Sysco (SYY 0.64%) -- distributor of food and related products to restaurants, health care, education facilities, lodging establishments, and other food customers -- is concerned about consumer demand. According to Sysco's 10-Q, a lack of consumer disposable income has led to pricing pressure. This then leads to weaker margins and negatively affects the bottom line. The good news is that the company still serves 18% of the $235 billion food-service market. That market isn't going to suddenly disappear. However, companies like United Natural Foods (UNFI 1.07%) and The Chef's Warehouse (CHEF 0.03%) have potential to steal market share from Sysco.

Let's take a look at what Sysco has planned to manage current and future tailwinds prior to looking at the competition.

Recent results

Sysco's first-quarter sales increased 5.7% to $11.7 billion year over year. But this was primarily due to growth through acquisitions. It has consistently bought up smaller companies in the food-service industry as a way to drive its top line.

These moves appear to be necessary since industry sources think the food-service market will only see moderate growth going forward. Fortunately, Sysco has a strategy in place to deal with this challenge.

Sysco's strategy

The basic premise of Sysco's strategy is to optimize core brands in key markets while exploring opportunities to grow market share. Sysco plans on attaining these goals through several initiatives.

Sysco wants to greatly improve the experience its customers have while doing business with the company. If strong relationships are formed, then those relationships are more likely to last. Sysco also aims to improve productivity, expand its product offerings and services via innovation, explore and capitalize on new high-potential markets, and develop and integrate top talent for management.

Additionally, Sysco will look to cut costs through its Business Transformation Project. Part of these cost reductions will come from consumer insights. In other words, if consumers feel as though something is overpriced, or of subpar quality, then Sysco may act accordingly.

Sysco expects to lower its operating cost structure by $300 million to $350 million annually by 2015. Additionally, Sysco aims to increase productivity in warehouse and delivery.

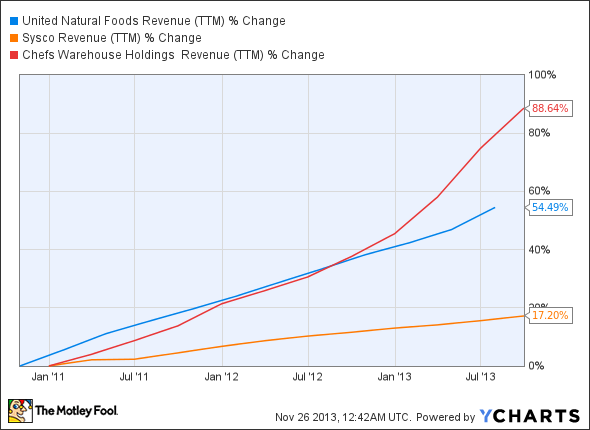

Sysco appears to be maximizing its potential. With a healthy debt-to-equity ratio of 0.60, and $1.47 billion in operating cash flow over the past 12 months, investors should feel comfortable in the company's ability to weather any potential storms. Sysco also yields a generous 3.40% dividend. All that said, it is a mature company. If you're looking for growth, consider the top-line performance comparisons over the past year:

UNFI Revenue (TTM) data by YCharts.

Smaller company, bigger potential

United Natural Foods carries and distributes 65,000 products to 31,000 customers throughout the United States and Canada, serving everything from supermarkets to independent operators. In 2012, Fortune rated United Natural Foods as one of its "Most Admired Companies."

United Natural Foods might not be the size of Sysco, but it's the largest publicly traded wholesale distributor to the natural, organic, and specialty industry in the U.S. and Canada.

United Natural Foods has increased its market share through its high-quality product offerings, service, and broad product selection. It looks to expand geographically through the expansion of existing distribution centers, the opening of new distribution centers, acquisitions, mergers, and organic growth.

United Natural Foods doesn't offer a dividend, but its debt management has been strong, with the company sporting a debt-to-equity ratio of 0.15. The company appears to be just as healthy as its healthiest customer.

Small-time

Chef's Warehouse isn't the most well-known company, but it should at least be on your radar. As you can see from the chart above, the company is growing at a rapid rate.

Chef's Warehouse's motto is "Where the Chefs Shop." It serves primarily fine-dining and independent restaurants. This is the right place to be at the moment, given the high-end consumer is doing well.

Though potential is high, there are two negatives for Chef's Warehouse. One, the company is highly reliant on discretionary income, and increased discretionary income doesn't last forever, whether it's the high-end, middle-class, or low-end consumer. The other negative is leverage. Chef's Warehouse sports a debt-to-equity ratio of 1.17. However, it all starts with the first negative and where the consumer stands. If the high-end to middle-class consumer keeps dining out, then Chef's Warehouse should grow fast enough that debts can be paid off. If that trend reverses itself, then Chef's Warehouse will be sensitive to that change.

The bottom line

Sysco isn't going to see the kind of growth it has seen in earlier years, but it's still a profitable company with strong market share in the food-service industry. Its 3.40% dividend yield is also appealing. Chef's Warehouse has tremendous potential, but it lacks resiliency. United Natural Foods offers the most top-line potential thanks to strategic geographic expansion plans and its resiliency to economic downturns thanks to its exposure to an in-trend market, and it has managed debt well.