The health-conscious consumer topic is on everyone's minds. However, many consumers still want as much satisfaction as possible, and in many cases, that goal can't be achieved without consuming delicious baked goods.

Despite the health-conscious consumer trend, you will still find baked goods in food stores, restaurants, and homes. What makes Flowers Foods (FLO 0.37%) so interesting is that it doesn't just target the conscious consumer, but the health-conscious consumer as well. And Flowers Foods has a plan for growth across all its markets.

Healthy baked goods

Nature's Own is owned by Flowers Foods, and it's a very important brand based on current consumer trends. Nature's Own products have no artificial flavors, colors, or preservatives. Furthermore, high-fructose corn syrup was recently removed, while fiber and Omega3 were added to recipes. These changes will likely strengthen the brand.

Inorganic growth

Flowers Foods hasn't been shy about acquiring companies that will help boost top-line growth. For instance, it acquired Tasty Baking back in 2011. This move was made for two reasons. One, snack cakes were in high demand. Two, Tasty Baking, otherwise known as Tasty, saw high demand in the Northeast. Flowers Foods acquired the company with the intention of geographic expansion, which is still playing out.

More recently, Flowers Foods acquired Sara Lee and EarthGrains assets and trademark licenses from BBU, which operates under Grupo Bimbo. Flowers Foods now has exclusive and royalty-free licenses for a broad range of baked goods in California (Sara Lee) and the Oklahoma City metro area (EarthGrains). The best part about this deal was that Flowers Foods was able to acquire these assets at a cheap price -- $50 million -- due to the Department of Justice forcing Grupo Bimbo to divest the assets.

The wheeling and dealing doesn't stop there. Flowers Foods also acquired Hostess assets, including Wonder, Nature's Pride, Merita, Home Pride, Butternut, 28 bakeries, and 36 depots for $360 million. This was a strategic move because competitors such as Grupo Bimbo and Pepperidge Farm -- a Campbell Soup (CPB 2.08%) brand -- will all be fighting for market share after the Hostess bankruptcy.

Thanks to past and future acquisitions, Flowers Foods expects to see sustainable top-line growth over the long haul. However, it also stated the risks; the economic environment, the potential for commodity cost increases, and competition from Grupo Bimbo and Campbell Soup. The former is the volume leader in bread with 100 brands, including Thomas and Entenmann's. As for Campbell Soup, baking and snack sales increased 3% year over year in the fourth quarter, and it expects continued growth in this area.

Recent results and fundamentals

In the 12 weeks ended July 31, 2013, sales for Flowers Foods jumped 31.8%, and volume increased 21.8% year over year. Pricing and product mix declined 0.9%. However, as long as Flowers Foods continues to be aggressive with acquisitions and meet consumer demands, pricing and product mix should help it fulfill its potential.

Flowers Foods is also strong on a fundamental basis, with a net margin of 6.57%, an ROE of 25.51%, a yield of 2.10%, and a debt-to-equity ratio of 0.59. That last number is very important -- it indicates that Flowers Foods was able to acquire companies and assets without using a lot of debt. Flowers Foods truly is a low-cost operator with a continuous focus on improving operations.

Category diversification isn't always better

Hillshire Brands (HSH.DL) also operates in baked goods, offering frozen pies, cakes, pastries, muffins, and more. This is in addition to meat products, such as hot dogs, corndogs, sausages, and more. In most cases, this type of category diversification would lead investors to be more interested in a company like Hillshire Brands than Flowers Foods. But in this case, Flowers Foods is more impressive.

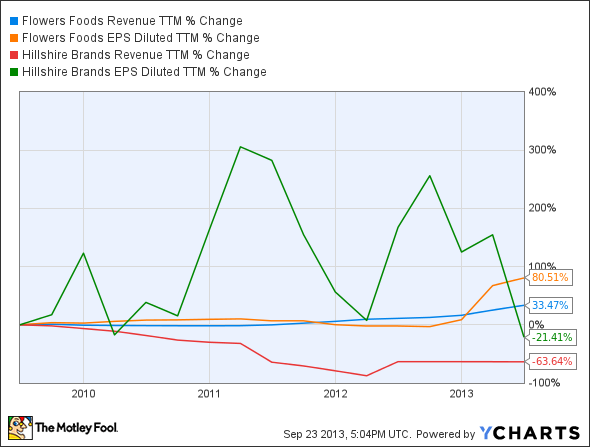

Some key metrics are similar. Hillshire Brands sports a net margin of 6.43%, an ROE of 51.18% (excellent), a yield of 2.20%, and has a debt-to-equity ratio of 1.96. The latter is a little high, which has the potential to impede the company's growth potential, especially during challenging times. Also consider the revenue and earnings-per-share growth comparisons over the past five years:

FLO Revenue TTM data by YCharts

The bottom line

Flowers Foods has been a winner since its IPO. This is a company that knows how to grow the top line via acquisitions, while also cutting costs and improving operations to grow the bottom line. All the while, Flowers Foods pays a healthy dividend. Maybe it's time you took a look at this powerhouse for yourself.