Source: MacRumors.

Iconic. Innovative. Indispensable. Inventor. Revolutionary. Not many CEOs are permanently associated with words like these. Apple's (AAPL 0.93%) co-founder and former CEO, Steve Jobs, was simply remarkable. Under his leadership, Apple brought products to market that have fundamentally changed the world. Now, two years after his death, uncertainty about the company's future still lingers, and the stock price is down 30% from its all-time high last year. With Apple CEO Tim Cook at the helm, can Apple endure?

Times have changed

Not only is the company's stock price down significantly from its recent all-time high, but the S&P 500 has meaningfully outperformed Apple stock since Jobs passed.

One year ago, things looked much better at Apple. In the 12 months following Jobs' death, a successful iPhone 4S helped the company post EPS growth and gross profit margin expansion. Wall Street responded positively. This time last year, the stock price was up 76% since Jobs passed.

During the last 12 months, however, uncertainty has taken center stage. Three major issues now pervade.

Market share. Based on data from IDC, Apple's worldwide smartphone market share is down from 16.6% in the year-ago quarter to 13.1% in the second quarter of 2013. Apple's tablet market share looks even worse, falling from 60.3% in the year-ago quarter to 32.4% today.

As the smartphone and tablet markets continue to grow at rapid rates, many consumers in developing markets are turning to lower-cost options. In the world's largest smartphone market, China, Apple's share of smartphone shipments in the second quarter plummeted to a paltry 4.8%, according to Canalys -- that's seventh place.

That said, Apple's U.S. market share story is still solid. Of all the smartphone subscribers in the U.S., 40.4% of them are using an iPhone, according to data from ComScore. Samsung came in second with a share of 24.1%. Everyone else has 8.9% market share or less.

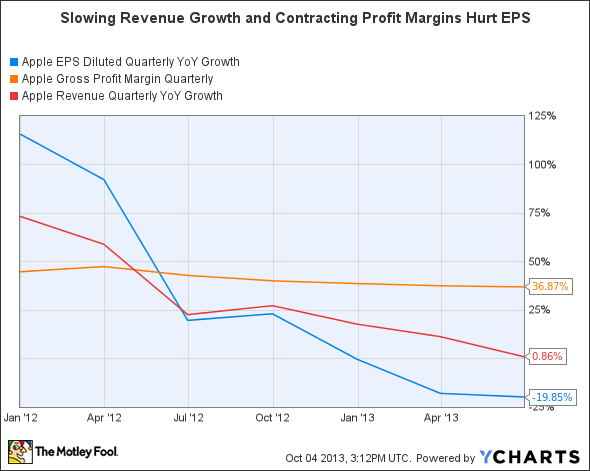

Declining EPS. Apple's success in the U.S. hasn't been enough to save the company from a slew of unfortunate trends in key metrics. As competition mounts and the smartphone market matures, growth doesn't come easily for the company. With revenue growth slowing and margins contracting, year-over-year EPS has taken a hit.

AAPL EPS Diluted Quarterly YoY Growth data by YCharts.

No new product categories. Since Cook took the helm, Apple hasn't entered any new product categories. The last new category that Apple entered was tablets -- that was in January 2010. Historically, new categories have been a major driver for Apple's business: iPods in 2001, iPhones in 2007, and the iPad in 2010. Where will Apple go next? While rumors about an Apple television have generally subsided, wearables remains a hot topic in the Apple rumor mill.

In fact, Apple CEO Tim Cook has explicitly expressed interest in wearables as a potential market for the company. At All Things Digital's D11 conference this year, he said:

I think wearables is incredibly interesting, and I think it could be a profound area for technology. ... I think there's lots of things to solve in this space, but it's an area where it's ripe for exploration, it's ripe for us all getting excited about; I think there will be tons of companies playing in this.

Wearables or not, Cook emphasized at All Things Digital's D11 conference this year that the company has several "game changers" in the pipeline.

Can Apple deliver? Investors are waiting. The Street is watching. And even Apple's board has expressed concern in the company's pace of innovation, according to Fox Business.

A new era

While Tim Cook's leadership style differs drastically from Steve Jobs', the two CEOs have very different roles to fill. Jobs built the world's most valuable publicly traded company, and Cook has to maintain it.

Running the world's most valuable company comes with some unique challenges. Cook faces an enlarged concern for social responsibility, dividend policy, and share repurchases -- issues that surfaced from time to time when Jobs was leading the company but less often (and to a much smaller degree). And the most difficult part of the job? When a company gets as big as Apple is, growing the bottom line simply becomes tougher -- that's the essence of the law of large numbers.

And if Apple introduces a new category, the iPhone business alone is already bigger than powerhouse companies like Procter & Gamble, Home Depot, and Microsoft. Even the long-awaited deal to launch iPhones with China Mobile may just barely budge the company's massive bottom line. And finally, Apple's impressive gross profit margin of 36.9% is nothing but lucrative bait to compel more competitors to do everything they can to get a slice of Apple's pie.

Does this mean Apple is a terrible stock? Not at all. The market is forward-looking, and Apple's price isn't currently priced for any meaningful growth. In fact, at today's price, the stock makes a very compelling dividend stock. And the company's massive share repurchase program looks set to give EPS a hand, going forward. Even so, as competition mounts and the law of large numbers works against Apple like gravity, the company needs to keep innovating. While innovation and Steve Jobs were basically one and the same, Cook will have to earn his respect.

Can Apple innovate without Steve Jobs?

To wrap things up, a Jobs video that Apple published last year:

Here's to you, Steve.