Many retailers have shown top-line growth recently, but unfortunately for Foolish investors, this is only because these retailers expanded their store count in most cases. When you look at comps (sales comparisons for stores open at least one year), most retailers are seeing negative trends. However, there are several outliers to this trend, one of which is Gap (GPS 0.87%).

Impressive comps

Prior to covering same-store comps, it should be noted that the Gap's net sales increased 8% to $3.9 billion in the second quarter year over year. If you exclude the foreign exchange impact, mostly due to the Japanese yen vs. the dollar, then net sales improved by an even more impressive 10% for the quarter. That said, store count increased 4.8%. This is why comps is the most important number in retail -- new store openings don't skew the results.

Comps grew at a 5% clip, higher than the 4% growth seen in the year-ago quarter. It's very rare to find comps growth in retail right now. For instance, in the second quarter, Macy's saw comps decline 0.8%, and American Eagle (NYSE: AEO) suffered a steeper 8% slide. That being the case, Gap's comps are impressive on a relative basis.

Let's breakdown comps by segment year-over-year:

- Gap Global: up 6%

- Old Navy Global: up 6%

- Banana Republic: down 1%

Those are strong numbers, and Gap is looking to open more stores in Asia, with a focus on Gap China and Old Navy Japan in order to match geographic consumer demands.

Also keep in mind that Gap is being aggressive with its newer brands, Athleta (women's yoga clothing, swimwear, and running attire), Intermix (women's fashion boutique), and Piperlime (online shoe shop). Therefore, growth potential won't just come from geographic expansion from existing brands but also the marketing of new brands.

The company's growth initiatives include expanding its global outlet presence, opening franchise stores worldwide, and opening more Athleta stores. The latter will make it a direct competitor to Lululemon Athletica (LULU 0.84%), one of the great retail success stories in recent years.

The Gap is optimistic about its future, raising its FY 2013 diluted earnings-per-share outlook to $2.57-$2.65 from $2.52-$2.60. It also intends to increase its dividend from $0.60 to $0.80 in the third quarter. Furthermore, Gap has a strong history of buying back shares. This trend should continue. Considering the company's fiscal discipline, there would be no reason to think otherwise.

Cause for concern

August comps indicated slowing growth. Taking a one-month sample isn't often a good idea, but it at least leads to a reason for some caution. While comps growth was positive, the pace of growth has slowed:

- Gap Global: up 2% vs. up 6% in August 2012

- Old Navy Global: up 2% vs. up 8% in August 2012

- Banana Republic: up 1% vs. up 12% in August 2012

Considering the company's growth potential, this shouldn't be overly concerning, but it should be noted.

Bizarre and fading competition

If you're considering Gap as an investment, then you might also be considering two of its peers. Gap is an established company with strong brands to its name. Another option, not nearly as established, is Lululemon Athletica which is a new and exciting company with stellar growth thus far, but it's also a bizarre story. Not only did CEO Christine Day suddenly announce she would be leaving, but there have been product missteps (including see-through yoga pants), and a fake job ad for CEO on the company's website and Facebook page.

Another potential headwind is Gap's Athleta brand. Considering Gap's deeper pockets and stronger marketing power, this could lead to Gap stealing market share from Lululemon.

As far as fading goes, this pertains to America Eagle Outfitters. However, the brand is only temporarily fading. Teen demand for apparel has declined, partially because teens are finding it difficult to land a job. This has led to American Eagle lowering its Q3 EPS guidance to $0.14-$0.16. The teen apparel market has become extremely promotional, which cuts into margins and then earnings. It's a challenging environment that's not likely to ease anytime soon. This is no fault of American Eagle, which should eventually bounce back. But that time doesn't look to be now.

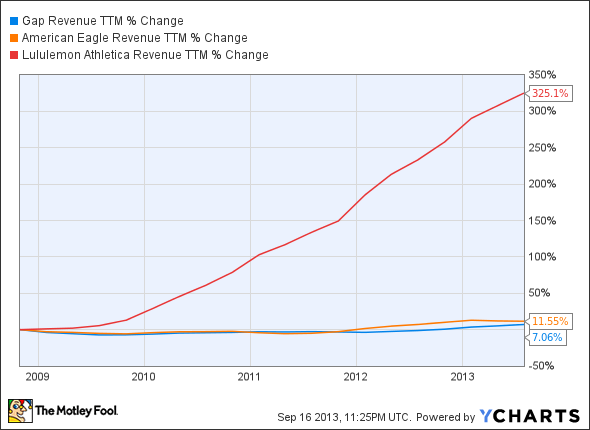

Let's take a look at top-line growth over the past five years for these companies:

GPS Revenue TTM data by YCharts

Lululemon is by far the most impressive in this regard, but this should be expected since it's the youngest, and it certainly comes with risks.

The bottom line

If you want high-growth potential and you don't mind significant risks, consider Lululemon over Gap. If you're looking to invest in a well-established company with strong brands, significant marketing power, and growth potential via geographic expansion and new brands, consider Gap.