Genesco's (GCO 0.71%) recent numbers haven't been impressive. While Genesco has a game plan to improve, this may be difficult goals to achieve based on recent consumer trends. The good news is that Genesco has always bounced back from difficult times in the past. That said, another footwear company has offered more consistency throughout the years, and this trend is likely to continue.

Recent results

Genesco's net sales jumped 5.7% year over year to $574.7 million in the second quarter. However, comps declined 2%, primarily due to lower traffic. Below is the comps breakdown for each segment:

- Journeys Group: Down 1%

- Schuh Group: Down 7%

- Lids Sports Group: Down 3%

- Johnston & Murphy Group: Up 7%

The Journeys Group targets ages 13-22. Therefore, the 1% decline is not bad on a relative basis in comparison with many other teen and young adult retailers. According to the Bureau of Labor Statistics, the youth unemployment rate (ages 16-24) in July was 16.4%. While this age range doesn't completely cover the Journeys Group target market, it's a good indication of the status of teen and young adult consumers. Due to economic stress, teens are replacing excess with thrift as cool.

The Schuh Group was acquired by Genesco in June 2011 in order to expand in the U.K. and Ireland. In the third quarter of fiscal year 2013, Genesco also opened its first Schuh Kids store in Scotland. Genesco likes to test new markets in small samplings before deciding whether it should pursue further expansion. The Scotland store is being tested right now. As far as the overall comps performance of the Schuh Group, it should come as no surprise that results are disappointing considering the current economic environment in Europe.

Lids Sports Group targets consumers in their teens to mid-20s. Though this segment's performance was poor for the quarter, Genesco feels that there are many underpenetrated markets for Lids Locker Room and Lids Clubhouse in the United States. The same can be said for Journeys Kids.

Johnston & Murphy Group sells men's footwear, luggage, and accessories, and some instances, women's footwear and accessories. These stores are often located in high-traffic malls and airports.

Looking ahead

Looking ahead on an overall basis, Genesco expects third-quarter comps to decline 1.2%. However, the company feels that a better product mix in footwear and easier comparisons in Journeys and Lids will lead to improved comps in the fourth quarter. Looking at the bigger picture, Genesco expects comps to improve in the low single digits for FY 2014. At the same time, Genesco has lowered its FY 2013 adjusted earnings per share guidance to $5.20-$5.30 from $5.57-$5.67.

Genesco's strategy is to grow organically by:

- Opening new stores

- Increasing retail square footage

- Improving store/e-commerce comps

- Expanding operating margins

- Enhancing brand value

Peer comparisons

One of Genesco's direct competitors, Finish Line (FINL) recently beat second-quarter expectations on the top and bottom lines. Net sales increased 13.3% to $436 million and diluted earnings per share jumped 10.2% to $0.54. Comps also improved 0.9%. In addition, Finish Line expects improved full-year results with diluted EPS growing in the mid-single digits and comps moving higher in the low-single digits.

Finish Line has performed phenomenally on the bottom line over the past five years. With Finish Line locations now found in 600 Macy's department stores, the company's top-line potential is evident. However, a lot will depend on how well Macy's draws traffic.

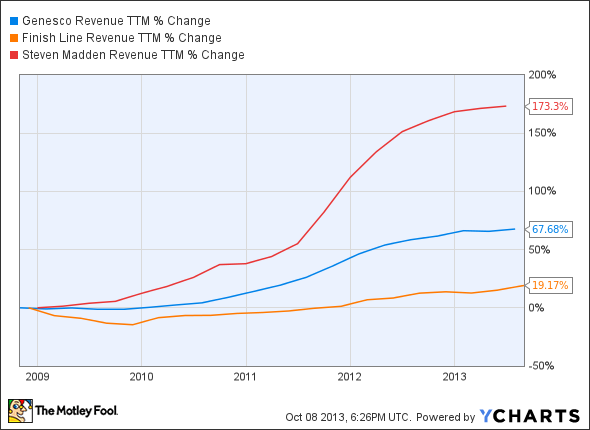

While Finish Line looks somewhat appealing, Steven Madden (SHOO 1.82%) should offer the best long-term investment opportunity of the three. First, consider the company's top-line performance over the past five years:

GCO Revenue TTM data by YCharts

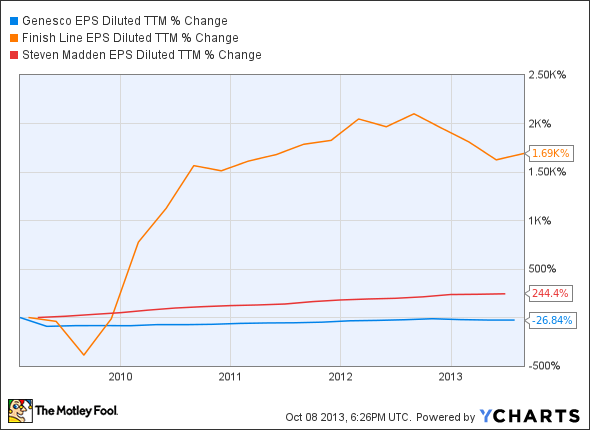

When you look at the bottom line below, keep two things in mind. One, Steven Madden's performance might lag, but a 244.4% increase is still very impressive. Also, the Genesco reading could be misleading simply because the company still hasn't achieved its 2008 diluted EPS number of $6.72. However, the bottom line has consistently improved since 2009, and it came in at $4.62 in FY 2013.

GCO EPS Diluted TTM data by YCharts

Now consider some key metric comparisons:

|

Forward P/E |

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|---|

|

Genesco |

11 |

3.87% |

13.01% |

N/A |

0.09 |

|

Finish Line |

13 |

4.31% |

11.63% |

1.20% |

0.00 |

|

Steven Madden |

15 |

9.87% |

20.60% |

N/A |

0.00 |

All three companies are fundamentally sound, capable of turning revenue and investor dollars into profit and managing their balance sheets well. Finish Line also offers a decent yield, which is a nice bonus. If you compare all three companies as a whole, taking into consideration their top and bottom-line performances and key metrics, Steven Madden is the most impressive. This is primarily due to the company's strong brand. Steven Madden's always looking for creative ways to drive the top line. Its most recent move was to partner with Keyshia Cole (R&B singer) for a special collection of shoes featuring seven heel styles, including pumps, booties, and tall booths with vibrant prints and colors.

The bottom line

Genesco is a solid company and Finish Line looks slightly more appealing right now. However, Steven Madden is the strongest and most fundamentally impressive brand of the bunch. Foolish investors should do their own research to determine which of these companies might make a good addition to their own portfolio.