You might not have noticed, but Orbitz Worldwide's (NYSE: OWW) stock has appreciated 273% year to date. This astronomical ascent might make you think that the company's underlying business is stellar, and that Orbitz is likely to outperform its peers in the coming years. However, Orbitz is facing fierce competition, and one (or even two) of those peers might present a better investment opportunity.

Industry trends

Orbitz recently stated that it was concerned about high unemployment rates in many countries, and that this has led to consumer spending pressure. On the other hand, Internet usage continues to climb, which is a long-term positive for online travel companies like Orbitz.

According to PhoCusWright, a travel and tourism research firm, the online travel booking penetration rates per listed region below still leave a lot of room for growth:

- United States: 60%

- Europe: 40%

- Asia Pacific: 25%

This should be great news for Orbitz, and it potentially is, but competition has increased over the past several years.

Competition from all angles

Orbitz must deal with competition from Expedia (EXPE 0.23%), Priceline.com (BKNG -0.51%), the ever-powerful Google (showing an increased interest in online travel), as well as airlines and hotels focusing more on distributing their products and services on their own websites.

The big problem for Orbitz is that its pockets aren't nearly as deep as the companies listed above. For instance, Orbitz has a market cap of $1.10 billion, whereas Expedia and Priceline sport market caps of $7.17 billion and $50.41 billion, respectively. Furthermore, Orbitz has $22.74 million in cash and short-term equivalents compared to Expedia and Priceline at $2.27 billion and $5.95 billion. The stronger financial positions of Expedia and Priceline don't just lead to more marketing power, but the opportunity to acquire smaller companies for inorganic growth.

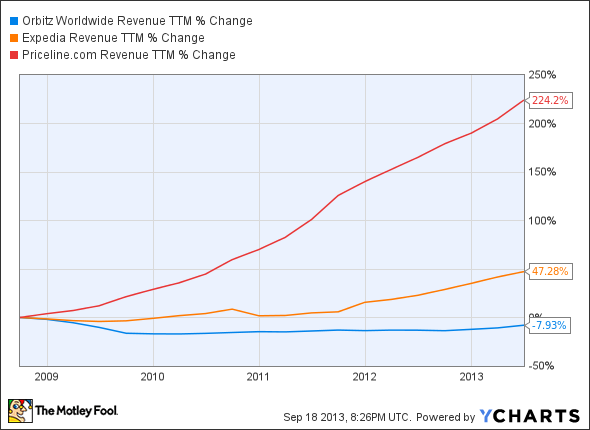

If you compare the top-line performance of Orbitz to its peers over the past five years, then you will see that Orbitz isn't the one that stands out (in a positive way):

OWW Revenue TTM data by YCharts

Earnings-per-share trends paint a similar picture:

OWW EPS Diluted TTM data by YCharts

And if you take a gander at a key metric breakdown, you will see the same company stand out yet again:

|

Forward P/E |

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|---|

|

Orbitz |

27 |

(18.74%) |

(162.29%) |

None |

0.01 |

|

Expedia |

15 |

3.31% |

5.20% |

1.20% |

0.46 |

|

Priceline |

20 |

26.65% |

35.33% |

None |

0.39 |

It's clear that Orbitz leaves a lot to be desired fundamentally. Priceline, on the other hand, is exceptional at turning revenue and investor dollars into profit, and there are no visible weaknesses. Expedia falls somewhere in the middle, and the 1.20% yield is a nice bonus that its peers don't offer.

The problem for Orbitz is that increased competition leads to pricing pressure and the need for more spending, which then cuts into profit potential. For instance, marketing expenses climbed 17%, or $11.6 million, in the second quarter year over year.

Company-specific trends

Looking at the big picture, Orbitz Worldwide has failed on the bottom line:

|

2008 |

2009 |

2010 |

2011 |

2012 | |

|---|---|---|---|---|---|

|

Revenue in Millions |

$870 |

$738 |

$757 |

$767 |

$779 |

|

Diluted EPS |

($3.58) |

($4.01) |

($0.58) |

($0.36) |

($2.86) |

In the second quarter, net revenue increased 12% year over year, but the cost of revenue jumped $3.9 million, mostly due to credit card processing fees resulting from higher global hotel volume and customer service costs.

Orbtiz has enjoyed the benefits of increases in airfare prices, booking volumes for hotels, average booking prices at hotels, vacation package volume, and car rental volume. However, airfare volume has declined due to higher prices and a decline in leisure demand.

Total gross bookings for Orbitz improved 4% year over year, which is a plus, but once again, Priceline steals the show, with 23% annual gross bookings increases over the past five years.

The bottom line

Most savvy investors will opt to invest in the best of breed, regardless of the recent top-performing stock throughout an industry. If you would like to invest in the online travel industry, then Priceline is likely to offer a better long-term option than Orbitz.