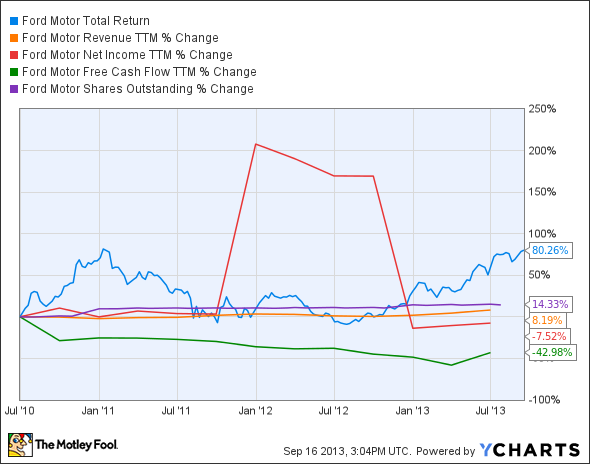

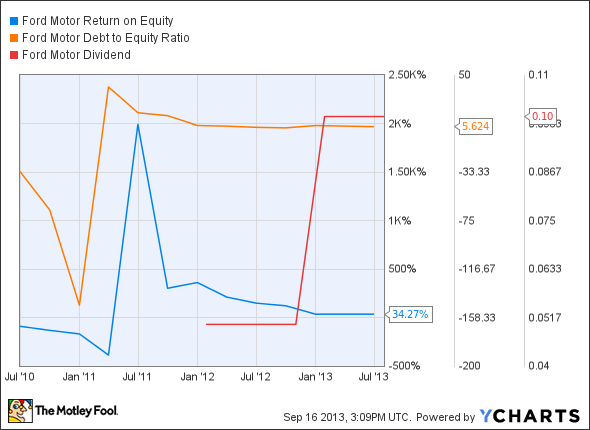

The graphs you're about to see tell Ford's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt-to-equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Ford's key statistics:

F Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

8.2% |

Fail |

|

Improving profit margin |

(14.5%) |

Fail |

|

Free cash flow growth > Net income growth |

(43%) vs. (7.5%) |

Fail |

|

Improving EPS |

(8.6%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

80.3% vs. (8.6%) |

Fail |

Source: YCharts. * Period begins at end of Q2 2010.

F Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

133.7% |

Pass |

|

Declining debt to equity |

117.1% |

Fail |

|

Dividend growth > 25% |

Reinstated in 2012 |

Pass |

|

Free cash flow payout ratio < 50% |

16% |

Pass |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Ford's earned a lot of plaudits during the recovery, but over the past few years, its fundamentals seem to have lagged public sentiment. The company's shares have made an impressive comeback from the financial crisis, but neither its free cash flow nor its net income has advanced at all in the past three years, and revenue growth has been modest at best. How might Ford bring its fundamentals back in line with its soaring shares? Let's dig a little deeper.

The auto-sales market in the US and China has been recovering rapidly, and a number of automakers such as Ford, Toyota (TM 0.69%), and General Motors (GM 1.98%) seem set to capitalize on this trend. My fellow Fool Patrick Morris notes that car sales in the U.S. have jumped abruptly during the year, outpacing 2009's stimulus-boosted sales after just eight months.

Ford's Fusion is one of the best-performing vehicles; its sales increased 13.4% through August, competing in the fuel-efficient segment long dominated by Japanese rivals Toyota and Honda (HMC 1.20%). Demand is so high that the Fusion sells three times faster than the industry average, giving consumers no room to negotiate better deals. That's not something often seen in the mid-market car segment, but is the Fusion alone enough to propel Ford's fundamentals?

Car manufacturers have been investing heavily to take advantage of enormous opportunities in China. Both Ford and GM have scaled up their operations in the region, as Chinese automobile sales spiked 11% last month. In addition, Ford's small cars have also received an overwhelming response in European markets, with market share up by 50 basis points to 7% despite an overall market decline of 5.7%.

My fellow Fool Matthew DiLallo notes that Ford has been facing strong hybrid car competition from Honda, after the Ford C-Max hybrid failed to deliver on its promised fuel economy. Honda's Accord Hybrid for 2014 delivers an EPA-certified rating of 50 mpg in city driving, compared to 47 mpg and 43 mpg of Ford's Fusion Hybrid and Toyota's Camry Hybrid, respectively.

However, Toyota's Prius hatchback still outperforms these other hybrid cars, delivering an EPA-certified 51 mpg city rating. Though these hybrid cars offer fuel economies of around 50 mpg, it won't be a cakewalk for car manufacturers to meet the government's future CAFE standards, which demand a fleet average of 54.5 mpg by 2025.

On the other side of the fuel-economy coin, Ford's high-performance F-150 SVT Raptor truck sales are also up 14% for the year, and with only a 15-day supply. Fool contributor Daniel Miller points out that the Raptor has been able to steal back some market share from GM's Silverado and Sierra, and the truck is well-positioned to continue driving greater sales over the next few quarters.

Taken all together, Ford's initiatives appear to point toward fundamental improvement in the near future, but none of these trends are unique to the past few quarters. If Ford's positive momentum doesn't translate into stronger fundamentals over the coming year, shareholders might find their gains stuck in neutral.

Putting the pieces together

Today, Ford has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.