Ball (BALL -0.47%) is primarily a metal-packaging company that has seen high customer retention and maintained a diversified customer base. Ball also expects the metal-container industry to grow globally, but headwinds exist.

Good news first

Ball has seen progress with its "Drive for 10" strategy, which consists of five initiatives:

- Maximize the value of existing businesses by reducing operations in North America and Europe (both seeing weak demand), and using extra equipment for higher growth areas

- Expand into new products and capabilities -- expanded into extruded aluminum aerosol manufacturing via Mexican acquisition in December, 2012

- Align itself with the right customers in order to achieve double-digit volume growth for specialty-beverage containers

- Broaden geographic reach -- new beverage-container manufacturing facilities in China, Brazil, and Vietnam.

- Use innovative technologically to maintain competitive position

Innovation and acquisition

Ball is constantly innovating, which helps drive top-line growth. One of the company's most successful and relatively recent innovations was the recloseable Alumi-Tek bottle, which has seen significant growth since 2008.

On the acquisition side, Ball acquired two aluminum-slug manufacturing facilities in North America in 2010, making Ball the largest producer of aluminum slugs in the world. Ball also acquired an aluminum-slug facility in Europe in 2011. Aluminum slugs produce packaging for beer and aerosol body sprays. Ball has also found a way to use recycled materials in the manufacturing of aluminum slugs.

So far so good, but as noted earlier, headwinds exists. Therefore, it's possible that one of Ball's peers represents a better investment opportunity.

Headwinds and peers

The biggest headwind isn't just being felt by Ball, but by Crown Holdings (CCK 0.29%) and Silgan Holdings (SLGN 0.19%) as well.

That headwind is declining volumes in North America and Europe. This signifies declining demand due to a weak consumer. As a result, all three companies are looking to cut costs in mature markets. But emerging markets are a different story.

With consumers in emerging markets seeing increased wage growth, consumers are spending more, which gives all three aforementioned companies more potential in these markets. However, Europe and North America will still weigh on potential.

For instance, Crown Holdings recently lowered its Q3 earnings-per-share guidance to $1.05-$1.10 from $1.15-$1.25, citing weak demand in Europe and North America. Sales plummeted 4% year-over-year in Europe, primarily due to pricing pressure. To help combat this negative trend, Crown Holdings will cut 3% of its European workforce.

Silgan Holdings, the largest supplier of metal containers for food products in North America, is also seeing lower volumes in Europe. Silgan recently acquired Portola, a manufacturer of plastic closures, to aid growth and combat weakness in mature markets.

It's evident what's taking place throughout the industry. The question is whether or not these three companies are capable of growing enough to offset weakened demand in mature markets. This will have to be accomplished via innovation, acquisitions, and/or geographic expansion. These seem like logical solutions, and they are, but there's just one big problem.

All three of these companies are highly leveraged:

|

Cash and Short-Term Equivalents |

Long-Term Debt | |

|---|---|---|

|

Ball |

$169.50 Million |

$3.83 Billion |

|

Crown Holdings |

$227.00 Million |

$4.13 Billion |

|

Silgan Holdings |

$113.19 Million |

$1.89 Billion |

That being the case, growth potential for all three companies will be impeded. It should also be noted that Ball and Silgan Holdings currently yield 1.1% and 1.2%, respectively. While these are positives for investors at the moment, if debt becomes too much of a burden, then dividend cuts could be possible down the road.

If you're interested in an investment in one of these three companies, then consider top- and bottom-line performance comparisons over the past year. Top line:

Ball revenue trailing-12 months data by YCharts

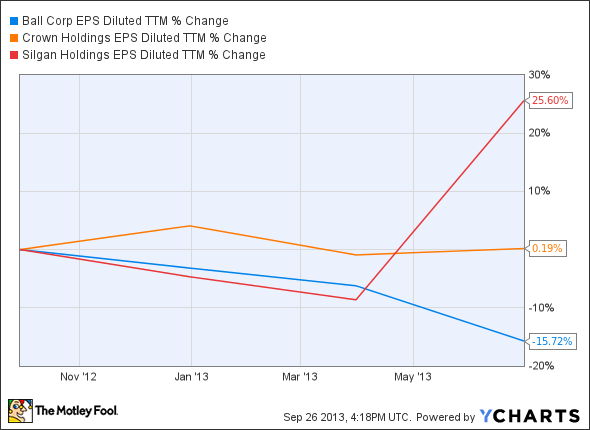

Bottom line:

Ball EPS diluted trailing-12 months data by YCharts

The bottom line

All three companies are likely to be long-term winners. Top-line growth is possible via innovation, acquisitions (if affordable), and geographic expansion in emerging markets. Bottom-line growth is possible through cost-cutting, especially in mature markets. But decreased demand in mature markets and high debt loads are reasons enough to be cautiously optimistic.