McDonald's (MCD -0.05%) stock has been slowly trending down over the past six months. We'll take a look at why, what McDonald's has planned to reverse this trend, whether one of its peers is likely to offer a better investment opportunity, and why the word "slowly" above is important.

Recent results and plans to improve

McDonald's has a simple game plan. Simple usually works in the long run, especially when the brand is as strong as McDonald's -- ranking No. 7 on Forbes' "Most Powerful Brands" list in 2013. This simple game plan is to offer speed, convenience, and tasty food in a contemporary setting.

While investors weren't thrilled with the company's third-quarter comps performance, it wasn't bad. For instance, comps improved 0.9% year over year. That's not a number that's going to make you rush over to TD Ameritrade and allocate all your investment capital to McDonald's. However, it shouldn't make you fearful, either.

Pay attention to the good news as well. McDonald's returned $1.3 billion in capital to its shareholders in the quarter, and it plans on returning $4.5 billion-$5.0 billion to shareholders in the form of dividends and buybacks during the year. Also note that on September 18 it hiked its dividend by 5%.

Geographical performance

Domestic comps grew at a 0.7% clip year over year, with the Monopoly promotion playing a big role. The Mighty Wings introduction also drove some traffic, but Mighty Wings don't have staying power. They will still be offered until November. After that, they will only be offered in select locations -- where consumers don't mind paying a premium for spicy wings that can be found elsewhere.

The Mighty Wings failure shouldn't be looked at as a negative. This innovation might not have worked out, but it proves that McDonald's isn't going to sit on its hands. It will continue to be innovative. And when one of these innovations hits, McDonald's has immense marketing power to help drive that innovation toward future sales growth.

In Europe, comps improved 0.2% with the United Kingdom and Russia showing the most strength, France showing moderate strength, and Germany displaying weakness. McDonald's aims for increased menu innovation and marketing for improvement.

In APMEA (Asia Pacific/Middle East/Africa), comps dropped 1.4% with China, Japan, and Australia showing weakness. McDonald's plans to improve performance in these areas via enhanced local relevance (menu items that match local consumer demands), expanded convenience, and new restaurant openings (helps drive brand recognition).

Overall, McDonald's expects the macroeconomic environment to remain challenging. McDonald's knows that factor is out of its control, and it plans to operate at its best for long-term sustainable growth. Its broad geographical goals are to optimize the menu, modernize the customer experience, and broaden accessibility.

McDonald's is often brought up in conversation with Burger King (BKW.DL) and Wendy's (WEN -0.70%). Are one of these peers likely to offer a better investment opportunity?

McDonald's vs. peers

Burger King hasn't performed well on the top line over the past several years, which will be demonstrated soon. However, Burger King does have a successful growth initiative in motion -- delivery service. Burger King currently has 75 delivery services in operation throughout the United States. Based on the success of this service, Burger King is looking to expand in this area. So, whether you're at home, school, or an office, you can still enjoy a burger and some Satisfries. However, your order must be at least $10.

Wendy's has also seen success, but in a much different area -- a reimaging program. This reimaging program will cost money in the short run -- $440 million-$500 million between 2013 and 2015. The modernized refurbished units are expected to help drive more traffic. At the same time, Wendy's aims for international expansion while it also moves more toward franchising. For example, Wendy's recently divested 24 restaurants in the Seattle area, and it plans on franchising 423 company-owned restaurants by the second quarter of 2014. This approach should lead to margin expansion, which should then aid the bottom line. Unlike McDonald's, one of Wendy's latest menu innovations -- the pretzel burger -- has been a success.

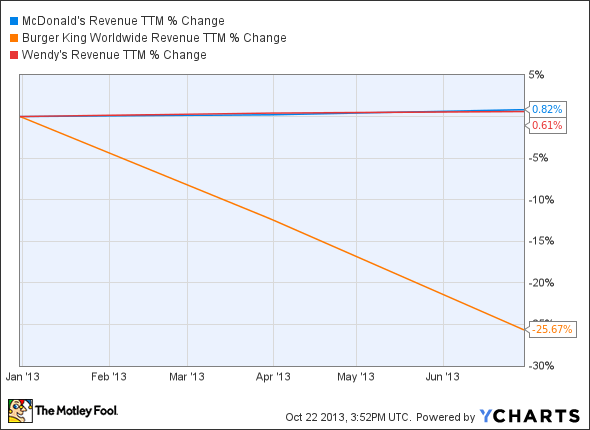

Despite Wendy's successful reimaging and menu innovation, McDonald's still outpaced Wendy's on the top line over the past year:

MCD Revenue TTM data by YCharts

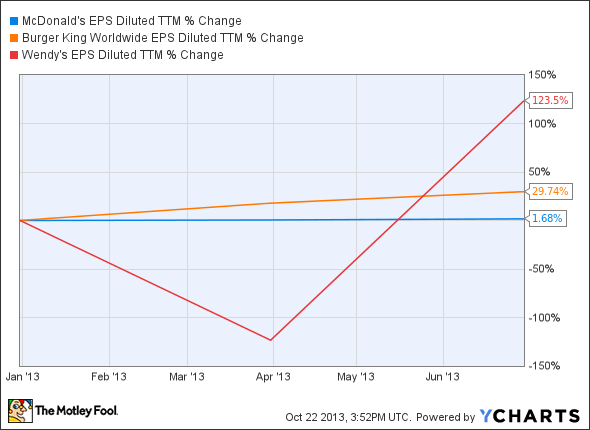

However, Wendy's impressed the most on the bottom line:

MCD EPS Diluted TTM data by YCharts

That said, if you look at some key metrics, McDonald's is the clear winner:

|

Forward P/E |

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|---|

|

McDonald's |

16 |

19.85% |

37.79% |

3.40% |

0.88 |

|

Burger King |

21 |

10.53% |

12.77% |

1.30% |

2.31 |

|

Wendy's |

31 |

0.58% |

0.65% |

2.30% |

0.75 |

McDonald's offers the most appealing valuation. It's the best at turning revenue and investor dollars into profit, and it offers the highest yield, all while displaying quality debt management.

The bottom line

Wendy's is performing well, and Burger King has potential to turn things around on the top line with its delivery service, but McDonald's offers more than potential. It's one of the most established brands in the world and it has rewarded shareholders for decades. If the stock suffers, this will likely happen slowly, which allows investors to add to their positions on the way down (incrementally). McDonald's isn't going anywhere, and adding on weakness should eventually pay off. All the while, you would collect generous dividend payments.