With Best Buy's (BBY -1.35%) stock appreciating 206% year to date, you might be wondering if it's time to jump on the bandwagon. Many people feel that Best Buy is in the midst of a turnaround. After all, a physical retailer that offers the latest technological devices under one roof will always exist, since there are consumers who won't want to shop online. So, how does Best Buy look for potential investors?

Company strategy

Despite the likelihood of there always being demand for a physical electronics retailer, Best Buy still lags its peers in most areas. The company is well aware of this unfortunate trend. In November 2012, it implemented a strategy called "Renew Blue," with six initiatives:

- Accelerate online growth.

- Escalate multichannel customer experience.

- Increase revenue and gross profit through store space optimization.

- Drive down cost of goods sold through supply chain efficiency.

- Continue to gradually optimize U.S real estate portfolio.

- Reduce SG&A expenses.

In the second quarter, Best Buy saw a 10.5% jump in domestic online comps year over year. This is a positive, but the vast majority of retailers throughout the industry are seeing online growth simply because more consumers are shopping online.

Best Buy noted that its Net Promoter Score improved by 300 basis points, but this customer service metric is regulated by Best Buy, not an outside company. The Net Promoter Score lets a company know how many customers would recommend their store to a friend. The score is broken down into Promoters (people who give a rating of 9 to 10 on a survey when asked if they would recommend the retailer to a friend), Passives (people who give a rating of 7 to 8, showing they are satisfied but not enthusiastic, yet can be swayed with promotions), and Detractors (people who give a rating of 0 to 6, showing they are unhappy with their shopping experience, and are capable of damaging the brand through negative word-of-mouth).

Best Buy has rolled out Samsung Experience Shops and Windows Stores, and it has piloted ship-from-store operations in 50 stores. Both initiatives have the potential to fuel growth. Best Buy has also amassed $390 million in annualized cost reductions. Is all of this enough for sustainable growth?

A rosy future?

Looking ahead, Best Buy aims to reduce prices wherever necessary in order to remain competitive. This makes sense, but the company will need to make up for price reductions with volume. This won't be easy considering the hesitant consumer. Best Buy will also increase marketing costs in order to drive mobile growth, but this will negatively impact the bottom line.

It's clear that Best Buy is capable of improving on the top or bottom line, but improving in both areas at the same time will be extremely challenging.

Best Buy also aims to improve its multichannel experience, optimize retail floor space, and replatform BestBuy.com. In other words, it looks to improve shopping opportunities for customers, make greater use of available real estate space, and redesign its website.

While it's too early to determine whether Renew Blue will be a success, the first-half results should at least be noted: Revenue declined 5.2% year over year, and comps slipped 0.9%.

If you're looking for more growth potential, or more safety, then take a look at Best Buy's biggest competitors.

Best Buy vs. peers

Amazon.com (AMZN 1.49%) and Wal-Mart (WMT 1.02%) might not be allies, but they do have one thing in common -- they conquer whatever stands in their way. You can talk about Amazon's high valuation (it's now trading at 108 times forward earnings) and Wal-Mart's maturity, but both brands are well established and they dominate their peers. Amazon is a high-growth play (risk included), and Wal-Mart is a safe dividend play. When you compare these two companies with Best Buy on a fundamental level, Best Buy leaves a lot to be desired:

| Company |

Forward P/E |

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio |

|---|---|---|---|---|---|

|

Best Buy |

13 |

(0.97%) |

(8.43%) |

1.80% |

0.47 |

|

Amazon |

108 |

(0.15%) |

(1.24%) |

N/A |

0.35 |

|

Wal-Mart |

13 |

3.61% |

23.45% |

2.60% |

0.74 |

Wal-Mart is clearly the most impressive fundamentally. It successfully turns revenue and investor dollars into profit and offers a generous 2.60% yield along with quality debt management.

Wal-Mart's domestic comps dropped 0.2% in the second quarter, and it warned about a weak consumer. It also trimmed its fiscal year 2014 sales growth guidance to 2%-3% from 5%-6%, and its fiscal year 2014 EPS guidance to $5.10-$5.30 from $5.20-$5.40. These might seem like major negatives, but you're not going to find a lot of retailers showing top-line growth whatsoever, and Wal-Mart's fiscal year 2013 EPS came in at $5.02. Additionally, the company's expectations have now been lowered. Any time that happens with a consistent winner, it's likely to present a good investment opportunity. Consider one more potential trend: If middle-income consumers begin to suffer more, then they may look for better values at Wal-Mart.

Unlike most retailers, Amazon plans on more hiring over the next two years. Amazon could hire as many as 6,000 people for its logistic centers in Poland to help the business expand in Europe. Amazon is also now gearing up for battle with eBay's PayPal by offering a "Pay With Amazon" button. Currently, it only has a few small partnerships, but this is Amazon we're talking about, so expect growth. This button will allow consumers to shop online on non-Amazon sites without having to enter their account number and password every time they place an order. Amazon's cut: a 2.9% fee plus $0.30 per transaction (or less with high volume).

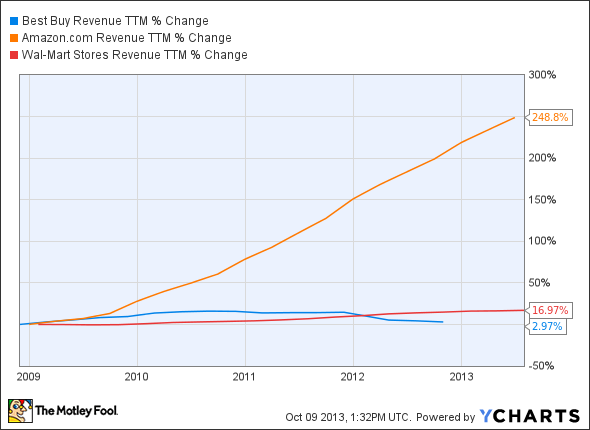

Now for the top- and bottom-line performances of the three aforementioned companies over the past five years:

BBY Revenue TTM data by YCharts.

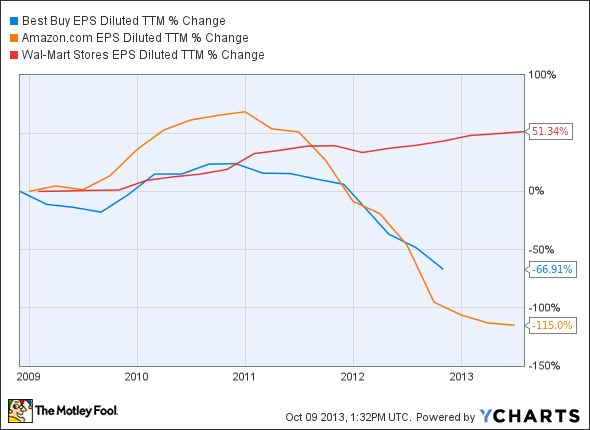

Amazon is an easy winner on the top line, but only Wal-Mart has delivered consistent bottom-line growth:

BBY EPS Diluted TTM data by YCharts.

The bottom line

If you can handle risk and you want growth, consider Amazon. If you're risk-averse and are looking for safety and dividend payments, consider Wal-Mart. Best Buy, unfortunately, doesn't offer the most potential in either area.