Imagine life without household brands like Huggies, Pull-Ups, Depend, Kleenex, Scott, and Cottenelle. Yeah ... not fun. Of course, other companies make similar products, but those companies haven't marketed their products as effectively as Kimberly-Clark (KMB 1.28%).

European strategic changes

Like most international companies throughout all industries, Kimberly-Clark hasn't been having a grand ole time in Europe over the past several years, especially in Western and Central Europe. Austerity measures have led to a weak consumer, which has affected Kimberly-Clark's performance.

However, Kimberly-Clark has been around since 1872. During that time, it has managed to navigate its way through many difficult economic environments and world events, including the 1896 Depression, The Great Depression, WWI, WWII, The Great Recession, and more. Therefore, while European austerity might slow things down for Kimberly-Clark temporarily, you should consider putting your trust in a company with such a strong and resilient history. Kimberly-Clark must now navigate through a weak consumer environment. And as far as Europe goes, it has implemented its "European Strategic Changes" strategy.

This focused strategy was implemented in Q2 2012, and it's expected to be completed by December 2014. During this time, Kimberly-Clark will reduce its headcount by 1,300-1,500 people. This is bad news for employees, but it's good news for investors. Labor is the biggest expense, and reducing headcount has the potential to significantly improve the bottom line, which pleases investors.

Also as a part of this strategy, Kimberly-Clark will close or sell five of its European manufacturing facilities and streamline its operations. Furthermore, Kimberly-Clark will focus more on stronger growth opportunities and divest its low-margin operations, especially in consumer tissue. Finally, aside from Italy, Kimberly-Clark will exit diapers in Western Europe and Central Europe.

As a separate strategy, as well as a way to keep investors happy, Kimberly-Clark plans to repurchase $1.2 billion worth of stock in 2013. This is in addition to Kimberly-Clark currently yielding 3.5%.

Recent results

Since Kimberly-Clark is in the midst of its "European Strategic Changes" strategy, let's see if any progress is being made.

In the second quarter, net sales came in at $5.3 billion, which matched the year-ago quarter. Selling prices increased, but unfavorable currency effects offset this trend.

Below is a quick look at net sales growth for each segment on a year-over-year basis:

- Personal care: down 1% (but organic sales volume up 3%)

- Consumer tissue: up 2.3%

- K-C professional: up 0.2%

- Healthcare: Down: 2.4%

On a geographical basis:

- North America: down 1.5%

- International: up 0.7%

Considering such mixed results, it can be difficult to paint a clear picture. That's why guidance is important. Kimberly-Clark expects FY 2013 volume, price and mix growth of 3%-5%, mostly led by international operations.

More products you find in your home

Kimberly-Clark has been a hands-down winner over the long haul, but we must also consider some peers so we can increase our chances of making the best possible investment decision.

For instance, the following brand names are also well known: Schick, Edge, Banana Boat, Hawaiian Tropic, Wet Ones, Playtex, and Diaper Genie. These all fall under Energizer (ENR -0.66%). Of course, Energizer also sells batteries. And we must also include a company that sells Listerine, Reach, Band-Aid, Neosporin, Tylenol, and Motrin, which is Johnson & Johnson (JNJ -0.69%).

Kimberly-Clark, Energizer, and Johnson & Johnson all offer similar valuations, trading at 16, 13, and 15 times forward earnings, respectively. However, there are some differences in key metrics.

|

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio |

Short Position | |

|---|---|---|---|---|---|

|

Kimberly-Clark |

8.71% |

37.00% |

3.50% |

1.55 |

2.30% |

|

Energizer |

9.22% |

18.71% |

2.10% |

1.05 |

N/A |

|

Johnson & Johnson |

18.38% |

19.26% |

3.00% |

0.22 |

0.90% |

Kimberly-Clark turns the highest percentage of your investor dollars into profit (ROE), and it offers the highest yield. On the other hand, Johnson & Johnson turns the most revenue into profit (net margin), it offers a strong yield, it has displayed better debt management, and it has fewer people betting against it.

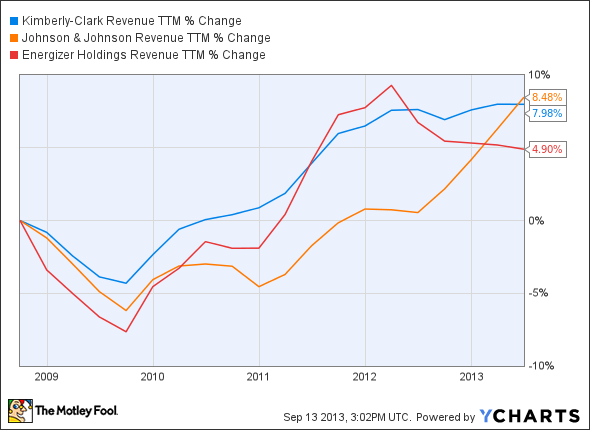

Kimberly-Clark and Johnson & Johnson have shown more revenue growth than Energizer over the past five years.

Kimberly-Clark revenue (trailing-12 months) data by YCharts

All three of these companies are likely to be long-term winners. However, Kimberly-Clark and Johnson & Johnson look to be slightly more impressive than Energizer at this point in time, with Johnson & Johnson being the most impressive of the bunch. In addition to Johnson & Johnson's strong fundamentals, it's also highly diversified, with operations in Consumer, Pharmaceutical, and Medical Devices and Diagnostics.

The Foolish bottom line

The praise above for Johnson & Johnson isn't meant to take anything away from Kimberly-Clark. This is an extremely well-run company that has thrived during good times and shown resiliency during difficult times. Kimberly-Clark has a targeted strategy to improve weak areas, and if the stock suffers at any point, it's only likely to be a matter of time before it rebounds. These dips should give investors an opportunity to purchase more shares. Best of all, you will also be collecting generous dividend payments in the meantime.