Finding a quality investment in retail has been relatively easy over the past several years. However, a lot of this performance has stemmed from new store openings to fuel the top line, and stock buybacks and layoffs to help aid the bottom line. If you look at comps, which indicate heightened demand without the advent of new store openings, you will be hard-pressed to find companies that have seen comps growth that exceeds performance in the previous year. The specialty retailer in focus for this article is one of those rare examples.

Impressive in several areas

In the second quarter, Williams-Sonoma's (WSM 1.73%) net revenue increased 12% to $982 million, and diluted earnings per share improved 14% to $0.49 year-over-year. But comps -- the most important number for specialty retailers -- showed 8.4% growth.

Not only is this a high growth number, but it's higher than the 7.4% comps growth seen in the year-ago quarter. This growth is simply due to strong demand for the company's products, which include Williams-Sonoma, Pottery Barn, Pottery Barn Kids, West Elm, and PBteen. Only the company's namesake brand has seen a decline in comps over the year-ago quarter:

|

Q2 2013 Comps Growth (y-o-y) | |

|---|---|

|

Pottery Barn |

up 9.9% |

|

Williams-Sonoma |

down 0.4% |

|

Pottery Barn Kids |

up 8.2% |

|

West Elm |

up 16.5% |

|

PBteen |

up 16.3% |

Other than the company's namesake brand, these are very impressive numbers. Additionally, Williams-Sonoma expects comps growth of 4%-6% for the fiscal year.

If you're looking at the top line, then direct-to-consumer net revenue (49% of company's net revenue) jumped 15.3% to $478 million, while retail net revenue improved 9.7% to $505 million.

As if that's not enough good news, Williams-Sonoma is on track for a double-digit earnings-per-share increase for the year. Williams-Sonoma expects non-GAAP (generally accepted accounting principles) diluted EPS of $2.69-$2.79, and revenue of $4.26 billion-$4.34 billion.

Chief executive officer Laura Alber is confident in the company's ability to grow sales, maximize profitability, and capture market share, primarily thanks to the company's successful and continuous campaign of product and geographic expansion. Part of the geographic push includes expanding the company's retail presence in Australia, as well as entering the U.K. market.

Before moving on to peer comparisons, it should be noted that Williams-Sonoma is in the midst of a three-year stock repurchase program worth $750 million, and only about $600 million has been put in play thus far. Therefore, even if Williams-Sonoma falters on the bottom line somewhere in the real world, it will still be able to reduce share count, which will aid earnings-per-share performance.

Williams-Sonoma vs. peers

It's pretty clear that Williams-Sonoma is headed in the right direction, but it's always possible that a peer is performing even better. However, that's not the case for Kirkland's (KIRK 20.11%), which saw comps decline 0.2% year-over-year in the second quarter. Some investors will say that this is a positive because it's an improvement from a 3.6% decline in the year-ago quarter, but Foolish investors want long-term consistent winners, not potential turnaround stories.

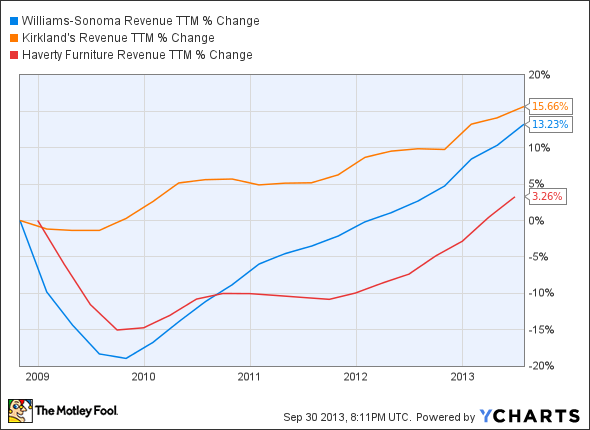

Kirkland's did recently up its full-year EPS guidance to $0.80-$0.90 from $0.75-$0.85 thanks to more focus on the sale of higher-margin products, but store traffic was still down 7%, and total transactions declined 6%. If you're looking at Kirkland's from a glass half-full perspective, then the average ticket price increased 5%, and the conversion rate improved 1%. You will also see that Kirkland's has performed well on the top line compared to Williams-Sonoma and Haverty Furniture (HVT 4.13%) over the past five years:

Williams-Sonoma revenue trailing-12 months data by YCharts

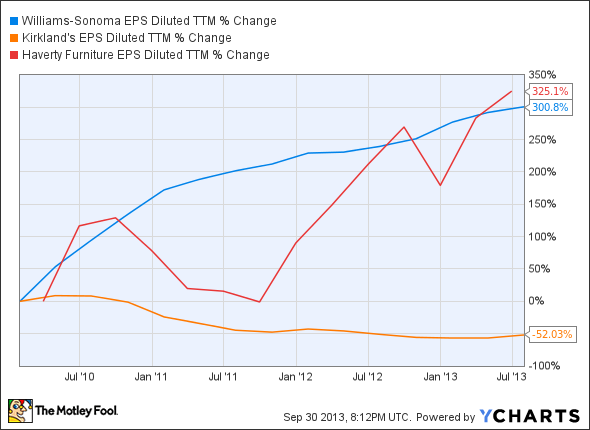

Whenever the top line is growing, potential exists. However, it's always better to invest in companies that deliver consistent top and bottom-line growth:

Williams-Sonoma EPS diluted (trailing-12 months) data by YCharts

You might have noticed that Haverty Furniture has performed well on the bottom line, but unlike Williams-Sonoma, it has been a volatile performance. In addition, Haverty lags Willams-Sonoma on the top line.

Another selling point is that Williams-Sonoma currently yields 2.2% while also offering a top-notch debt-to-equity ratio of zero. Haverty also sports an impressive debt-to-equity ratio of 0.1 while yielding 1.3%. Not bad, but not as good as Williams-Sonoma. Furthermore, Haverty still hasn't exceeded its 2008 revenue level, whereas Williams-Sonoma soared past its 2008 revenue total back in 2011.

The bottom line

Williams-Sonoma has a lot going for it, including successful product and geographic expansion, which has increased demand for the company's products. Additional positives include a stock-repurchase program, a somewhat generous yield, and a strong balance sheet. The only potential negative is that Williams-Sonoma is sensitive to consumer health, which could lead to volatility.